Blog

Spending money on stuff makes you poorer

What's more important: status or financial freedom? Will this status bring us happiness? And does money bring happiness? We can be happy and achieve all our goals with different levels of wealth.

Positioning of investment portfolios

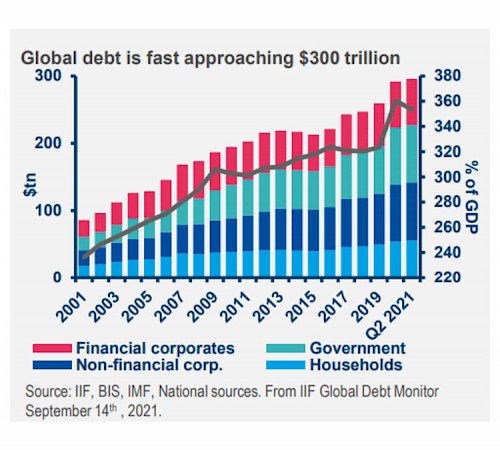

When we look at the composition of investment portfolios, we look to the future, to how wealth will be created, the environmental and social impacts, monetary, fiscal and budgetary policies, debt and the geopolitical environment.

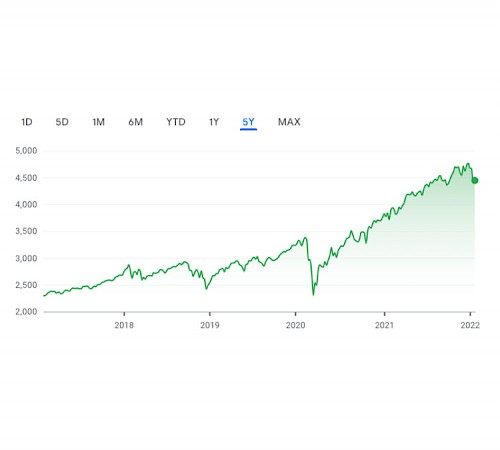

Macroeconomic alignment and trends for 2022

In this article we will explore the implications for the investment portfolio of this macroeconomic alignment and trends for 2022, notably across major asset classes, sectors and industry and in geographic terms.

Macro prospects and key outlooks for 2022: what do analysts say?

It is time for balance sheets and expectations. By consulting the different outlooks of the main management companies and investment banks, it is possible to find convergent ideas, but also some divergent ideas.

A sort of investment guide

During 2021, we went through several themes that were transversal to financial investment, from the perspective of the individual investor, and that are part of the planning we must do when we decide to invest money.

What you must know about investment funds

In this article, we are going to talk essentially about securities investment funds, that is, funds that invest in listed or unlisted financial assets.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.