Positioning of investment portfolios

As we have seen in the previous two articles, dedicated to the investment outlook and macroeconomic alignment and trends for 2022 by some of the main investment managers, the global economy seems to be entering a new regime. The last few decades have been characterized by low and stable inflation, practically negligible interest rates, a consistent fall in the implicit yield (yield) of bonds, an increase in inequality and considerable returns on financial assets.

As we have already mentioned, financial markets are machines for updating expectations regarding the evolution of the world in the future. Therefore, I recall this article on the relationship between the economy and financial markets, in which we concluded that markets are great leading indicators of the economy in the future.

When we look at the composition of portfolios, we look to the future. We look at the future of the economy, that is, at how wealth will be created, the environmental and social impacts, monetary, fiscal and budgetary policies, debt and the geopolitical environment. They are all pieces of the puzzle not to mention the surprises that we will find along the way.

From a macroeconomic point of view, inflation and the interest rate play the main role. They were the main catalysts for financial assets in recent decades and this role should be maintained this year.

Historically, low or negative real interest rates like now are not common and are usually associated with dramatic events such as major wars or major economic depressions. With World War II, low real interest rates came during a period of severe financial repression. It was necessary to keep interest rates low so that governments could pay off the debt issued to finance the war. The truth is that we are in a new extraordinary moment after a sharp increase in debt, in what can be called a new episode of financial repression in perspective: a combination of inflation (to reduce the value of the debt) and low interest rates to be more easy to service debt. This means that real interest rates, i.e. nominal interest rates minus the inflation rate (see article on putting your money to work), will stay negative or low for longer.

Employment and inflation

One of the main mandates of some central banks is to increase employment. And the truth is that, in one way or another, the labor market was protected during this crisis and we have situations of full employment in parts of the developed world. This situation has led some analysts to recall the Phillips curve, the relationship between unemployment and inflation. According to this theory, in the short run, a lower unemployment rate leads to a rise in the rate of inflation.

It is therefore not surprising that concerns are focused on when and how much interest rates will rise.

But there is an interesting data to retain for analysis. In recent years, it seems that whenever they prepare to go up, something happens that prevents them from going up. However, there it is, this time it is different. Inflation is there and employment is robust. The monstrous debt, as mentioned above, will be the balance in the decision to raise interest rates and the smoothing factor of it.

What does this mean for savers and investors?

It essentially means lower profitability in perspective for this and the coming years, whatever the investment style and profile. It also means that it is essential to make fewer mistakes, especially in financial plans that are more advanced in terms of longevity and that are closer to the goal (such as retirement). It will be more difficult to recover due to the time factor.

Volatility will increase due to the increase in uncertainty regarding the evolution of inflation and interest rates, which will cause greater instability in the portfolios. We will be tempted to do something, but in most cases, the right action is to do nothing. More than looking at the daily evolution of the markets and macro indicators, we must look at our plan, our objectives and follow the main strategy defined.

This pragmatism in relation to the main strategy does not prevent the taking of directional tactical decisions in the face of macro evolution. This new year could mean favoring more value styles and sectors on the equity side, and variable or inflation-indexed rates for bonds.

The more than likely rise in interest rates and the persistence of inflation should benefit some traditional sectors such as banks and insurance companies, but also sectors more linked to industry such as the automotive sector, construction and materials and machinery and equipment and the energy sector. The end of the pandemic could also mean a recovery in sectors that have been heavily affected in recent years, such as the aviation, tourism and leisure sector.

In this sense, some regions may stand out more than others. And in this scenario, Europe and Asia Pacific stand out as the preferred regions for this year.

In an October 2020 article, we warned of the invisible economy and a paradigm shift: 75% of the S&P 500's value derives from intangible assets. Therefore, despite this more adverse macro environment for the technology sector, which flourished in an environment of immense liquidity and low interest rates, we cannot take it away from a long-term view.

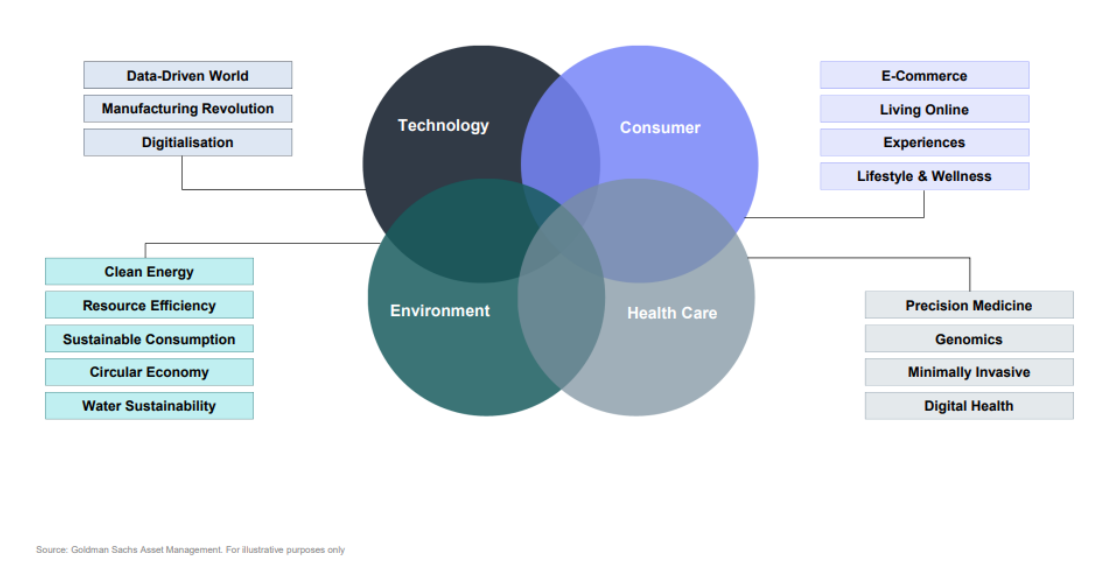

Megatrends are redefining the economy and the world and must also prevail in a long-term investment strategy. In the following figure, we see the megatrends defined by Goldman Sach: technology, consumer, environment and health.

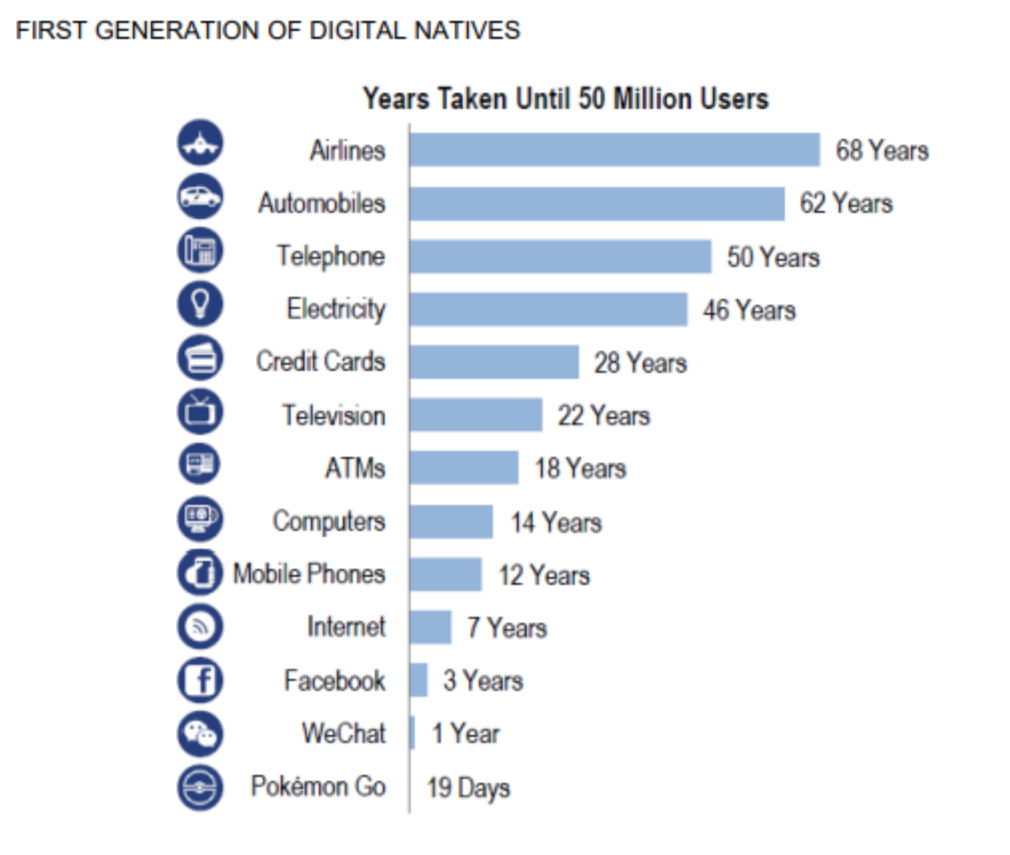

Although we have a world with an apparent lower degree of globalization (more interventionist and even nationalist states) the truth is that we are increasingly connected. The world is increasingly digital and this is visible in geographic terms, in demographic terms and in economic terms, such as through the increase in data consumption and cloud services.

At this moment, the millennial generation is already the main consumer force, leading to a change in consumption habits and preferences, and the next generation, the digital natives, no longer live without the virtual world.

Source: 2022 Outlook: Getting Real – Gondman Sachs

So, in summary, we leave those that seem to us to be the main issues for this year, with direct implications for the investment portfolio:

- Inflation in wages: Is it possible for workers to negotiate better wage conditions?

- Profit Margins: Do companies have the power to pass on higher costs to consumers without compromising profit margins?

- Bottlenecks in the logistics chain: The variants of the pandemic and disruptions in world ports do not suggest improvements in supply chains. But will the problem be dispelled this year?

- Real estate: Will rents continue to increase as suggested by industry forecasts?

- Energy prices: Will the disruption caused by the transition to renewable energy lead to another year of price increases?

Alongside these issues, we also list the 10 risks that the Eurasia Group highlights for this year:

- The failure of the Covid-zero policy, especially in China;

- The power of tech: big tech companies are redefining the nation-state world order;

- The mid-term elections in the USA;

- China's domestic policy;

- Tensions with Russia: from the political situation to the energy crisis;

- Iran;

- The energy transition will not be smooth: more costs for consumers;

- The global power vacuum: the US does not want to continue to be the world's policeman and China will not take its place;

- Cultural change in companies towards ESG criteria (environmental, social and governance);

- Turkey, an example of the difficulties that some emerging countries will experience in overcoming the economic crisis.

Managing assets is almost always managing risk, literally navigating unknown paths. Having a map for the trip always helps and not being in a hurry to arrive can be even more important in a year that is expected to test patience.

Circumstances point out that this time is different. This time the year will be more volatile and more difficult to define a trend. But look, it's like that every year. What has not yet happened is always more difficult to foresee.

That's why we value the plan and decisions made without considering the noise of information and the impulse of the moment.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.