Macro prospects and key outlooks for 2022: what do analysts say?

At the change of year, it is time for balance sheets and expectations. By consulting the different outlooks of the main management companies and investment banks, it is possible to find convergent ideas, but also some divergent ideas.

In the process of defining the investment policy, in addition to investment objectives, risk tolerance, preferences and restrictions and the investor's knowledge and experience, we must organize the set of economic and market expectations adjusted to the investor. These two sources of information are essential to building a truly personalized investment portfolio.

It is clear that these analyzes of information and expectations should not only be carried out at the beginning of the year, as if the change of year would change the normal evolution of the world. However, taking advantage of the set of reports produced, we decided to detail the market view in 3 articles:

- The first one with a look at the macro perspectives and the main themes for the future, based on the reports of Amundi, Fidelity, Credit Suiss and Vanguard, after the retrospective vision of Hindsjght Capital;

- A second article on the implications for the investment portfolio of this macroeconomic alignment and trends, namely in the main asset classes and in geographic terms, where we also analyze the outlooks of Goldman Sachs, Schroder, Pictet, Jefferies and ESN;

- A third article with our view of the market, in a broader perspective and from the perspective of a non-professional investor.

The case of hindsight

Analyzing what happened in the financial markets in 2021, namely what resulted in the best investment, is the annual task of Hindsight Capital, a tradition at each end of the year starring John Authers in his newsletterPoints of Return, on Bloomberg. A kind of investment strategy, in which managers make transactions with full knowledge of how the results will be.

This time, if we knew in advance what would happen during the year, the main transactions were:

- S&P500 in Turkish Lira, taking advantage of the collapse of the Turkish currency in 2021 and the excellent performance of the index;

- The growth of cryptocurrencies, through the long Etherium and short transaction in Silver;

- Volatility, through a long investment in the MOVE (bond volatility index) and short in the VIX (equity volatility index). Bond volatility increased due to the presence of inflation, while equity volatility fell in the wake of the “TINA - there is no alternative” argument;

- The fall of China. The instability in the Chinese financial market in contrast to the good year of the Ho Chi Minh index of Vietnam;

- The recovery of retail in the face of life at home. In this case, the move to make was in the REIT Regional Mall index investing short in the home entertainment sector;

- The problem with clean energy. The energy transition was not a good deal in 2022, so Hindsight Capital invested long in natural gas and short in stocks of solar energy companies. Geopolitical tensions from Russia contributed greatly to this transaction;

- The return of oil. Taking advantage of the clean energy downside in 2021, the long investment in oil exploration companies and short in clean energy companies resulted in a return of almost 150%;

- The real estate investment. In 2020 office real estate investment was highly depressed with the thought that no one would ever go back to offices. But it wasn't reality. In 2021, office investment performed very well, as opposed to short-term debt investment by Chinese real estate development companies, exacerbated by financial woes at companies such as Evergrande;

- The logistical bottleneck. The economic stoppage in 2020 and the consequent difficulties in the movement of goods became an opportunity in 2021. Thus, the transaction to be made would be a long investment in transport companies and logistics operators and a short investment in aviation company shares;

- Pressures of life in a pandemic. Long investment in coffee futures and short in brewing companies. He continued his life with restrictions at the expense of bars and restaurants.

The great transformation

Investing in the great transformation is Amundi's proposal in its Outlook for 2022, considering that the world is currently facing its biggest challenges ever: the energy transition to combat the climate crisis and the development of an inclusive economic growth model.

Amundi highlights 3 themes for this year:

- Inflation, at a time when economic growth is starting to slow down;

- De-synchronization of fiscal and monetary policies, as well as the impact of the economic slowdown in China;

- Acceleration of ESG integration into investment portfolios.

The independence of central banks is at stake, while dealing with multiple issues, namely inflation, growth, unemployment, green transition and inequality.

There is also a shortage in several aspects, starting with qualified human capital and raw materials.

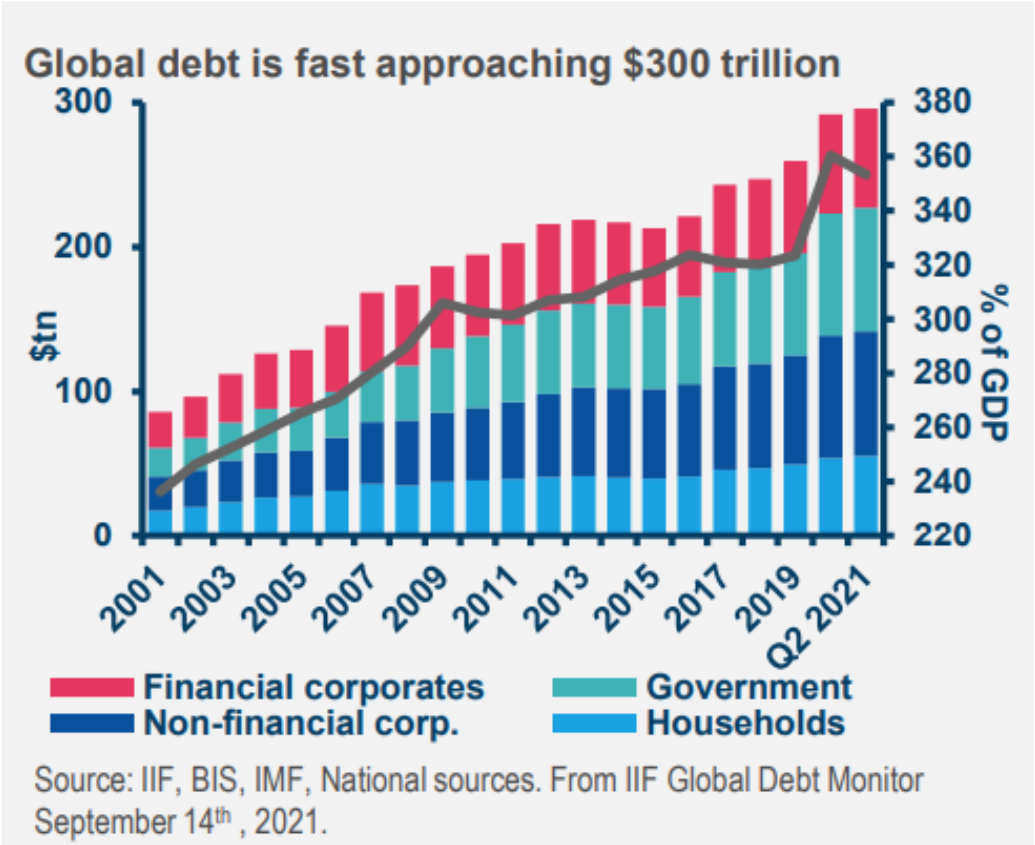

The end of the old globalization strategy accelerated with the pandemic, also resulting in greater intervention by states in the economy with a focus on ESG issues. Therefore, the already high amount of debt could grow even more, jeopardizing its sustainability.

This graph shows how the world debt has more than tripled in 20 years, reaching 300 billion dollars and 350% of the world's GDP.

It is also important to highlight the narrative of stagflation, which is defined as a situation where the inflation rate is high and economic growth is weak or even negative.

Debt dynamics play a pivotal role in this environment, as central banks must maintain a strategy of financial repression to support the borrowing needs of states while looking at inflation and economic growth.

The paradox of monetary policy

Unraveling the paradox of monetary policy is what Fidelity proposes.

The various narratives that both central banks and governments will try to navigate this year without losing the confidence of the markets, increase the conditions for errors in the definition of monetary policy.

The dilemmas arise in the midst of a return to normal process, soaring energy prices, high levels of debt and continued economic growth:

- How to tighten monetary policy and contain inflation without ending the economic recovery;

- How to deal with higher energy prices as the world transitions to a low carbon economy.

In macro terms, Fidelity highlights the persistent nature of inflation, China's focus on the real economy, the impact of the climate on strategic asset allocation and the dynamics of the dollar in the event of a more defensive scenario in 2022. The stagflation scenario is also placed on the table, as shown in the graph below.

The great transition

The big transition is Credit Suisse's vision.

The Swiss bank points out that the stimulus worked, but that monetary policy conditions will change profoundly: asset purchases by central banks will end and interest rates will rise.

They also note that the cyclical and monetary policy perspectives are diverging in several countries after a high correlation in the first months of the pandemic.

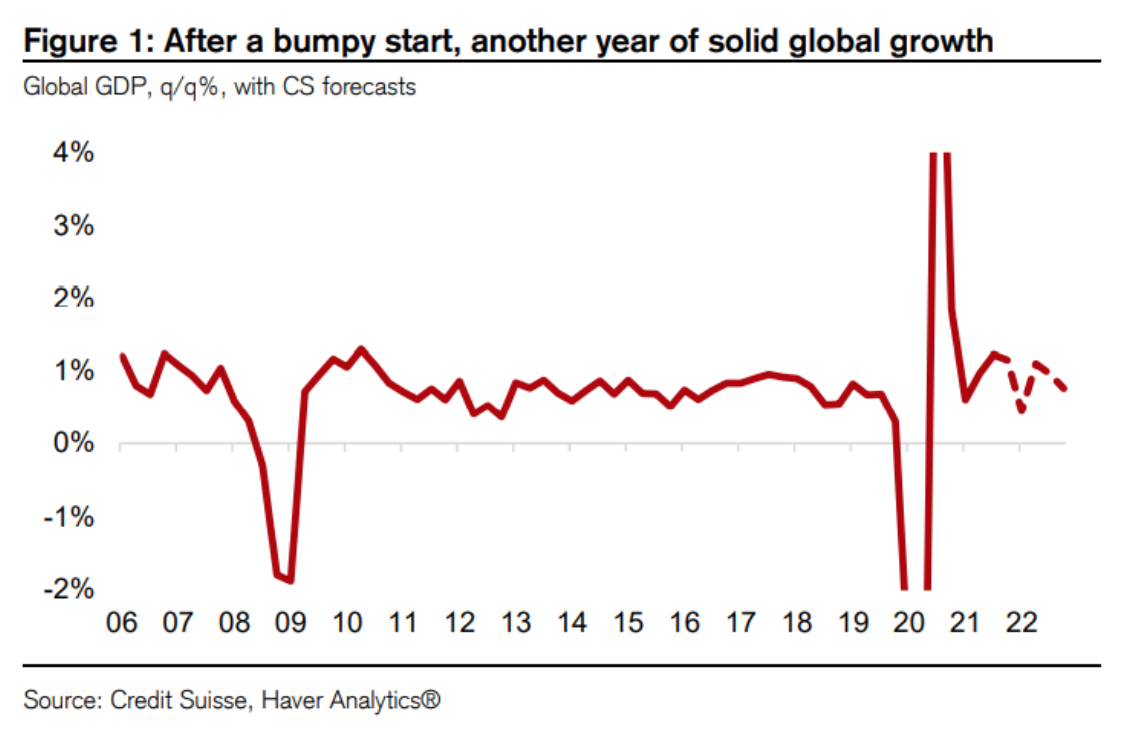

For Credit Suisse, after a shaky first quarter due to the Omicron variant, very high energy prices and a retraction in fiscal policy, the world economy is expected to return to a growth path above pre-pandemic trend in 2022.

Consequently, Credit Suisse believes that, after a scenario of stagflation – lower growth with high and unexpected inflation – we will be on our way to a scenario called the “Goldilocks economy”, that is, a period of stable growth, with inflation falling and unemployment at minimum.

There are still 4 trends worth mentioning:

- The need for human resources – one of the major shocks caused by the pandemic was in the job market. The participation rate has decreased and it is not certain that people will return to work. This situation, which in part may be temporary, will bring greater bargaining power to workers and a change in migratory trends;

- The ongoing disinflation process in emerging markets – inflation is more persistent in emerging countries which can mean greater pain in economic growth. In fact, historically, the disinflation process in these countries is associated with a deceleration and even a drop in GDP;

- The great transition – the global economy is in the process of transitioning from decades of low and stable inflation to a much more volatile period, an era of greater macroeconomic instability. Demography and globalization contribute greatly to this. The population is aging and there is a certain retraction in the globalization process. Another problem is with governments and the increase in their weight and intervention, firstly due to climate change on the one hand and increased inequality on the other;

- Greenflation, that is, inflation present in the green transition process of the world economy. Divestment from fossil fuels and volatility in renewable energy prices will bring further bottlenecks and price increases. The greenflation process may not even lead to greater global inflation, but it will lead to greater volatility in monetary and fiscal policies and in energy prices.

Achieve a better balance

In the case of Vanguard, the proposal is to achieve a better balance. The management company considers that the economy and markets are unbalanced:

- demand for human resources exceeds supply;

- financial conditions are still very comfortable, even when compared to economic fundamentals;

- monetary and fiscal policies remain remarkably expansionary.

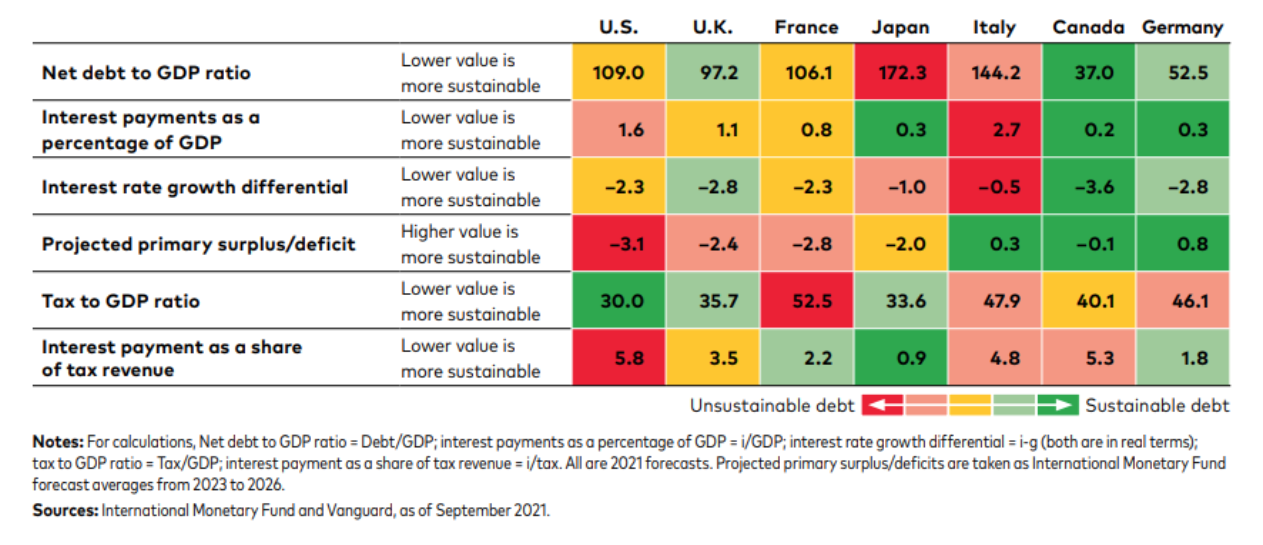

The economic recovery is expected to remain strong, although the withdrawal of stimulus could mean greater risks for financial markets. In the US and the Eurozone, Vanguard projects economic growth of 4%, in the UK 5.5% and in China 5%. There is also the expectation that several economies will reach a situation of full employment and robust growth in wages. This pressure from wages should translate into a greater importance of wage inflation in the evolution of interest rates.

In terms of inflation, it is expected to remain high and permanently in various components, such as wages and housing. Still, inflation is expected to be lower towards the end of 2022 than it is now at the beginning.

There is, therefore, the greatest risk of error on the part of central banks in the way they will deal with the withdrawal of stimuli and in the sense of a more restrictive policy. On the fiscal side, governments will be divided on the need to finance policies boosted by the pandemic - energy transition, social policies and inequality - and more balanced budgets to ensure debt sustainability.

In terms of scenarios, Vanguard proposes a central scenario, with a 60% probability:

- Economic and social activity normalizes during 2022;

- New mutations and vaccine distribution issues subside leading to increased immunization in early 2022;

- The unemployment rate will continue to fall during 2022;

- Inflation decreases towards the target;

- No further support is needed from central banks and governments;

- Global growth of 4.6% in average terms;

- Demand greater than supply, with both growing.

As for the world's main institutions, a highlight is the IMF's World Economic Outlook which can be consulted here, as well as its quarterly updates.

In the next article, we will look at expectations for capital markets, namely in terms of geography, sector and main asset classes.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.