Macroeconomic alignment and trends for 2022

In this article we will explore the implications for the investment portfolio of this macroeconomic alignment and trends, namely in the main asset classes, sectors and industry and in geographic terms, where we also analyze the outlooks of Goldman Sachs, Eurasia Group, Jefferies and ESN.

A more active view is a strategy common to all analysts and management companies, with a proposal for a diversified combination of sectors, factors and geographic exposure by country to maximize risk-adjusted returns.

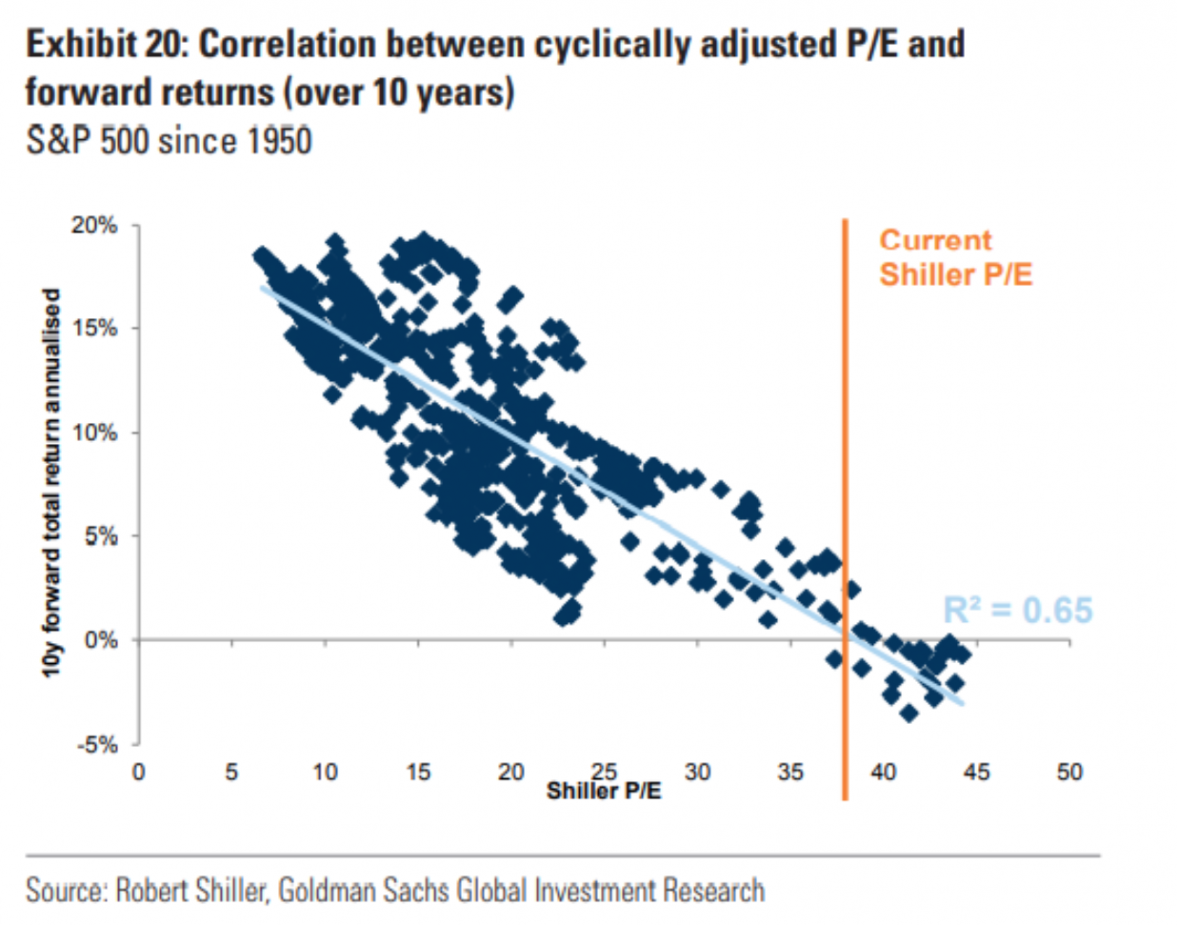

The expectation is a lower return in a longer time cycle, compared to recent years of strong valuations. However, as the ESN Outlook notes, the fundamental valuation level cannot be used as a useful indicator of how close the stock market may be to highs (or lows). There are other factors to consider, but while fundamental valuation is of little use in timing equity markets, it does provide a good indication of the level of expected returns over the long term.

THE OUTLOOK FOR VARIOUS SECTORS AND INDUSTRIES

According to Goldman Sachs, greater variation in returns across sectors and industries is to be expected. This stems from the macroeconomic environment of negative real interest rates and the continuing rise in inflation.

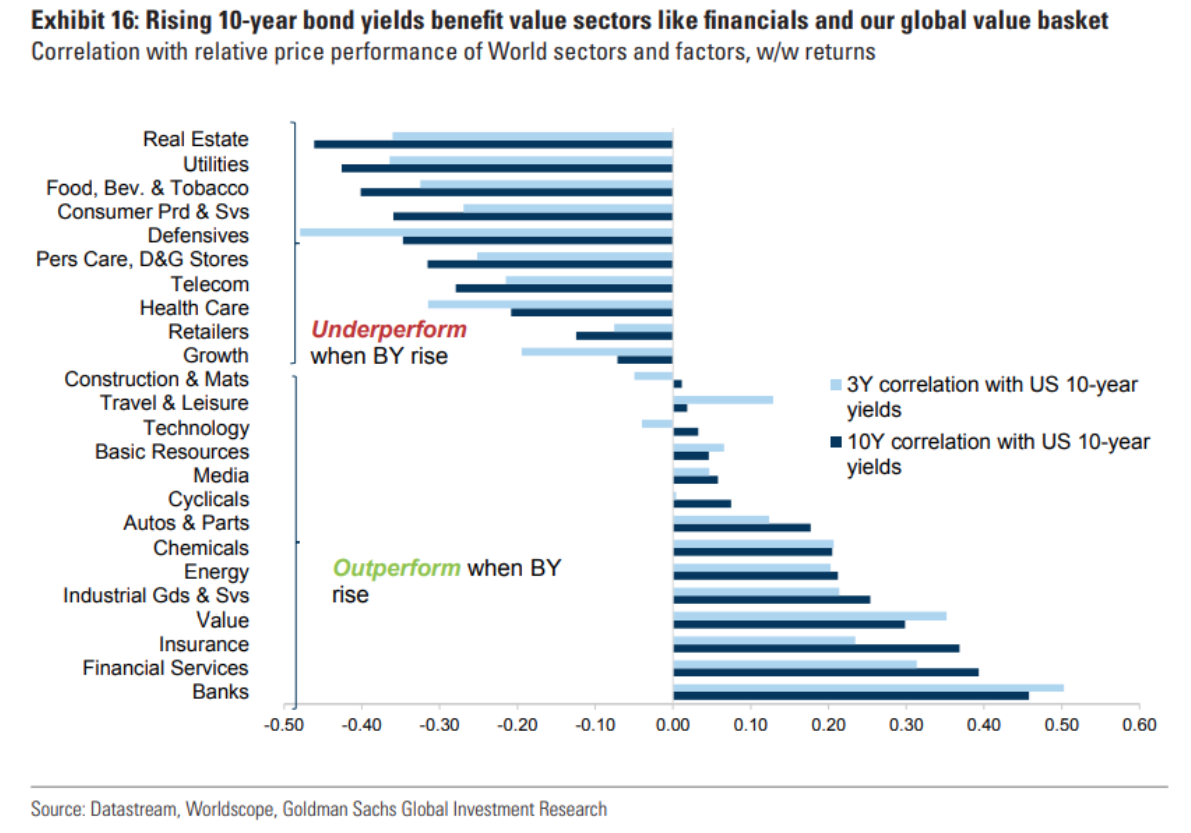

In what we can call the beginning of the normalization of interest rates, the rise in interest rates on government bonds benefits the value sectors, namely financial ones, and the more cyclical sectors.

Cyclical sectors are sectors that are more vulnerable to changes in the economy, such as interest rates, inflation or exchange rates, that is, they are more correlated with the economic cycle and economic trends. Non-cyclical sectors are sectors that are less related to the evolution of the economy, that is, sectors that remain well even in times of economic slowdown or recession. Stocks in these sectors are considered more defensive. In this case, companies that produce and sell food, energy, water or gas, non-durable goods such as toothpaste or detergents stand out. They are necessities and even in times of crisis people do not stop buying these products. In the case of more cyclical sectors, we have travel and leisure, cars, furniture, luxury goods, that is, products considered more durable and whose purchase can be more easily postponed.

The following chart demonstrates this, through the correlation of each sector with the interest rate on the American debt at 3 and 10 years, and the preference for sectors such as banking, financial services, insurance, energy (producers), automobiles, among others. others.

The strategies that have flourished most in the last decade reflect the success of the digital revolution. This trend is expected to continue, however, with decarbonization on the way, part of the growth should be driven by CAPEX and R&D, that is, by increasing the investment and research capacity of companies and using more intensive capital towards the green revolution .

And on this path, the sectors with the highest investment growth ratio stand out, namely pharmaceuticals, biotechnology and life sciences, automobiles and components, semiconductors, technological equipment and software, utilities (because of the green revolution and energy transition) and media and entertainment.

A GEOGRAPHIC ANALYSIS

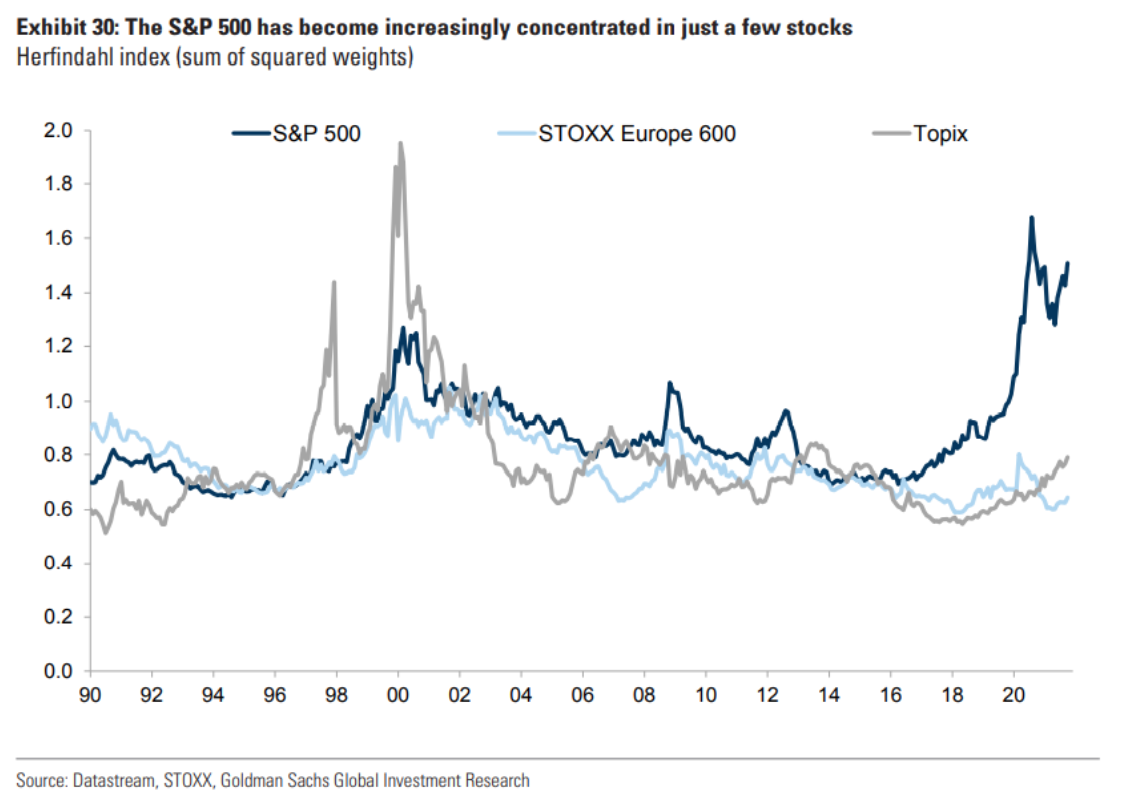

In regional terms, Goldman Sachs presents a very interesting analysis related to the level of concentration in equity indices. Low interest rates led to a very strong expansion of valuations of long-duration assets, that is, whose results are expected to grow more in the long term. This situation, particularly in the US, has led to a higher concentration in the S&P500 index in some companies. This concentration is evident when analyzed using the Herfindahl index - a measure of market concentration - and compared with other indices - STOXX Europe 600 and Topix (Japan).

Although the expectation is not for a worse return for US stocks when compared to other indices, it does mean, however, that the risks are higher.

Thus, regions such as Asia and Emerging Markets are considered to be undervalued in relative terms. Much of this undervaluation is due to the uncertainties surrounding China, which is in a phase of profound change.

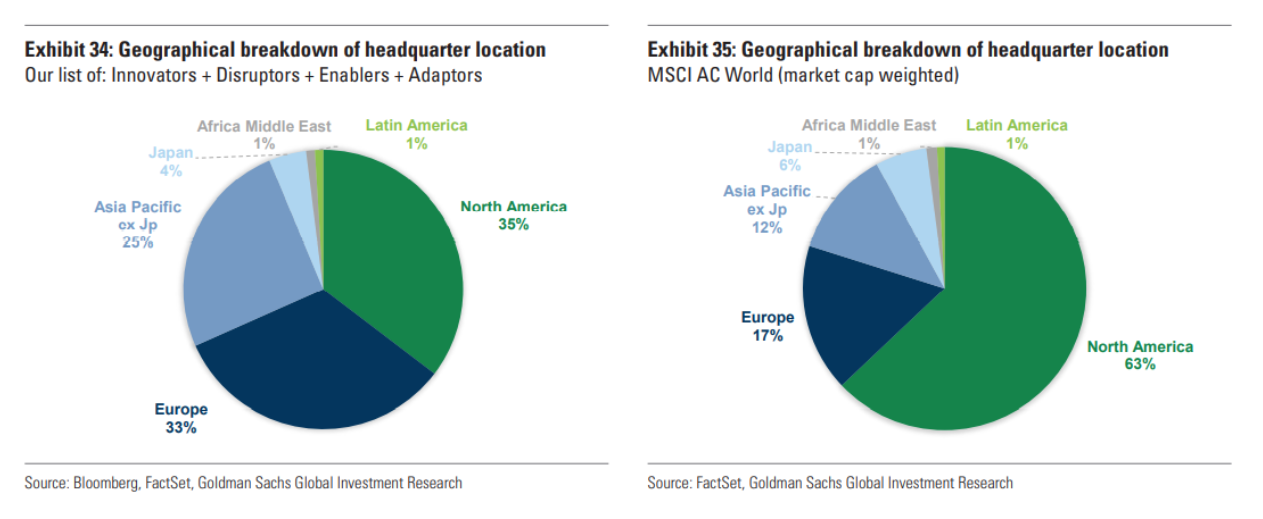

The model based on the strategy: Innovators + Disruptors + Enablers + Adapters shows greater regional and sectoral diversification than the MSCI AC World Equally Weighted index.

In the case of ESN, the Outlook points to below-average returns for the US (S&P500) and within-average for Europe and the UK.

We also look at Credit Suisse's vision and the main regions:

- USA – difficult first quarter, but recovering in the following ones. The market will be more volatile and a stronger industrial and real estate sector is expected;

- China – the economic slowdown will continue, accompanied by strong regulatory changes and real estate and debt constraints. The stabilization of this scenario could mean a good year for Chinese stocks;

- Eurozone – the Omicron variant, energy prices and geopolitical conflicts can mean greater volatility in the market;

- Latin America – back to bad times, with high inflation and very low economic growth;

- Southeast Asia – better prospects for 2022 after a disappointing 2021.

MAIN ASSET CLASSES

Let's start with Vanguard.

Vanguard prepares market forecasts in a probabilistic manner. Annually, they publish long-term forecasts, with a 10-year view.

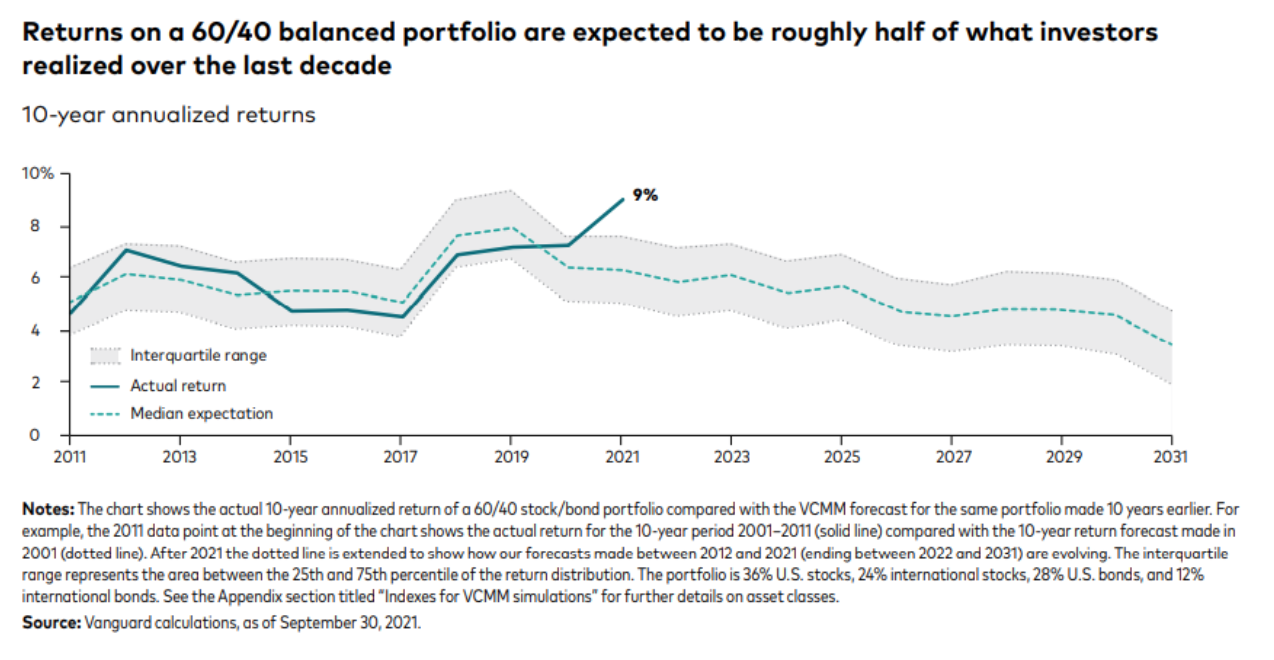

The following figure considers a balanced and diversified portfolio globally, with 60% in equities and 40% in bonds since 2001. The path since 2001 has been followed by low inflation, low interest rates and low growth, which supports Vanguard's vision of a next decade with lower returns for investors.

They also highlight the importance of not looking to extrapolate future returns with the past, essentially due to the very different macroeconomic environment that is expected: more inflation and normalization of interest rates.

Vanguard's vision for the next decade points to:

- US stocks – below-average returns

- International equities (non-US) – returns within the estimated average

Investor psychology (expansion of market multiples based on high expectations and low interest rates) and higher earnings explains much of the error in Vanguard's forecast for the decade 2011-2021 (figure above).

Vanguard considers that stocks have not been so overvalued since the tech crisis in 1999/2000, so the outlook for the next decade is much more subdued, 3.3% per year for the US and 6.2% for the MSCI ACWI index without the US. .

For global bonds, despite predictably higher interest rates, the expected return over the next 10 years is 2% per annum.

In the specific sector of high yield, debt of companies with higher risk, the outlook is for a return between 2.2% and 3.2%.

Also noteworthy are inflation-linked bonds, which Vanguard believes are a good buffer for investors to use against inflation.

Vanguard aims for a balanced portfolio for an economic environment that is also more balanced. It also considers different strategies for the upcoming macroeconomic environment which, however, may generate additional risks:

- Portfolios designed for specific macroeconomic scenarios include important trade-offs – if the scenario does not materialize, the portfolio becomes the worst of all options;

- A balanced portfolio works well for investors who are agnostic about the future of the economy;

- In the case of portfolios with macro inclinations, this should be built on the basis of an optimization framework, in a quasi-tactical and punctual perspective, ignoring the correlations between assets. This strategy can lead to inefficient portfolios.

1. Equities

In the case of equities, Amundi prefers the value style, and selection between quality and momentum taking into account inflation and ESG criteria. In fact, Amundi believes in an acceleration via ESG criteria

Goldman Sachs considers that current high valuations are no guarantee of low returns, but a high CAPE (cyclically adjusted P/E, by R. Schiller) is usually followed by below-average returns, at least over a 10-year period. . In the US, CAPE is above the 95th percentile, which in itself should imply lower returns in the medium term.

The big risk for equities, as defined by Goldman Sachs, is that inflation expectations become more consistent and investors lose confidence, forcing central banks to raise rates, which in turn undermines current valuations. , triggering a more negative sentiment and correction.

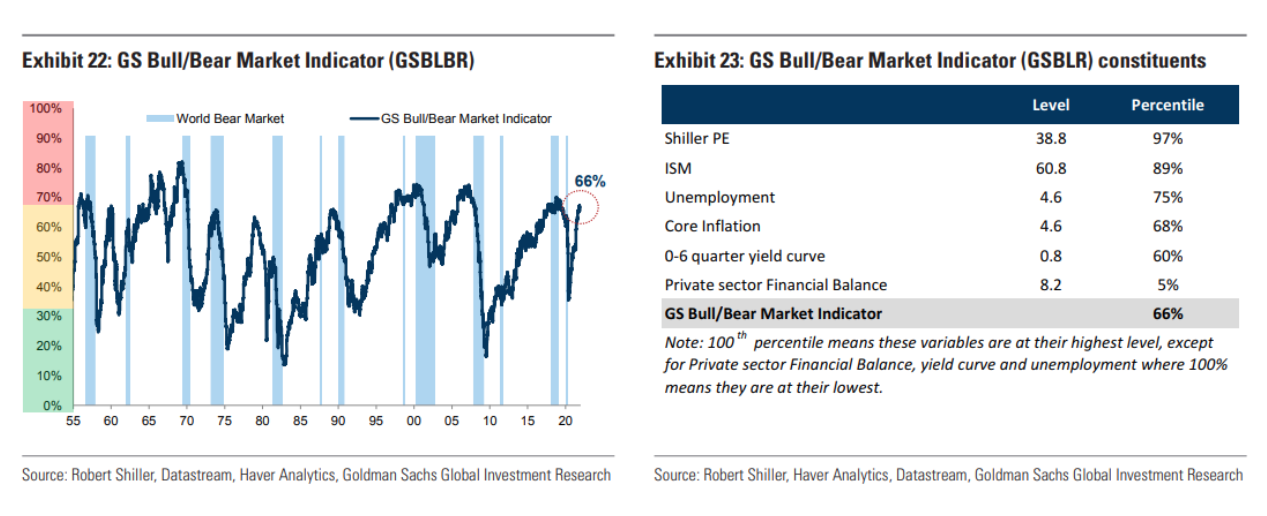

Analyzing the GS Bull/Bear Market indicator, we see that a high reading of the indicator implies a bear market or low returns for the next 5 years.

Therefore, more active management is considered essential in the strategy of these analysts. Goldman Sachs considers that there are fewer opportunities in value/growth or cyclical/defensive views and more in diversified strategies across factors, regions and sectors.

2. Bonds

In bonds the focus is on shorter maturities, lower duration and increased credit scrutiny. Liquidity will be less abundant and the energy transition should continue to support the search for “green” debt.

Higher-rated debt (investment grade) is unattractive and carries a very high interest rate risk

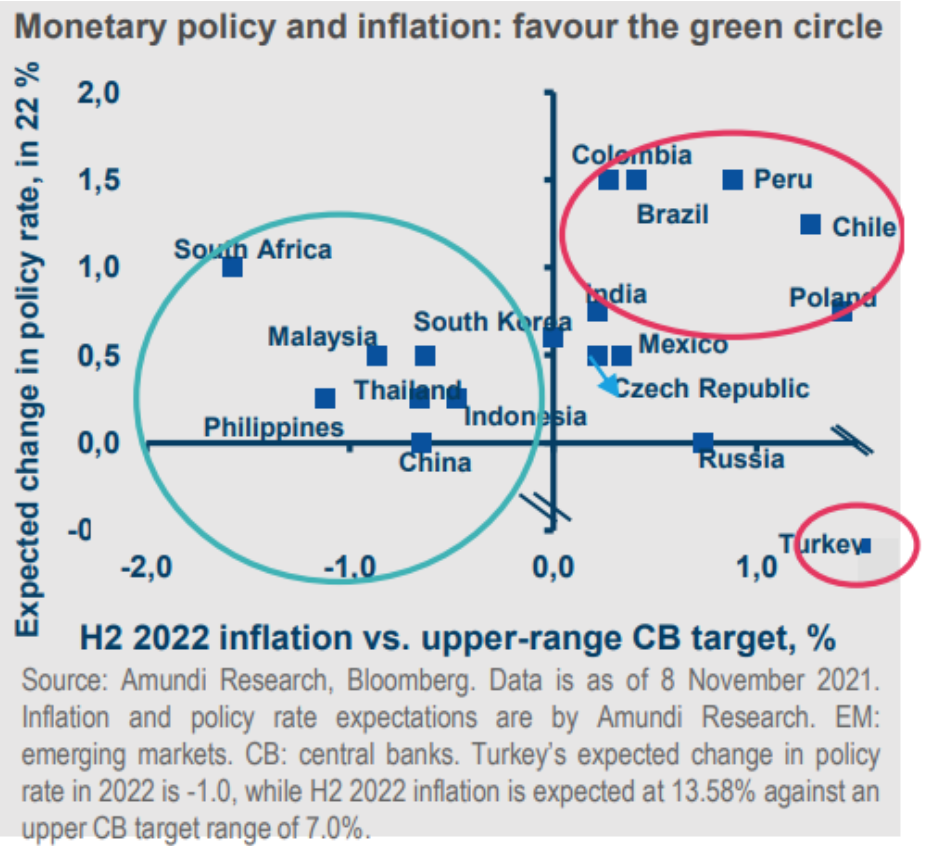

3. Emerging Markets

In emerging markets the view is not positive. Or rather, it is more positive for emerging Asia and less positive for Latin America.

4. Raw materials

In the long term, favor the commodities needed for the green transition. Possible failures in the supply of oil and gas.

The Eurasia Group believes that the economic impact of rising energy costs will be felt this year. Rising costs will hurt economic growth prospects for much of Europe and Asia through 2022. As China continues its massive domestic gas transformation program, demand for gas will continue to increase, pushing up prices. seasonally and creating new supply shortages that once again force it to ration energy deliveries to industry next winter. The US is also likely to experience higher natural gas prices as investment in the unconventional sector is stymied by a combination of bearish investor sentiment and unclear policy signals from the Biden administration. These rising energy costs will fuel global inflation and provoke anti-incumbent political sentiment, causing instability in some emerging markets and affecting elections in France and the US.

5. Crypto and metaverse

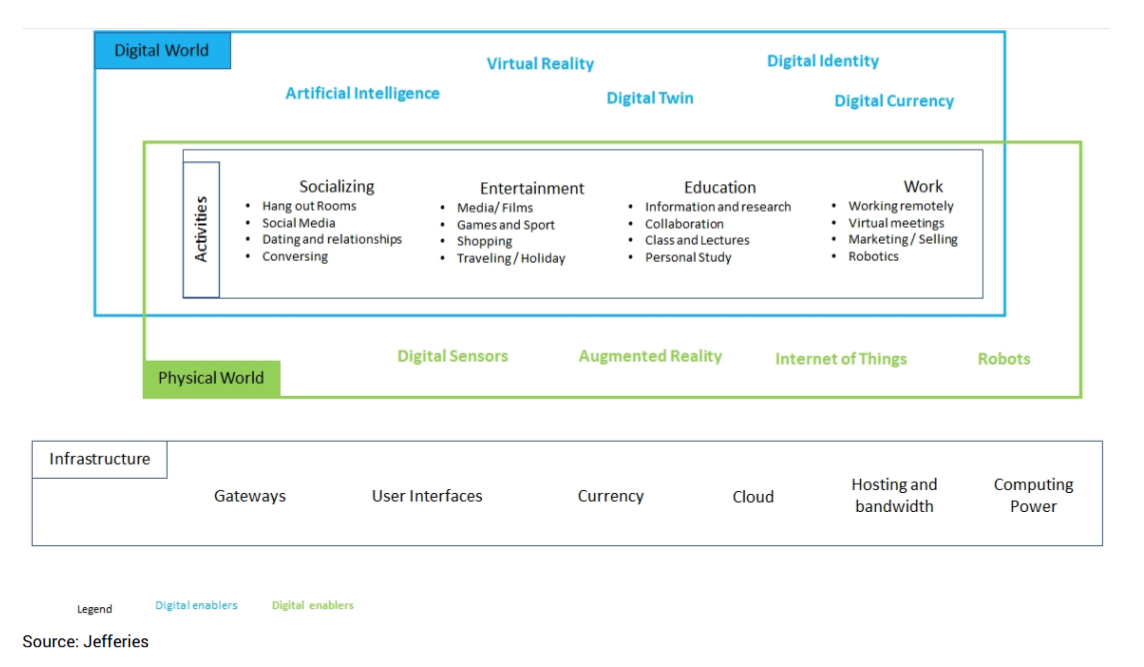

A final word for Jefferies research regarding the metaverse.

The metaverse can be seen as a new platform for the digital age, built on top of the internet and combined with other technologies and interfaces that will allow us to enter and, perhaps, live in it.

It's about the digitization of everything, the birth of our virtual identity (digital twin) alongside the physical one and the development of various economic activities. It will be necessary to use technology such as blockchain and a form of currency that could be cryptos.

Initially, investors will be focused on developing the hardware needed to move from the internet to the metaverse, then to software and business:

- Games, crypto and AR/VR devices

- A digital financial system (DeFi)

- A digital system of decentralized autonomous organizations

- A monetary system – tokens/cryptos

- Digital asset identifiers and store of value (NFTs)

- Smart contracts on the blockchain

- Web property (web 3.0)

Jefferies considers that 40% of the world is ready for the metaverse/web 3.0, mainly Gen Z, an internet native generation.

There are several activities that will be completely transformed by the digital world, namely in the social, entertainment, education and work areas. Blockchain could also revolutionize sectors such as banking, real estate, insurance, legal and stock exchanges.

In the next article we will present our view of the market, in a broader perspective and from the perspective of a non-professional Portuguese investor.

This is at a time when the geopolitical environment is thickening and creating even more tension and volatility in the market.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.