ESG Investing

ESG Investing is an investment philosophy that includes environmental, social and corporate governance criteria (ESG Enviroment, Social & Governance) in the decision-making process in order to achieve the investor's long-term goals and a positive social impact. These ESG factors are a set of criteria that can be used to classify companies and investments along with traditional performance metrics.

Investors are increasingly determined to include these practices in their investment policy and to know how they can do this efficiently.

Therefore, Future Proof has developed an investment process that includes topics related to ESG, climate, disruptive trends, responsible and sustainable investment and with a positive impact on society.

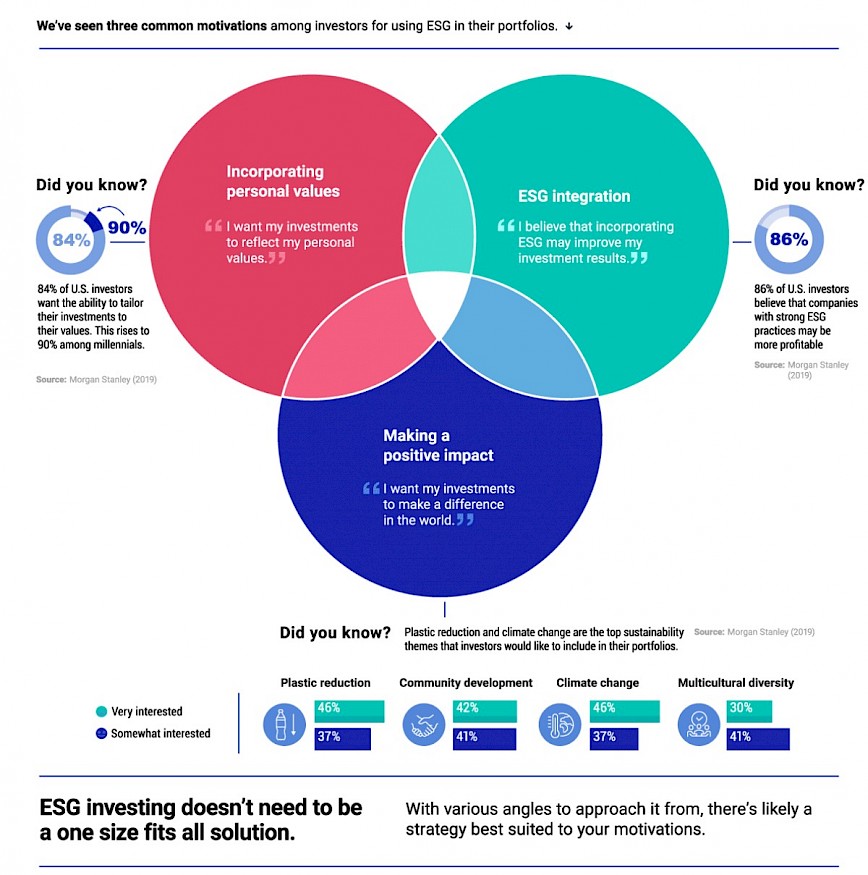

An MSCI investigation identified the top three motivations for investors to use ESG investment:

- Integration of ESG criteria: Investors believe that the integration of ESG criteria in decision making can improve the long-term results of their portfolio, increasing the probability of reaching the defined objectives;

- Inclusion of personal values: The costumization of the investment portfolio is a marked trend in the construction of a financial plan. For this reason, ESG factors are considered an essential tool to align decision making with the personal values of each investor;

- Positive impact: Also known as impact investing, this practice demonstrates the willingness of investors to make a difference with their financial investments. The objective is to combine financial gains with environmental gains and social development.

These motivations are in line with the main value-based investment approaches. Although related, there are some important differences:

- SRI - Socially responsible investment: It means choosing investments that exclude businesses and companies that conflict with investor values. The most common SRI exclusions are non-renewable energy, arms, tobacco, gambling or alcohol companies.

- ESG Investing: Approach focused on companies that make an active effort to limit their negative social impact or deliver benefits to society. Good practices include behavior at the environmental, social and governance levels of the companies themselves.

- Impact investing: Investment with impact is characterized by a direct relationship between priorities based on values and the use of investor's capital, with the aim of generating and quantifying a positive social impact. Investment in economic development in low-income communities and societies, or the reduction of the carbon footprint are some examples.

SUSTAINABLE GOALS

The wide variety of humanitarian, ethical, anti-corruption, environmental and social concerns that many investors reveal and defend will naturally have an impact on the way they invest.

You will need to align your values while meeting your long-term investment goals.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.