Blog

The Loser’s Game

Warren Buffet says that the first rule of investing is not to lose money and Charlie Ellis, in his book "Winning the loser's game", compares the average investor to an amateur tennis player - a game that is won by avoiding mistakes rather than complex moves winners. Why is it so important not to make mistakes?

Investments and inflation

A few days ago we were exchanging messages with a potential investor. I am always happy when someone discusses a 20-30 year savings plan. However, I realised that something was missing. Such a long-term investment plan must include inflation in the calculations, something that the investor was not taking into account.

Future Proof - Cure for pain

After a forced confinement we continue with a kind of conscious enclosure. Always based on expectations of healing and a miraculous return.

The cure for pain can be music.

The idea that we need to be active investors

What I mean by being active refers to our portfolio, continuously selling and buying, what is called turnover in finance. It can also be done with passively managed ETFs.

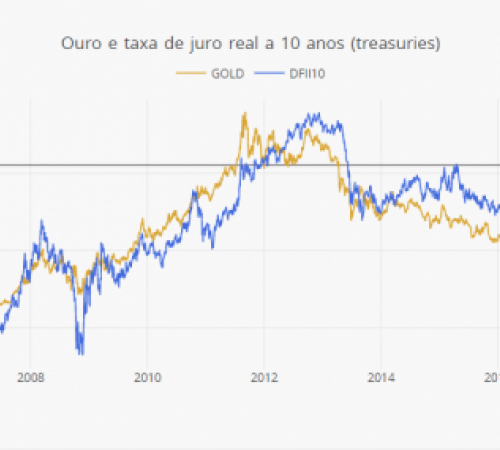

Love over gold

Gold is that type of asset that does not generate indifference, it has something astounding. It is an unofficial currency of the world. It is the great asset of refuge and store of value. It is accepted and valued. It has multiple applicability. And he has a love-hate relationship with his admirers. It's millenary!

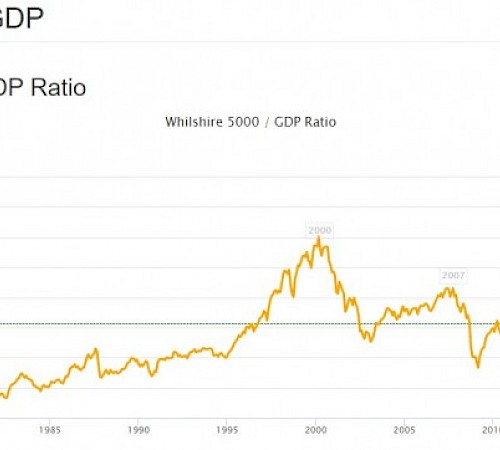

GDP and the welfare economy

We measure the economy using methods from the 1940s of the last century. With so much debt and inequality and falling productivity, the economy has evolved and become too complex to be summed up in a measure like GDP. The truth is that few investors make investment decisions based on GDP.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.