GDP and the welfare economy

When talking about the differences between financial markets and the economy, a ratio that has been so appreciated over the decades is immediately apparent: Market Cap to GDP - market capitalization as a percentage of GDP.

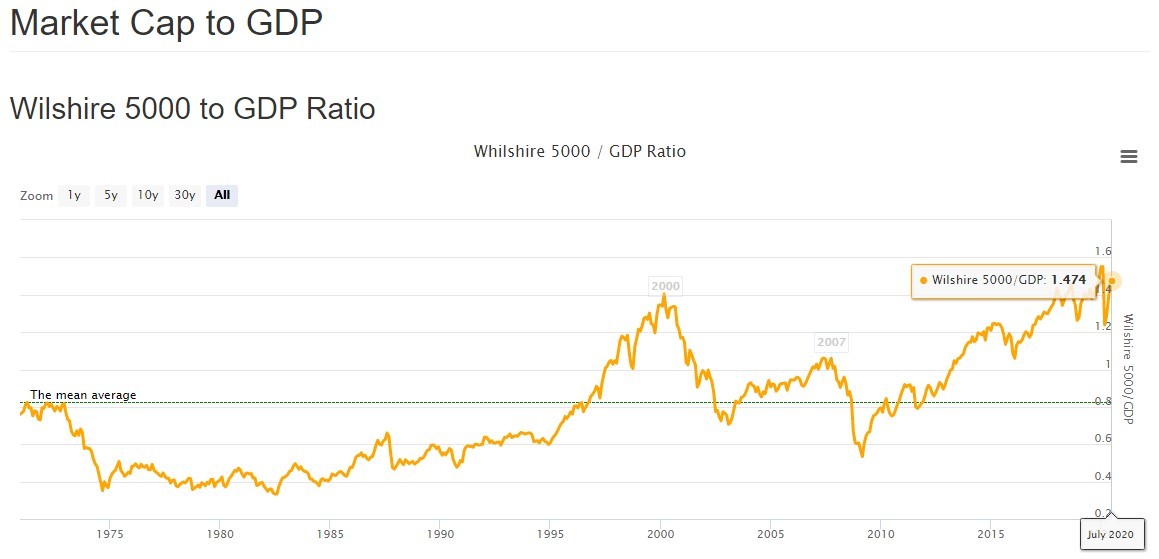

This ratio, known and popularized as the Buffett Indicator, is a long-term indicator for the stock market and is seen as a way of understanding how the market valuations are at a given moment against economic fundamentals. Thus, we should expect similar growth in the equity market (from a total return, price and dividend perspective) and in real GDP (adjusted for inflation).

The chart below, using the information available on the Long Term Trends website, represents one of the possible forms of the indicator, that is, the American Wilshire 5000 index against the American GDP.

As you can see, there is a different reality visible in recent years.

Naturally, the low (but stable) rate of inflation and the low (or negative) returns on debt instruments such as bonds or deposits are attractive factors for investing in shares, despite the obvious risk of overvaluation.

As Damodaran said, markets are veritable forecasting machines, full of noise and errors, of course, but they provide us with the current value of a service or a product, a sector or a region at a given moment.

He would add that in addition to forecasting machines, financial markets are emotional intelligence machines. To dissociate the evolution of an index, or a title, from feelings such as fear or trust, from the capacity for motivation or influence, is to miss the essence of human behavior.

It is also common to hear that, in general, markets seem to be more often right than wrong, despite the bubbles and depressions. They reveal a temperament that is highly conditioned by fear and emotion, by happiness and luck or bad luck, by irrational and impulsive behavior. But between curves and peaks, highs and lows, in V or W, they leave safe clues about the future.

Therefore, there is increasing criticism of the use of certain statistical and economic measures such as GDP, as they are no longer able to capture the true state of the economy as well.

GDP ignores, for example, leisure, happiness, housework, the flexibility of the labor market. It ignores the distribution of wealth at a time when inequality is growing. It ignores the environment, sustainability, innovation, education. Skips the production of personal data. It ignores digital disintermediation, it ignores the shared economy or even the economy of producing digital goods from home, such as the production of content for blogs, videos, medical services or open source software. Many of these activities are even zero price activities. Therefore, we will have to conclude that the macroeconomics will still not have been able to systematize the economy of the future.

Basically, we measure the economy with concepts and methods from the 1940s of the last century. With so much debt, low productivity and high inequality, the economy and society have evolved and become too complex to be summed up in a measure like GDP. As well explained in this paper on the future of GDP prepared by Credit Suisse, one of the strong conclusions is that few investors make investment decisions based on GDP.

In this infographic made available by the European Council, based on work by the OECD, economic growth is clearly related to individual well-being.

GDP, and other economic indicators such as inflation, unemployment rate, or debt as a percentage of GDP, are absolutely essential in a rigorous analysis process and are part of the matrix of information to be produced, collected and analyzed. But other metrics and indicators must be considered to complement the analysis and decision-making process.

This infographic identifies the well-being economy as an economy that reduces inequality, promotes social protection, invests in education and training, health and preventive measures, and a better balance between work and leisure.

The number of users, scalability, happiness, sustainability and social responsibility are preponderant factors in new businesses and good investment stories. Is it the future? Not all. It is up to each investor to do their homework and decide the best path to take to achieve their goals. The economy, with or without GDP, will continue to follow its parallel path in the search for individual well-being and as a society.

It is also essential to look at the geopolitical and emotional system of the analyzed economies and the way in which businesses are structured.

In short, the future of the economy appears to be:

- In companies with little debt and with a willingness to innovate and creativity;

- With global vision and scalable;

- That respond to needs or create those needs;

- That they adapt to people and are flexible in their business model;

- That they have a responsible and sustainable business;

- With high quality human capital and clear concerns about your well-being;

- Based on open and politically stable countries, good social infrastructure, education, justice, security, health and a simple, transparent and effective tax system.

The fragility of democracy and civilization is also in these scenarios that becomes more evident. And today, more than ever, we are prepared to look at the economy also from a perspective of well-being and responsibility, and not just in ideological and productive terms.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.