The idea that we need to be active investors

First of all I must clarify what I consider an active investor and explain that this is no longer an article about passive management vs active management.

What I mean by being active refers to our portfolio, continuously selling and buying, what in finance is called turnover. It can also be done with passively managed ETFs.

Over the years, and speaking with various investors, it is rare for someone who admits not knowing the future. Everyone has an opinion on whether the market will go up or down. When faced with the impossibility of knowing the future, they occasionally put together a story of the past in which they “got it right” in the movement of the markets.

This “ability” to predict the future comes from many biases that are studied in behavioral finance. From the overvaluation of our intellectual abilities to the retrospective bias (hindsight bias). When we look at the past we conclude that it was obvious what was going to happen, but at the time it never seems.

As I write these words I myself wonder if my opinion is correct or is it just my bias to try to rationalize everything in order to understand better but deep down these decisions are just based on fear (How Evolution design your fear).

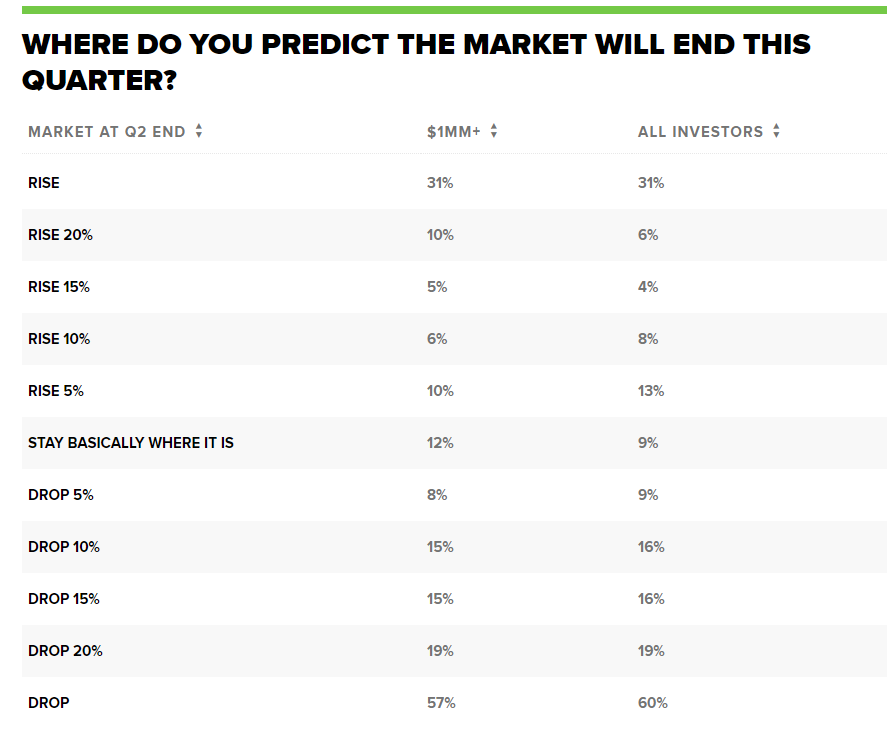

In mid-April E-trade made a questionnaire to its customers. This was the result:

Fonte: A conflict over the No. 1 rule of investing among wealthy Americans during this crisis

Since then the S&P 500 has risen more than 15%. Only 31% of people said the S&P would go up and only 15% of people agreed that the S&P would go up at least 15%. On the other hand, 60% thought the market would fall, practically double the bullls.

Alongside this question, they also asked the opinion of which sectors would perform better in the second quarter of 2020. 64% of the people were of the opinion that Health Care would be the sector with the best performance and only 11% the Consumer Discretionary sector (one sector historically with performance in line with the economic cycle).

Sector returns were 21.62% (VHT - Vanguard Healthcare ETF) and 47.14% (VCR - Vanguard Consumer Discretionary ETF), the exact opposite of what most people expected, and by a significant difference.

This is for me a case where fear and what apparently made sense (health care being the sector with the best performance during a global pandemic) took over peoples opinions. One study that resulted in a book is the Enigma of Reason. In this book it is quite dissected how much we are the first to lie to ourselves because our opinions, most of the time, are mere rationalizations of our fears and biases, being mere justifications for what we think a priori.

So, as I said in the article “The futility of trying to guess the future!”, we have to study and develop ideas and plans in the medium/long term in periods of calm so that, in times of crisis, we can be guided by ideas and policies more impartial and concrete. Thus, we avoid taking decisions with nerves on edge or fear of a sharp fall in the financial markets.

We don't have to be constantly active and always making decisions to buy and sell funds/ETFs to achieve our investment goals. Not making changes to the portfolio is also a decision, and sometimes the hardest and the best one, decreasing the probability of making a mistake.

With a degree in economics (2006) and a postgraduate degree in Finance from Universidade Católica do Porto (2010), he later realized that he shared the same enthusiasm for programming.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.