What is goal based Financial Planning?

Goal-based Financial Planning is an approach to investing built with a focus on behavioral finance and targeted at individual investors and families. For each objective, a portfolio is built according to a pyramid of priorities, a kind of “bucket list”, and taking into account the risk of non-achievement.

Key factors to consider

- Goal-based investment plan, goal-based investing, and wealth management or goal-based investment advice are similar concepts used in this article.

- The financial industry considers investors to be rational beings, but we all have different behaviors and attitudes towards investment, decision-making in a risk context and the optimization of our assets.

- Each investor or family has multiple lifelong goals, with different levels of priority and risk. The construction of savings and the management of investments must be aligned with this vision.

- The risk of not achieving an objective is different from the risk associated with the periodic volatility of the investment portfolio and is valued by the investor.

- Human capital, clear definition of goals, risk of premature death and risk of longevity are fundamental variables to build a truly optimized and personalized portfolio.

This model of advice and wealth management based on objectives and goals is related to the notion of risk. It is an extension of the traditional Markowitz model of market risk diversification. On the one hand, the financial industry associates risk with standard deviation, that is, with the variability of portfolio returns. However, on the other hand, the investor associates risk with the possibility of not being able to achieve his investment objectives.

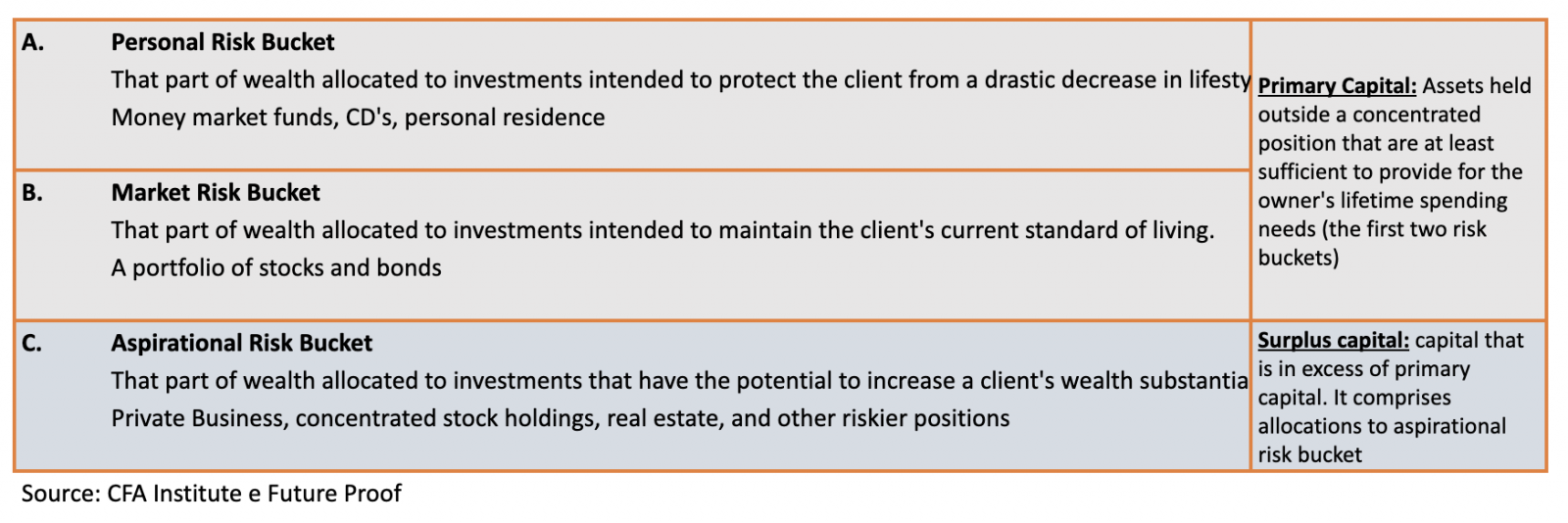

Thus, objective-based investing modifies the traditional mean-variance model to include the results and insights of behavioral theories associated with finance. The portfolio is divided into layers in a kind of pyramid, with each layer designed for progressive levels of investor objectives.

Approaches to Asset Allocation

We can identify 3 different approaches to asset allocation. One, more traditional, focused only on investment assets and instruments. In this approach, the best known and most studied model is the mean-variance optimization (MVO). The MVO considers only the expected return, risk and correlations between the asset classes defined as investment opportunities and aims to maximize the expected return on the portfolio for each unit of volatility (measured by the variance), in a given time horizon and consistent with the risk tolerance and restrictions of the investor. One of the best known indicators in this model is the Sharpe ratio. That is, it is a very focused approach from the perspective of volatility.

There is also the approach with the objective of financing the responsibilities assumed, that is, designing an investment plan with the objective of paying these responsibilities when they come due.

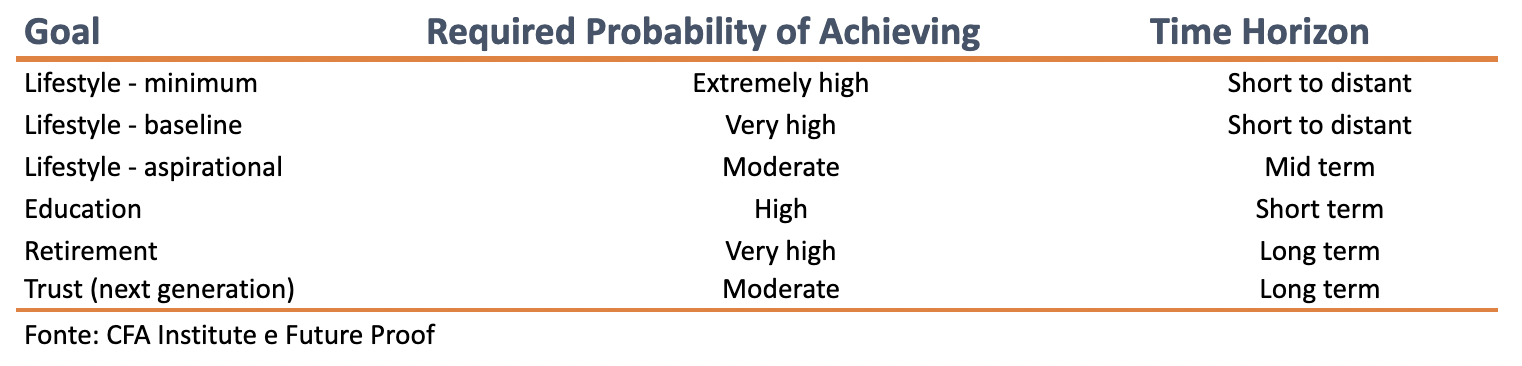

Of course, all approaches to asset allocation mirror the need to achieve objectives. But the approach we're dealing with here, known as Goal-Based Investing, is specifically targeted at individuals and families. It presupposes the construction of investment strategies and the allocation of specific assets to different portfolios, each one aligned with a specific objective. See the examples in the following table.

Each objective has different liquidity needs and time horizons, in addition to a different risk tolerance, according to the necessary probability of realization. Objective-based planning takes into account the investor's balance sheet, that is, the assets and liabilities assumed, including the income from human capital and expenses associated with lifestyle.

In the following table we define three levels of objectives, organized according to risk, that is, the priority for the path of financial independence.

The objective-based approach to wealth management transforms the relationship and communication between advisor and investor. It shifts from a purely quantitative and generic, product-focused view to a more transparent, intuitive and natural model in order to be more easily understandable and service-focused.

The influence of behavioral models

Taking into account the cognitive and emotional aspects of each investor, in addition to the rational aspects, is an essential feature of objective-based planning.

First of all, because this approach assumes that investors see their money in different safes, that is, we tend to say that these euros are here and the others are there. Basically, we do not accept the fungibility of money. This cognitive perception is known as mental accounting.

Traditional finance focuses on what the investor should be, while behavioral finance focuses on what the investor is. That is, on the one hand, there is risk aversion, rational expectations and asset integration, on the other hand, loss aversion, biased expectations and asset segregation (we see our assets in different groups).

In our opinion, both are necessary. We have to be as rational as possible in analysis and decision-making, but we have to accept that we are emotional beings and influenced by different factors, such as mood, noise and our knowledge (or lack of it).

If we take these factors into account, we can build one or several portfolios, fully customized and adapted to each major objective or priority. Basically, to meet our motto that each portfolio is unique. It is personal and non-transferable.

The bored investor

Investing is a tedious process. At least that part of the investment that corresponds to the defined plan, step by step, repeatedly. Success is not visible. It requires consistency and rigor. Waiting for time to work in our favor, through the mechanisms of the compounding effect (compound interest), and for money to work to achieve our investment goals is a consistently monotonous process.

And this annoyance becomes even more egregious in this age of quick gratification, sensationalism, sudden cravings, and the lack of patience needed to wait for results. We want to see results right away. But this immediacy does not take into account any systematized process, nor any outlined plan. It is random and highly volatile, implying a risk that is both high and unnecessary.

We tend to look only at the end product, never at the process that made that product possible. But the process (the plan) is what makes success possible in the end. The plan also allows for discussions between advisor and investor as market conditions evolve and the time horizon approaches.

Example of an objective: the MBA

You've decided it's time to invest in your future! Give your career a boost. Be an expert in that area. Open horizons in other matters. Having defined the objective, it is necessary to build the investment plan.

This is the simple, practical and organized way of figuring out if you will have money for your MBA, without jeopardizing other more and less prioritized goals:

- Define the objective and name the MBA

- Tell us by when, how much you need and the priority of the objective

- Analyze the plan to get there

- Finally… finally apply for the MBA!

Our job is to model your financial flows to organize and achieve the defined objective, making it a more fluid and participatory process. We assign probabilities of completion, in different scenarios, and the safest path and most aligned with the preferences and restrictions of the investor.

In this modeling context, we cannot leave behind the other risk levels, namely those that are in the highest priority group, but also the risks of longevity and premature death. The importance of life insurance protection, as we have been highlighting (blog and podcast), should also be well highlighted in planning based on objectives.

In short

Before we put all the assets and asset classes together to form the portfolio we have to ask ourselves a few questions.

And the main question is: what or what are the objectives? Why are we investing?

In the end, we want portfolios that are more optimized and aligned with the interests of investors, with more or less risk, always taking into account each portfolio and each objective. If Portfolio A has a short-term time horizon, we know that the approach should be more conservative. If, on the other hand, Portfolio B has a very long time horizon, the addition of greater risk may be less daunting for the investor.

The greater connection to behavioral aspects are the starting point for a more rational investment, based on a more natural, intuitive and transparent process.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.