Why do you have to increase your savings?

Savings is one of the essential resources of the financial plan. It is a kind of renewable energy that needs to be fed periodically. Therefore, we must define savings as a priority: Pay yourself first!

But first things first!

The current economic and geopolitical situation advises prudence.

However, a look at traffic in big cities, restaurants and consumption levels conveys a different feeling. Everything is fine!

Decreasing unemployment levels, shortages in many products, extended delivery times, record-breaking tourism, expanding credit. Important data, but that can hide a rapidly changing reality.

It's just that if we look at the markets, it makes sense: government bonds with one of the worst performances ever and with many equity indices with drops of more than 20% since the beginning of the year.

What's up?

Let's imagine that there are 2 types of people: those who live life in the future (suffer and celebrate in anticipation) and those who live life in the present (suffer and celebrate in the present moment). It seems like they are different people. The truth is that we behave like this in different situations and then make the wrong decisions. Markets and central banks say today that the future is dangerous, but consumers and governments believe there is no problem (yet) and someone will be here to lend a hand.

Within a few months the first group will be partying in anticipation and the second group will be highly depressed. Can we avoid this merry-go-round of emotions?

There is no perfect model, far from it, but there are other ways beyond these extreme cases. Paths where there is good sense to stop and think, ideas and plans for the future and a critical view of the information received. This would be the third group of people. He knows that the market will not end today and he knows that if he doesn't buy the property now, he can buy it later. It also knows that the cost of living will continue to rise and that consumption needs to be rationalized and optimized.

In the midst of this exaggerated typification and generalization there is, of course, the unique situation of each person and it is this that we must take into account when making decisions. We can't control whether the market goes up or down, but we can control when we make a buy or sell decision. And this is where our effort should be: how to make a decision.

In the act of consumption, for example. Naturally, there is basic consumption, the same essential and on which our existence depends. But until then, and without getting into controversy, it may be possible to adopt a different lifestyle that allows for good food, more time dedicated to leisure, less unnecessary travel, greater energy efficiency, reuse of materials and resources, and other ideas to reduce the waste.

Plan, optimize and save

That's why it's so important to look at that third group of people. The objective of this group is to plan, optimize and save. It can even be in this order. If we take a shopping list to the supermarket, we will avoid buying too many of the products we don't need. If we optimize our resources at home, we will have more space and time to live and pursue a better quality of life. If we plan to optimize it, we will be able to save. And saving can mean living better at any point in the economic cycle. Avoid depressions and moments of great euphoria. Calm down that carousel.

The truth is that despite inflation and the need for consumption and investment, we really have to increase savings. This savings will be used by economic agents to consume, invest and improve our standard of living in the future.

Don't go after those who say you have to consume to boost the economy. This economy also needs savings and investment. The dynamism comes from the flexibility and independence that each of us has with regard to money and financial well-being. Consuming even without having the money to do so creates dependency and vicious circles of impoverishment.

The risk of running out of money

A look at Goodhart and Pradhan’s book “The Great Demographical Reversal” helps us understand the change that is taking place: an aging population, a change in the life cycle and dependency ratio, and a colossal increase in retirement and with health and well-being, where the impact of diseases such as dementia seems to pontificate.

The gap between retirement age and average life expectancy is increasing, which means a greater risk of longevity, that is, a greater risk of not having the money to maintain our lifestyle in the future or even live a dignified life.

What to do?

Several Portuguese personalities have been alerting to the need to increase savings. I highlight the recent interview by António Horta Osório to CNN Portugal, where it was clear in the prediction that next year will be "very difficult" for Portugal and "the more the Portuguese are prepared, the more they will be able to defend themselves, so as not to have a clash of surprise".

Luís Aguiar-Conraria, in his political and economic analyses, and also in his weekly column on Expresso, has been giving his views on the importance of saving. When participating in the Future Proof Talks podcast, in the episode about Richard Thaler's book, Inappropriate Behavior, he left several examples of how we can save more. In fact, in the chronicle of aging, social security and savings, Aguiar-Conraria even mentions that “anyone who does not want their standard of living to fall sharply with retirement must have substantial savings”.

In the article The importance of time: stop trying, we leave some clues about the next steps to take. Starting to save with €1 a day is possible. We start slowly and increase savings whenever possible. As?

- with the annual bonus;

- with the return of the IRS;

- with the Christmas or Holiday allowance;

- with the salary increase;

- with an organized decrease in consumption;

- with the renegotiation of credit, service and subscription contracts.

And yes, you can start right here. To prepare for the shock of surprise in the future, there is nothing like analyzing your housing and personal loans, rationalizing the use of your credit card, analyzing and negotiating your telecommunications, energy and other recurring subscriptions that you can do without for now.

Small steps to feel more comfortable now and in the future.

An opportunity for the future

Savings need to increase not only to meet urgent, short-term needs arising from a possible recession, but also to take advantage of current market conditions.

Ben Carlson, in his article Bear Market Opportunities For Every Generation of Investors, points to the opportunity that the market is creating for investors of all generations.

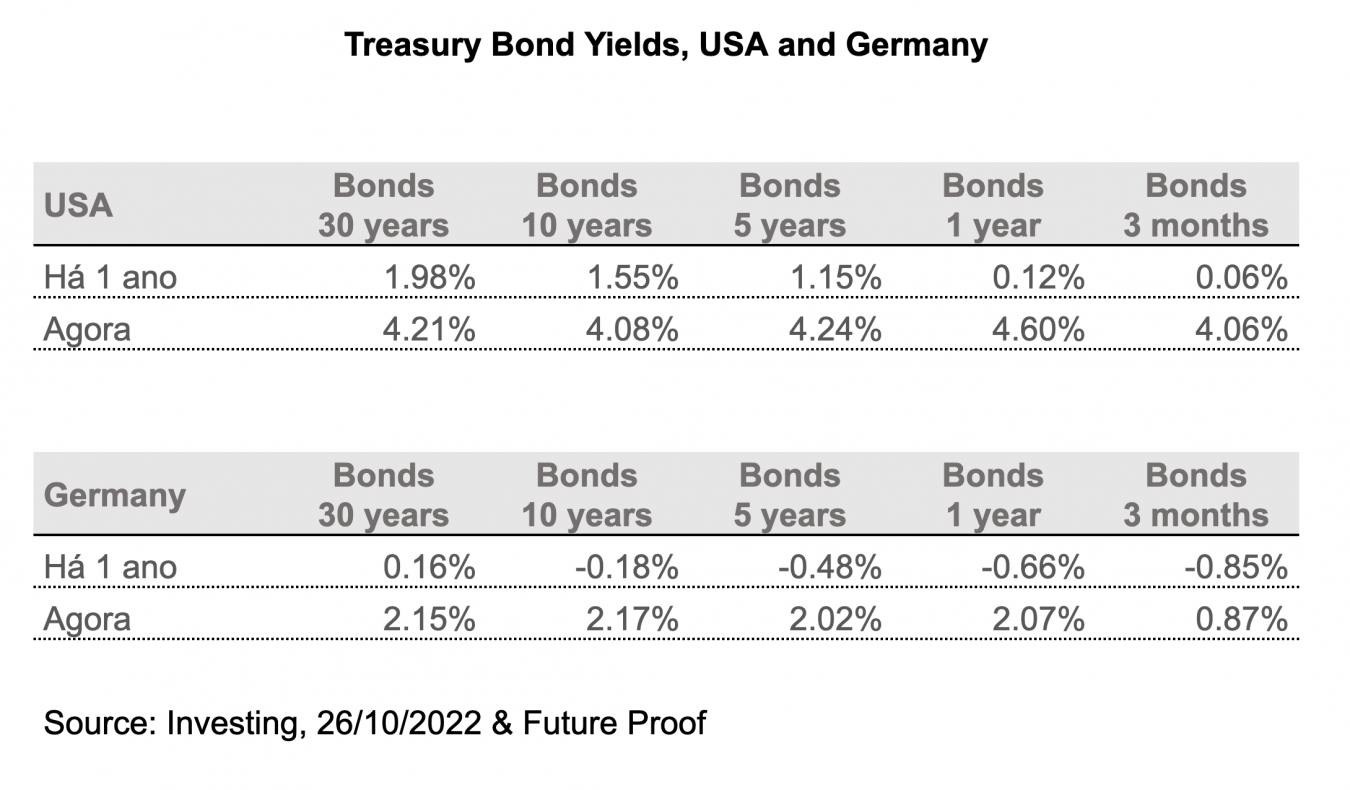

The table below is very clear in the paradigm shift in financial markets, namely in the interest rates implicit in the government bond market. These bonds represent the yield rates over the various maturities in two countries with very low levels of credit and default risk, as demonstrated by their high debt ratings.

This means that, although these conditions are still lower than the current inflation rate, they can already be seen as an opportunity, especially for the older generations, close to or already at retirement age, where there are already prospects of obtaining a remuneration substantially better than a year ago and with lower levels of volatility.

Although not yet fully reflected in term deposits, it is already possible to find much more attractive interest rates, for example in savings certificates.

For younger generations, who are on the opposite side of financial goals and constraints in terms of time and liquidity, they also now have better opportunities to apply their short-term emergency funds and better prepare their long-term goals.

In these times of crisis, especially in a year where the market drops are being brutal, for those who have their assets fully invested it is really difficult. But the message is clear: keep saving. For those who are able to save and invest periodically, the world's main shareholder indices are now down between 20% and 30% from the highs of last year and early this year, depending on the indices. Keep the course. invest.

Define short- and long-term goals, design a savings and investment plan and policy, pay attention to preferences and restrictions in terms of liquidity, time horizon, fiscal, personal and professional situation, and invest.

My personal experience has passed through both groups of people, and every now and then I feel the call of one of them. It's normal. Or at least I assume it is. My goal is to make as few mistakes as possible when I invest and when I consume. It is obvious that I seek satisfaction, self-fulfillment and even recognition, but I am aware that it is an inefficient result that does not help me achieve my savings and investment goals. But, in the end, I always try to have control over the decision-making and not be dependent on what the market is doing at the moment or the poster for the next Primavera Sound and the summer trip I wanted so much to do.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.