Where to invest in 2022: waiting for a recession

Want to know where to invest in 2022? Waiting for a recession could be the title to describe the last few months and anticipate what 2023 and 2024 could be.

A series of circumstances, such as the injection of liquidity in recent years, the shock, and its replicas, caused by the pandemic and the roller coaster of raw material prices, namely energy, became the ideal plot for the announced end. : the recession.

Central banks, all over the world, also showed the path of recession with one of the most aggressive and quickest interest rate hikes ever. The objective of this policy is clear: to provoke a recession, as they believe that is the only way to stop inflation.

We can discuss whether the shock was in supply or demand or if the measures came too late, but the truth is this: decision-makers, governments and central banks designed a financial repression with a strong impact on people's lifestyle and purchasing power. .

For investors and their investment portfolios, the impact was felt brutally with one of the worst years ever in terms of asset classes such as bonds, for shareholder sectors such as technology or for the typical 60/40 portfolio ( shares and bonds).

So there is no doubt that something very significant is happening. But the certainty is so universal that we could be “victims of the propensity to extrapolate trends infinitely”. John Authers, in his chronicle Points of Return of 09.26.2022, points to a reality that befalls journalists and what he calls the “Curse of the Cover”, that is, “when a trend is so clear that newspaper editors they put it on the cover, at the exact moment when the trend is at its peak”.

And there is no lack of examples of this curse. In the same article, Authers highlights the April 2019 Bloomberg Businessweek cover on the death of inflation and another on the 2011 economic crisis in The Economist.

As we know, even with a delay of 2 years, the death of inflation was prematurely decreed and the cover with fears about the economy in 2011 was published at the moment when the recovery began.

Long becomes the wait

The news of the recession has already been announced several times. We've been talking about this for at least a year. The truth is that there are certainly a lot of people hoping that the recession will finally materialize.

As the expectation drags on in time, a kind of curse is formed, a promise that feeds itself and is eventually fulfilled. Sometimes, we get carried away by the excess of certainty in a given scenario and this changes our perception of events and the way we can take advantage of them or overcome them.

Our behavior is completely conditioned by this expectation and as it approaches the notion of danger makes it even more difficult to make rational decisions and leads to moments of panic, like those that have been experienced in the stock markets in recent months.

This is why sentiment is so important in the analysis of expectations. An almost universal truth about the recession and the fear it has engendered in financial markets could mean that the turning point is close to good contrarian style.

And finally, the arrival of recession may not be enough. Imagine that even provoking a recession, with rising unemployment and social tensions, central banks are unable to bring inflation to the target?

To answer this question, we have to answer another: what is a recession?

In episode 29 of the Future Proof Talks podcast, “The Inflation, Currency and Debt Puzzle”, we address this situation, putting some views on economic recession on the table. Robin Brooks, chief economist at the institute of international finance, in May this year said: “We’re in another global recession scare now, except this time we think it’s for real.”

So I went looking for three ways to define a recession:

- Many countries and institutions argue that a technical recession is the contraction of GDP in 2 consecutive quarters. It is perhaps the most generalized definition by the media;

- The NBER, an American organization, defines a recession as a significant decline in economic activity that spreads throughout the economy and lasts for more than a few months. After the recession of the covid-19 pandemic, it still hasn't declared a recession again;

- The IMF and World Bank prefer to characterize a global recession as a year in which the average global citizen experiences a drop in real income. With the current levels of inflation and the lower rise in wages, the drop in income is real, already this year.

The truth is that increasing the risk of global recession is a priority for financial markets, which has important repercussions for investor psychology.

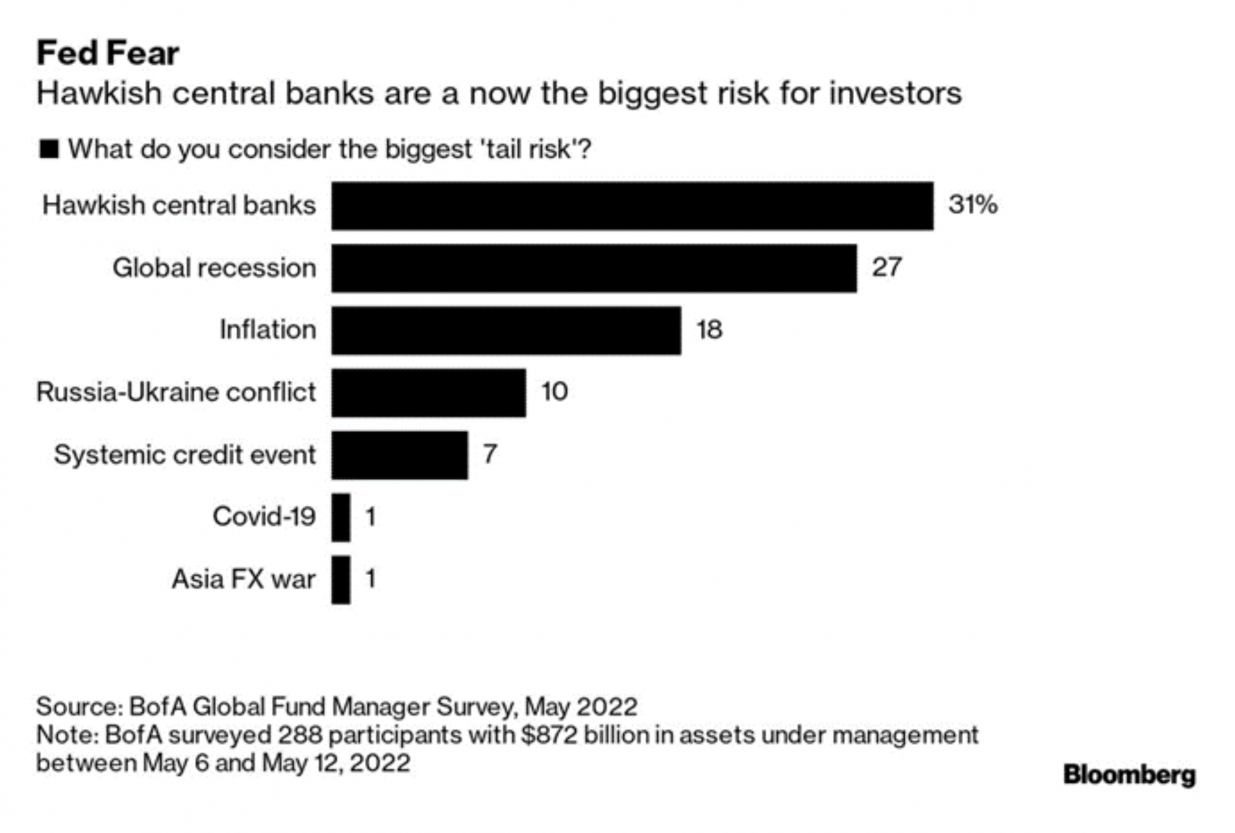

But again expectations are important: markets are falling this year not because of the fear of inflation, but because of the consequences of controlling inflation. Doing so can bring pain…

What can an investor do in this scenario?

Continue to invest. Analyze your individual situation. Redefine the lifestyle. Save. Check whether it is necessary to change or update the investment plan. Continue to invest.

This is the answer to this question and to the question above about inflation remaining high even in a recession scenario.

There are no miracles: the only way to achieve financial independence is to continue investing, in the long term, in any macroeconomic scenario.

Okay, but investing in what?

A

defined portfolio essentially depends on investment objectives, risk tolerance and our needs, preferences and restrictions. Rebalancing, as a tool included in the strategy, is the pendulum that guarantees the alignment of the portfolio with our specific situation. It can mean selling high and buying low, it can mean discipline and focus on the defined investment policy and not on the macroeconomic moment. The strongest message to get across is “follow the plan”. Don't be disappointed with what you're reading. I'm sure this strategy will help you.

For investors with short-term goals and even for the emergency fund, instruments with a more interesting risk-return binomial are beginning to appear, such as supranational bonds, treasury bonds or even savings certificates. However, it is never too clear: our individual situation is different from the situations of other investors.

As John Bogle says, there is a common path that we can all follow. Selecting index-tracking assets (passive investments such as some ETFs and index funds), which are cheap and fiscally efficient, is the common thread.

Some important rules:

- Long-term returns are generated by investing in real businesses that produce dividends and earnings growth;

- Temporary speculative returns are an illusion: the return comes from owning a position in an asset, not trading it;

- Diversification is fundamental: individual companies are born and die quickly;

- Unnecessary costs are very high, avoid them;

- Investors with a long-term plan, as a group, earn more than more speculative investors. The gross market return minus costs, minus timing (emotional and cognitive errors), minus selection errors, justify why investors, on average, obtain a return well below the market return.

Expectations move markets. With the economic slowdown a certainty, the question is its depth and duration. And that doubt could fuel even more uncertainty, turning into a recessive spiral. More than actions and measures, we see enormous weight in words. This quasi-propaganda scenario around the recession could still mean less social harm as people take stronger protective measures. It's a matter of survival. On the other hand, a turn in inflation expectations could mean stabilizing interest rates and less pressure on the family budget.

When we are designing our long-term financial plan, one of the tasks to do is to define the set of expectations for the economy and the markets. Long-term expectations, trends that move in long cycles, in certain regions and sectors and that will help us to build the investment portfolio. These expectations may be updated periodically, in order to understand the impact of any changes in the scenario and monitor the risk of not achieving our objectives.

But the factor that will most strongly impact the evolution of our portfolio is our own performance. Our ability to follow the path, to adjust the standard of living to the moment we are going through, to increase savings when the market does not correspond to expectations and also the ability to be optimistic and believe that the world will be better in the future.

Waiting for a recession is not a trend, it is a lethargic state that blurs our vision and prevents us from seeing the turning point. Because the trend will soon be reality and new expectations will be created to feed time and space.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.