The impact of war on financial markets: part II

The behaviour of the financial markets in times of war: when a dramatic event happens, a market fall is to be expectedl. But history tells us a different story, sometimes.

The behavior of markets in geopolitical events

The market is an expectations updating machine and a leading indicator of the future world. Therefore, it is natural to think that the results are somewhat counter-intuitive.

When a dramatic event, such as a war, happens, the markets are to be expected to crash. But history tells us a different story. Markets react more by expectations than by the actual event happening.

However, it must be said, war is itself a markedly uncertain event. I don't know what will happen, or how far the conflict will escalate. What affects us the most is uncertainty, not knowing what to expect. In a normal environment, we try to predict the future of the economy, which sectors will grow the most, which companies have the best business model. But if an unexpected event appears, expectations change.

Let's go back to history to contextualize the moment.

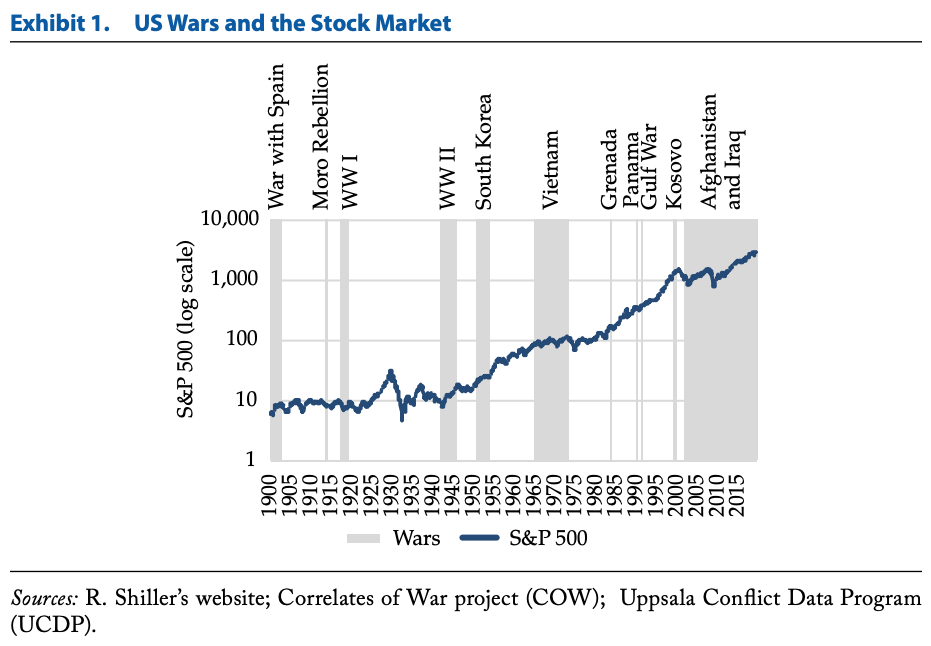

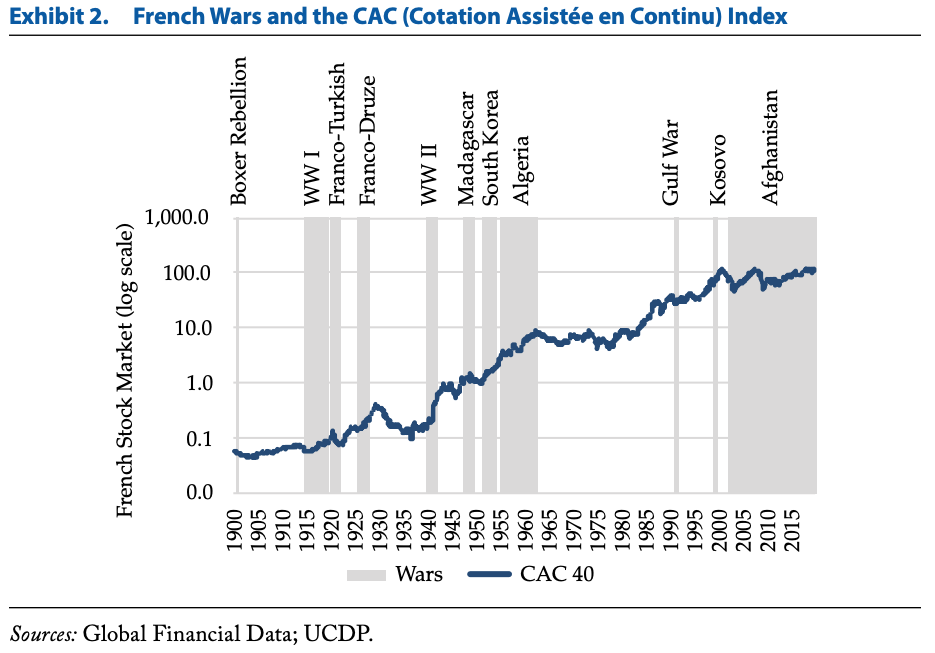

In fact, if we are to see the impact of the various war events on the markets, we may be in for a surprise. During the two world wars, for example, the American stock market rose. There it is, the idea is to look to the future. What will the economy be like after the war? Humanity has already gone through great privations, through Dantean scenarios of destruction, and life prevailed. And it is this survival instinct that also prevails in the financial markets. We believe that the world, tomorrow, will be better.

But let us analyze the behavior of the American and French markets during periods of war and geopolitical crises.

These graphs, taken from the monograph Geo-economics, the interplay between geopolitics, and economics, and investments, can give the false impression that markets rise when there are wars. In fact, during the First and Second World Wars, for example, we had strong rises in the financial markets. But is this a correlation with causality?

No event is the same. In every war, in every geopolitical event, the context is different. In this case, we come from a pandemic. The economy is still in a recovery mode, central banks and governments are still expansionist and we have an inflation problem ahead. With this further shock, the first impact we see is the prolonging of the energy crisis, the continuing logistical difficulties and a new dilemma for central banks about the measures to be taken. On the one hand, their mandates aim to control inflation, but on the other, we have a possible recession ahead. The economic sanctions imposed on Russia will certainly make a dent in the other economies as well. The economic and financial world is intertwined and contagion is likely.

To assess the impact of these geopolitical events on the markets, we must look at the long term and ask questions. Will this event affect potential economic growth in the future? How will they affect the companies' results and cash-flows? Will we have a permanent or temporary change?

It is that geopolitical events usually bring about structural changes.

Take the example of cryptocurrencies. With such strong sanctions imposed on Russia, the monetary and financial system could be seriously compromised. Therefore, alternative systems can be used to overcome the setbacks of conflict. People want to save their savings and avoid the impact of the strong currency devaluation as much as possible. In this sense, they may try to buy real goods such as smartphones, watches and gold and currency or digital assets such as NFTs (this event could also precipitate a more concerted action worldwide to regulate these and other assets, which is symptomatic with the idea of a less global and more controlled economy).

The impact of geostrategic conflicts and tensions appears to be even more profound. The world reaction to the invasion of Ukraine is being economically devastating. We cannot say that the markets will go up because in other wars they also went up. No!!! In this case it is different. In fact, it's always different. They can even go up, because as we have already seen, the movements are often counter-intuitive, but the sanctions will ricochet and put the world economy in a slowdown and even in a possible recession. There is a military, political and economic war going on.

The impact on financial instruments

Another issue that arises is the liquidity of financial instruments, such as ETFs. How can an ETF of shares of Russian companies listed on a German or English stock exchange be traded when the Russian stock exchange, where these companies are listed, is closed? Of course, many of these companies are also listed in other markets, but not all. And the ETF must continue to demonstrate that it is following the benchmark.

Closing the scholarships is nothing new. At the beginning of the first world war, the stock market in New York was closed for 6 months. After reopening, the Dow Jones index rose by about 80%. But at that time there were no ETFs and other liquidity-based instruments.

In relation to ETFs, another important situation is what index providers will do. MSCI, one of the most important in this sector, decided to remove Russian assets from its benchmark indices for emerging markets. When and if the market reopens, asset managers will literally dump Russian assets as they have to sell them to follow the index. For there to be a sale, someone has to buy. If one of the great benefits of financial markets is their liquidity, that is, the ability to transform the assets we hold into cash, in this case, the situation will not be so linear. The adjustment will be made by price and the insolvency of many companies.

The importance of politics and the Investment Plan

All these geopolitical and economic events demonstrate the importance of a diversified portfolio, the correct allocation of different asset classes, economic expectations and investor preferences and objectives. This is the ecosystem of the smart investor, the patient and optimistic investor. An ecosystem based on an investment plan and policy. The earth is not flat, neither are investments.

Going after only the best investment of the moment leads us to make mistakes, to trade in excess and not take advantage of market opportunities and the long-term capitalization effect. Trading based on news does not protect us. The plan is not stone, but it helps us make decisions. In this plan, we must have short-term, liquid investments, a safe emergency fund and the investment portfolio, or portfolios, in accordance with the objectives we have defined and adjusted to the projected economic environment.

Recentemente, num episódio sobre liquidez do podcast Future Proof Talks, questionei se este conflito entre a Rússia e a Ucrânia poderia ser classificado como um Black Swan, um evento inesperado. Concluímos que não, apesar de, pela sua natureza, conter alguns elementos surpreendentes. Mas há uma conclusão que posso tirar já da minha experiência ligada aos investimentos: os eventos que mais me surpreenderam foram aqueles que nunca tinham acontecido durante a minha vida e que, de alguma forma, tiveram impacto em mim. Alguns até nem foram importantes ou impactantes para a evolução dos mercados, mas a surpresa revela o diferente nível de peso que cada evento provoca em cada um de nós.

Recently, in an episode about liquidity on the Future Proof Talks podcast, I asked whether this conflict between Russia and Ukraine could be classified as a Black Swan, an unexpected event. We concluded that it cannot, although, by its nature, it contains some surprising elements. But there is one conclusion that I can already draw from my experience with investments: the events that surprised me the most were those that had never happened in my life and that, in some way, had an impact on me. Some were not even important or impactful for the evolution of the markets, but the surprise reveals the different level of weight that each event causes in each of us.

Uncontrolled inflation is one such event. A war too. Therefore, the investment portfolio must also contain our personality, our anxieties and our ambitions. Basically, our history, without forgetting that the important thing is the future and that it is for this future that we invest.

Read the full article in The impact of war on financial markets: part I

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.