The impact of war on financial markets: part I

The last few months were marked by concerns about inflation and interest rates, in other words, about monetary policy. Central banks were, once again, taking the lead and financial markets were unstable with uncertainty and possible errors in the implementation of this policy.

In this January article, on positioning of the investment portfolio, I referred to the geopolitical environment and financial repression as fundamental factors, along with others, for the composition of an investment portfolio. He was far from anticipating an event of the magnitude of Russia's unbelievable and violent invasion of Ukraine.

Geopolitics is, ultimately, the study of the balance between options and limitations, understood as the study of how geography (the “geo” in geopolitics) influences the international policies of countries and societies (the “politics”).

And here we are in a deep social and humanitarian crisis, as well as political and economic. We follow the war in real time, as well as other geopolitical events and financial markets. We look at the monitor, waiting for news, for the fluctuation of titles, for a reason to act, for the latest attacks, hoping that our attention will help in the course of events. Life is really lived in real time. So much so that at times it seems more like a mathematical simulation full of coincidences, great cycles, eternal deja-vus, as if we were always stuck in the past or in conscious alarm – a failure of the Matrix?

From geopolitics to geoeconomics

Due to the (still) integration of the world economy, the role of economic factors in the strategic preponderance of a country or regional bloc, combined with this continuous and shared experience in communication and data networks, a new branch of geopolitics was born, geoeconomics. Politics is essentially the battle between different narratives. Economics also encompasses narratives and history. Although we attach great importance to the quantitative element, it is obvious that to evaluate the macro environment or a particular financial asset we need this quantitative analysis, but also history, the narrative that supports our analysis - as Aswath Damodaran defends.

The consolidation of this path is verified, for example, by the importance of Germany in the world and, mainly, in the construction of the European Union, but also in institutions such as the IMF, the World Bank - dominated and encouraged by the USA - and the Cintura and the Route or Asian Infrastructure Investment Bank – driven by China. Yes, the opposing China-US blocs also reveal themselves in their economic role, in the geoeconomy. Economic power has become as essential as military power in the political strategy of supremacy and domination.

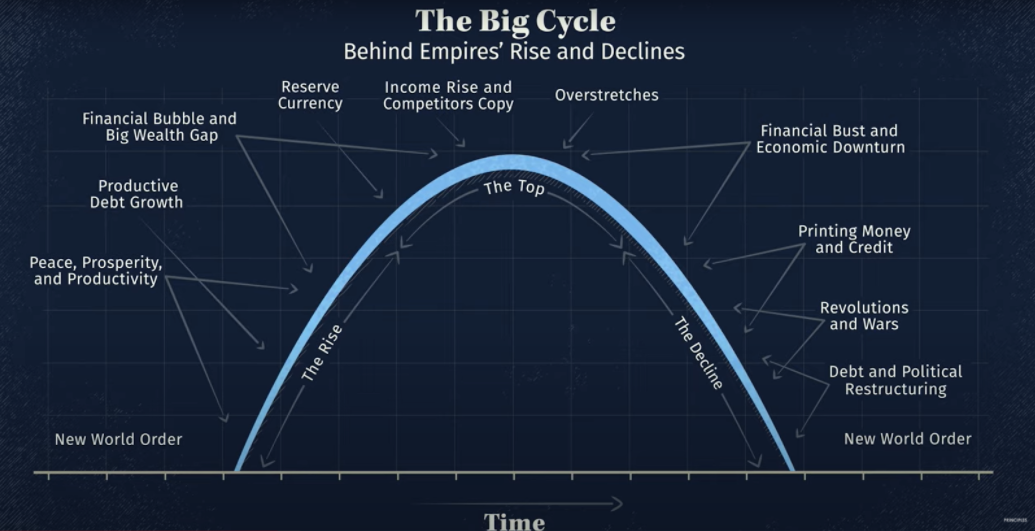

As Ray Dalio points out in his new book, Principles for Dealing with the Changing World Order, there are signs of change in the world order. In this documentary about that book, Dalio talks about how he learned to anticipate the future by studying the past. According to the author, the world must expect a new order, that is, a new form of supremacy and domination that may well pass through China.

From geopolitical event to volatility

With the triggering of a geopolitical event, volatility increases. This increase in volatility does not, however, mean an increase in profitability expectations. It is common to hear that “the greater the risk, the greater the potential for profitability”. No doubt. But to analyze this concept, we have to separate risk from volatility.

An increase in volatility, that is, an increase in the rate of change in the price of a financial asset in a given period of time, normally means greater risk. The truth is that an increase in volatility is usually associated with a bear market. This fall is also a moment of opportunity and rebalancing of the portfolio.

When looking at volatility we can use the VIX (Cboe Volatility Index). The VIX is a short-term indicator calculated based on the implied volatility of a 30-day option and does not incorporate long-term risks such as geopolitical and economic risks and events. It gives us a snapshot of current sentiment. But we can also analyze historical volatility based on the statistical concept of variance, that is, the deviation of periodic returns from the average in a given period. This volatility, when analyzed over long periods, tends to be an indicator with predictive value.

If at the beginning of the year we were having doubts about the continuity of economic growth, this possibility now seems even more questionable, since the sanctions applied to Russia and the entire devastating environment of a war will have serious repercussions for the world economy.

Disruptions in terms of energy and food, the postponement of investments and structural reforms and the fear of the possible escalation of the conflict create a new scenario for the world economy and the accentuation of financial repression. That is, the difficulty of investors to invest their savings with the expectation of a return above the inflation rate or even positive in the near future.

This situation will require even more what we have been repeating on the Future Proof blog: patience, optimism and the ability to save. Because at this stage we will ask several rhetorical questions: Will we be comfortable in starting or reinforcing a particular investment portfolio at a critical moment, in the wake of an event? Should we change the current investment strategy? Should the investment policy be updated in light of new developments?

The truth is that, given all this scenario, we will certainly go through a phase of decline in asset valuations that can be more or less pronounced depending, mainly, on the escalation of the conflict and its impact in the near future.

In any case, we cannot ignore the future. Throughout human existence, evolution has been overwhelming. From language, through agriculture, industry, technology, to the digital revolution and the evolution of health and education, for example. We live better and better. For every crisis, war, natural catastrophe or pandemic that we go through, the future tends to be better. There is hope. Let there be trust.

But generalized panic in an extreme situation is a constant. Emotions win over reason and just as we buy on impulse, it seems that we decide to sell even before that impulse.

Narratives can change quickly. The feeling too. The lesson for us investors is that we must be extremely cautious remembering that impulsive decision making and focusing on the short term can be devastating in the long term.

Let's stop to think. Let's look at our plan and our investment policy:

- Have our goals changed?

- How is our personal and professional situation?

- Has our investment time horizon changed?

- Do we have the flexibility to change our goals and preferences?

Read more on this subject in The impact of war on financial markets: part II

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.