The 60/40 portfolio

The 60/40 portfolio, where 60% is invested in equities and 40% in bonds, is the starting point for many portfolios.

At a time of great anxiety and instability in the financial market, we began to question some of the basic principles of investment. One of them is patience.

John Authers, in his Points of Return column on Bloomberg, systematizes as follows: "The stock market wouldn't be the stock market if it didn't have its ups and downs. Anyone knows that the elder J.P. Morgan, when asked to predict the market, said: “It will fluctuate.”

In these ups and downs, myths and absolute truths fall, like the typical 60/40 portfolio, 60% stocks and 40% bonds, or even other distributions, but balanced between stocks and bonds.

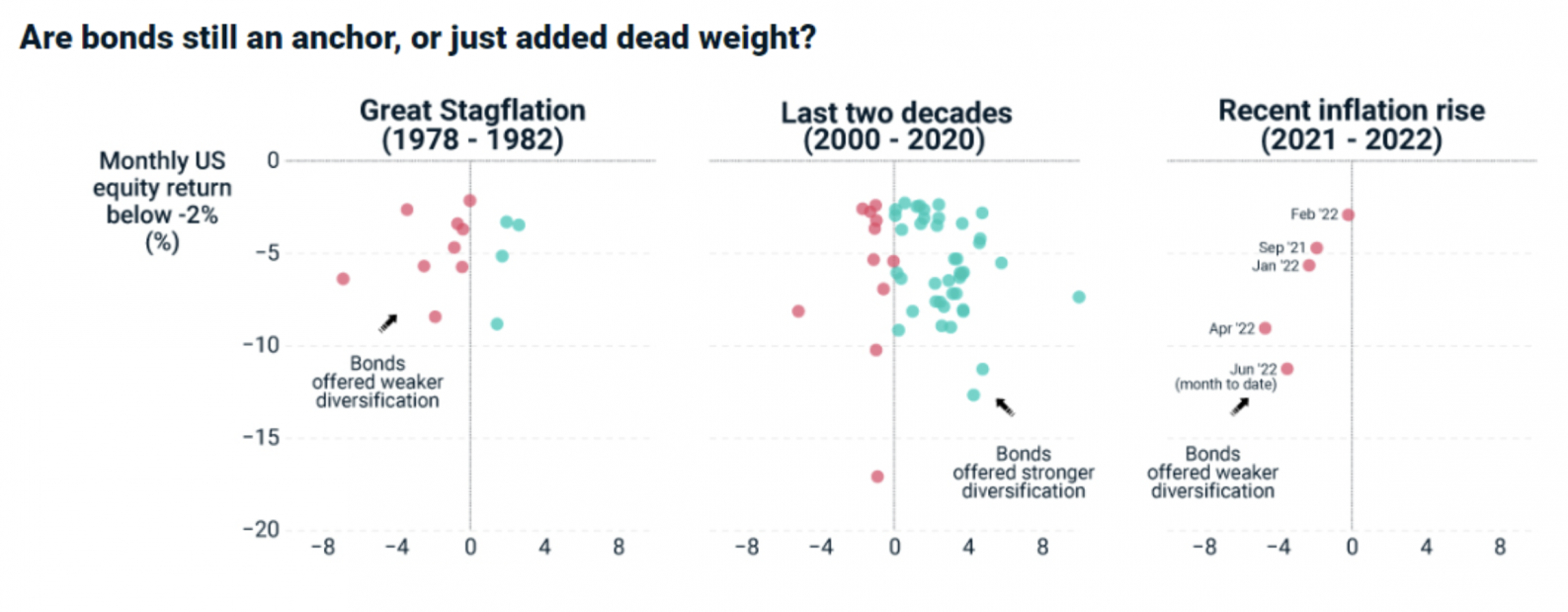

Over the past few decades, we've gotten used to bonds being a good diversifier, perhaps the most stable, in a portfolio with equities. But the macro environment of recent months has been changing this predictability. In such a way, that diversified portfolios between stocks and bonds are falling, that is, bonds (prices) are falling in line with stocks.

The good news is that it's not the short term that counts and almost no one has only stocks and bonds in their portfolio. And in the long term, even breaking myths and rules considered valid, wars and depressions, the market should respond to the optimism resulting from the growth of the economy and the results of companies.

There is yet another interesting aspect: the drops now could mean more returns in the future.

The illusion of diversification

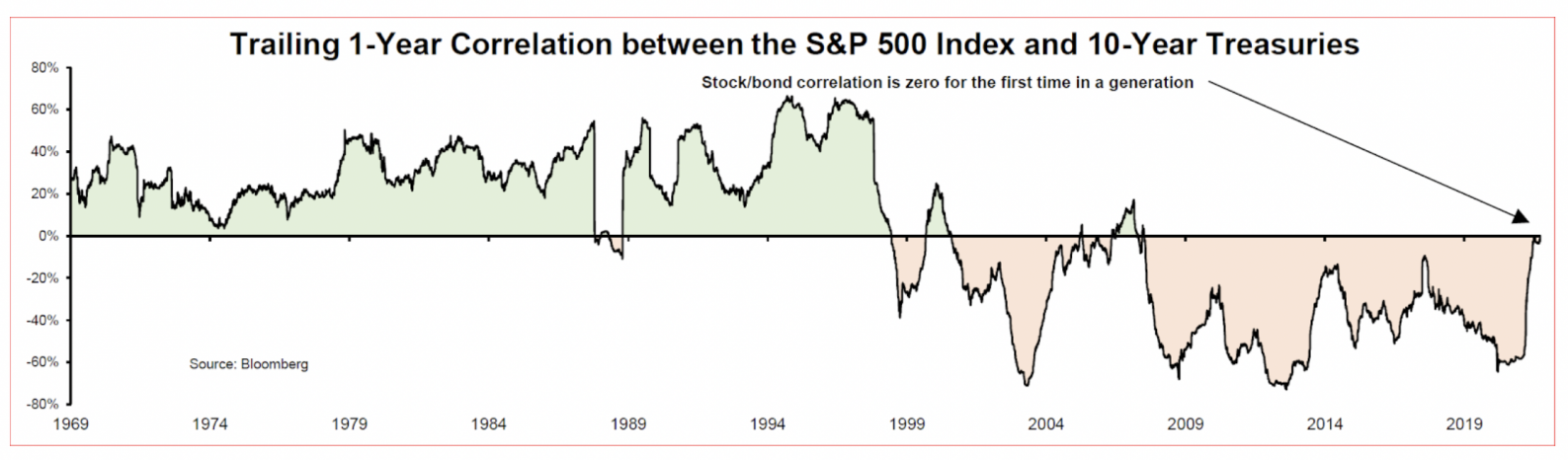

This graph demonstrates the correlation between the S&P 500 and the 10-year interest rate on US bonds since the 1970s. For the first time in a generation, the correlation is positive.

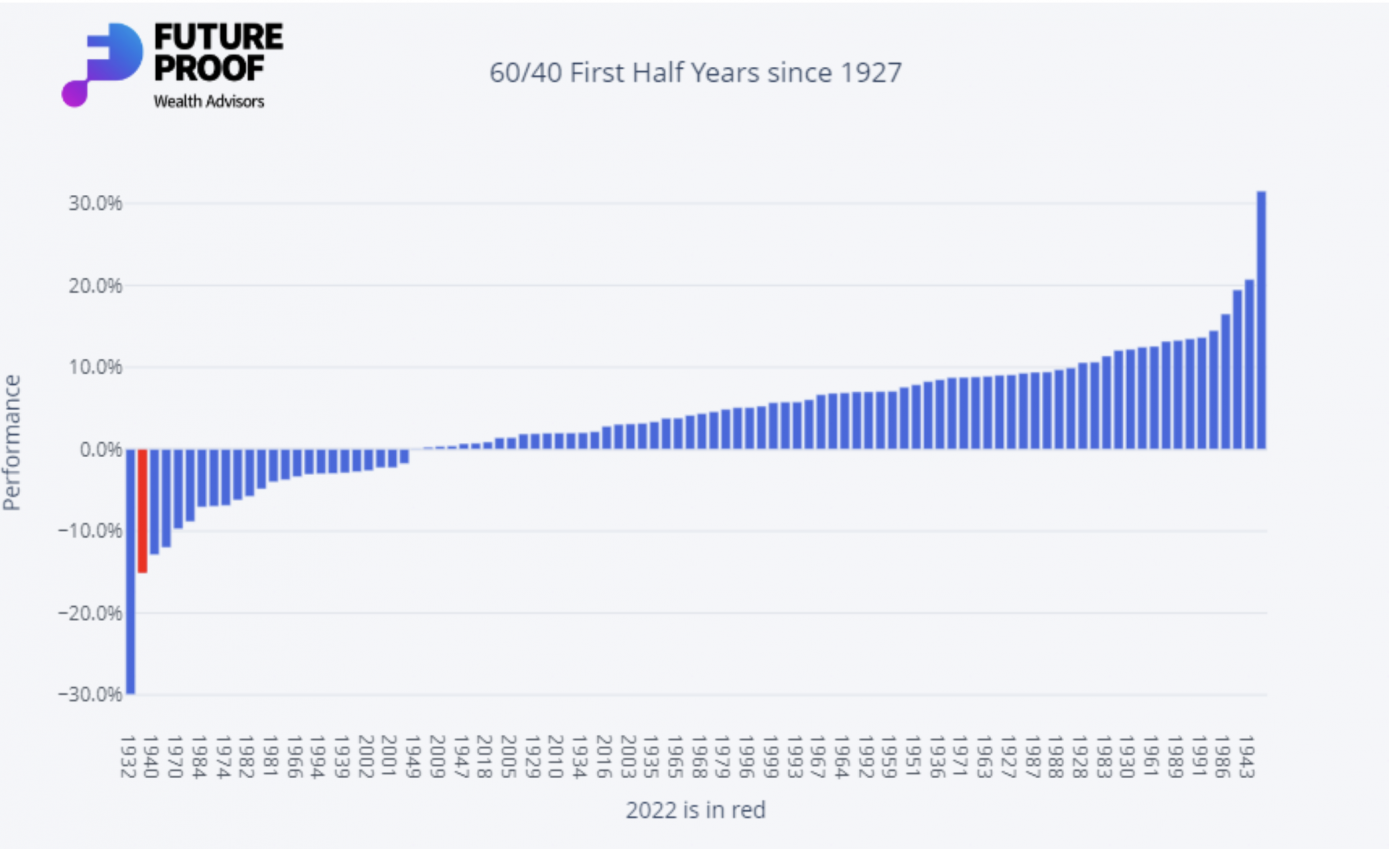

In fact, as we have seen in the first half of 2022, the decline in a portfolio composed of stocks and bonds was the second worst since 1927.

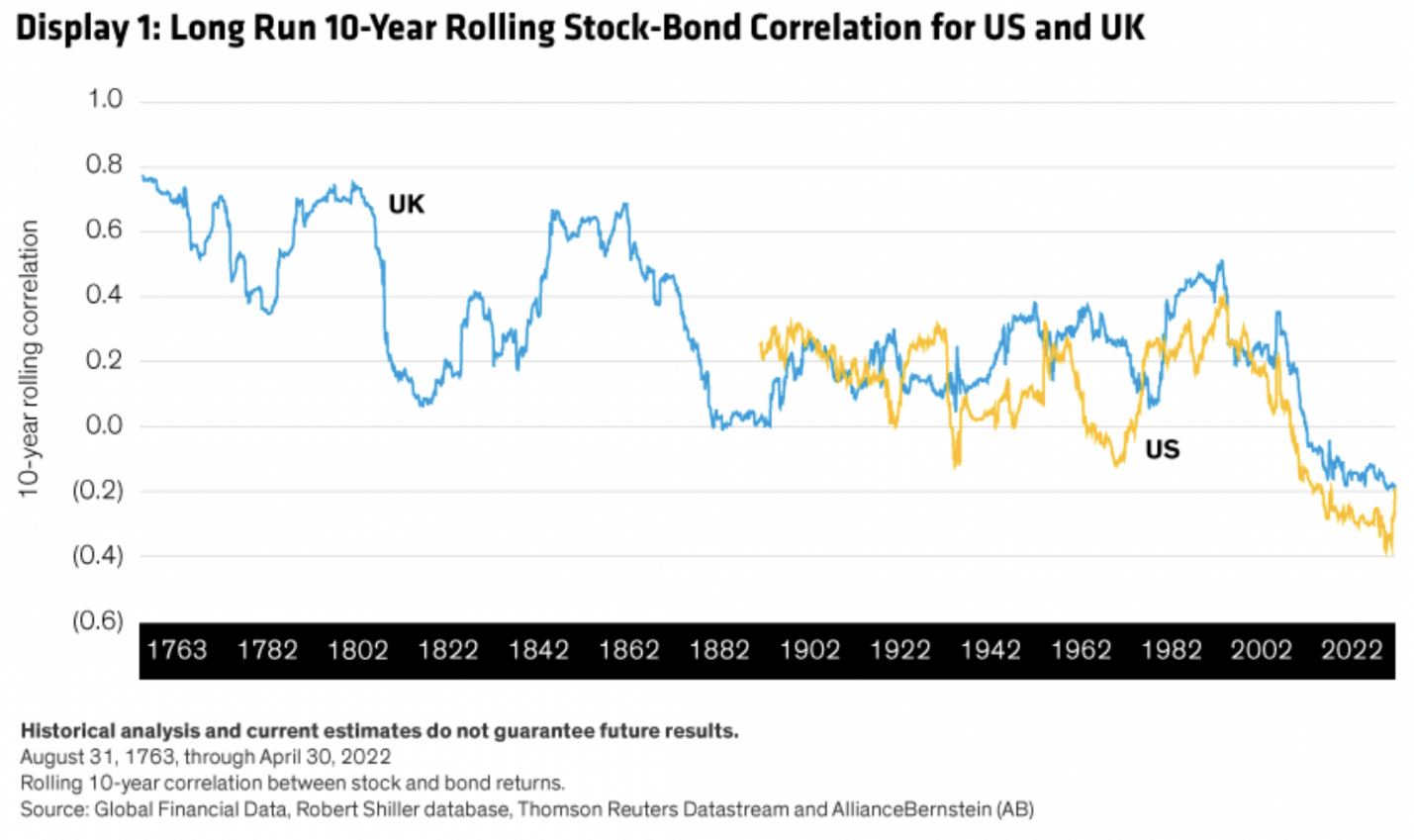

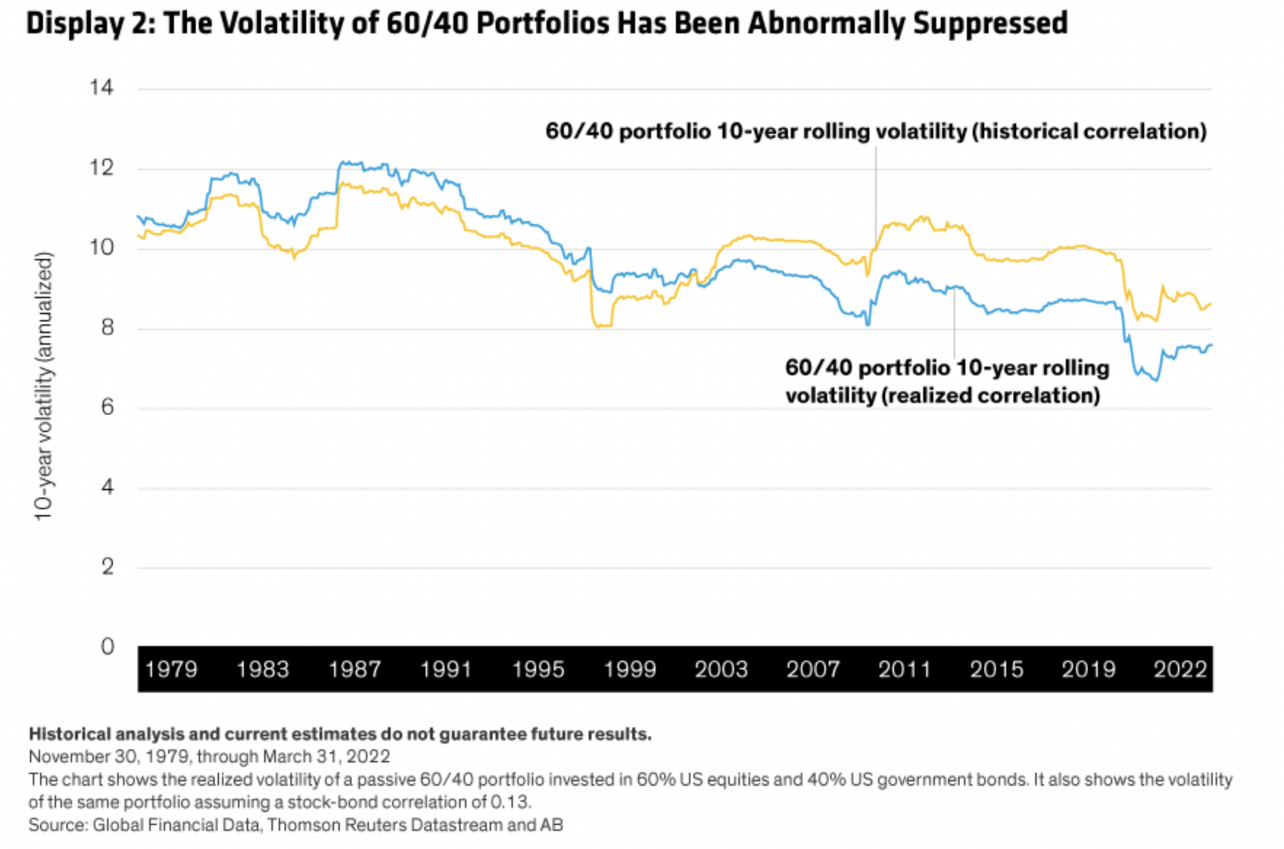

The following charts also help to understand that the last few years have been abnormal, that is, volatility and correlation have always been higher than what has happened since 2000.

Source: AllianceBernstein L.P.

We have highlighted in several articles on the blog, namely in the last one on the Modern Portfolio Theory, the importance of diversification. But the diversification we advocate presupposes looking for assets, or asset classes, that have a low or negative correlation between them. And, as we are now feeling, these asset classes are not limited to stocks and bonds. In addition to real estate, commodities, gold and other alternative investments, we may have several asset subclasses within equities and bonds that are best suited to each macro and market environment. For example, in bonds it made sense to change the portfolio to floating rate bonds, indexed to inflation and, in general, with less exposure to duration (sensitivity of the bond's price to changes in interest rates). In the case of stocks, we have the example of the energy sector.

On the other hand, when we define the correlation between the different assets and asset classes in the portfolio, we are usually using historical information. What is an error. Historical data cannot be used to extrapolate the correlation to exist in the future. We invest, set goals and set preferences for the future. However, we decided which assets to invest based on past performance.

We cannot say that the 60/40 wallet does not work. In fact, we can, if we take into account the data of the past and a funneled reading of this balance.

We can also mention that it does not work taking into account the objectives and preferences of a particular investor. Each wallet is unique. It is personal and non-transferable.

Then there's time. The 60/40 portfolio may not work for 1 year or 5 years, but if this is the ideal portfolio for a particular long-term investor, we will have to incorporate the importance of time and patience, adjusting it according to expectations. to the market.

If not, we fall into the illusion of diversification. A portfolio that we thought was balanced, after all it wasn't. Assets that we believed to be diversifiers turned out to be more correlated than previously thought. And so, the portfolio, as a whole, becomes vulnerable to the same risks, which appear at the same time: rising interest rates and widening risk premiums.

Fonte: MSCI

The effect of inflation on the 60/40 portfolio

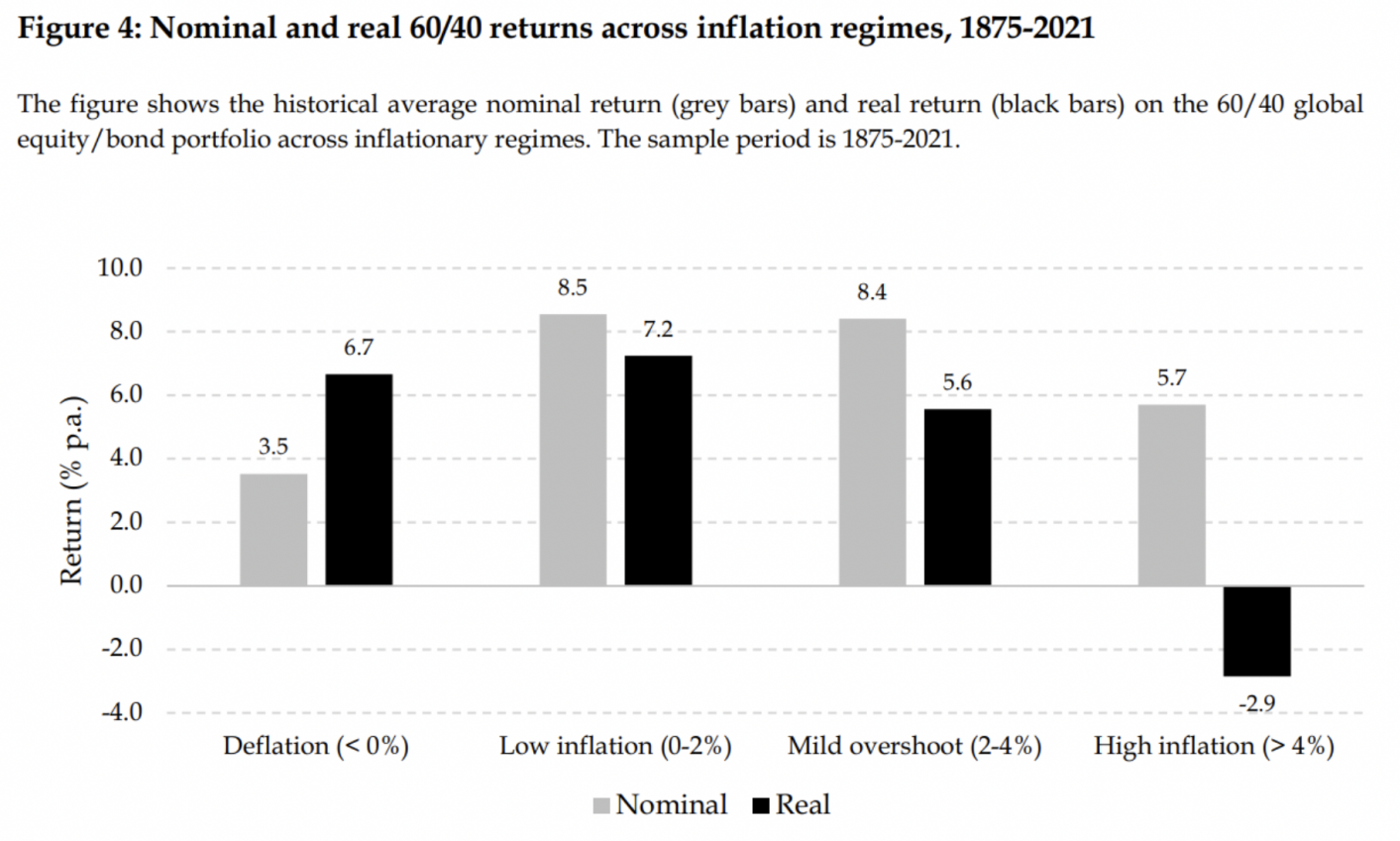

A team at Robeco Asset Management in the Netherlands has produced a historical study since 1875 on the performance of different investment factors and asset classes in different inflation environments. For a 60/40 portfolio, the results were as follows:

- If inflation is controlled below 4%, then real and nominal returns should be healthy;

- In a low inflation regime, between 0% and 2%, as happened in the last years after the Great Financial Crisis, the best real returns appear;

- The only inflation regime that presents negative real returns is, unsurprisingly, the high inflation regime, defined by the authors as above 4%.

Therefore, if inflation is expected to be above 4% for an extended period of time, we must adjust our portfolio, our objectives and our preferences and restrictions accordingly.

Source: Robeco

Should we continue to invest in stocks and bonds?

Of course yes.

We advocate diversification by asset classes, by different geographies, sectors, strategies, types of instruments and listed and unlisted, real and financial assets.

After all, as Ben Carlson says, diversification is the way we express our inability to predict the future.

Of course, diversification should not be done at random. And, in addition to knowing our personal reality, we must also form a set of expectations regarding the future of the market and the economy.

The recommendation we give, knowing that we don't know your specific situation, and that we can only speak in general, if the portfolio is adjusted to your risk tolerance, your goals and your preferences and restrictions, then there is no reason to change .

We cannot control the market. The focus should be on what we can control, that is, time, patience, savings and optimism. These factors are intrinsic to our reality, as are those emotional and cognitive difficulties related to our behavior in certain situations. Making fewer mistakes and being less subject to behavioral biases increases our probability of success.

For the rest, it is in the selection of assets, that is, in the process of strategic allocation, that we can also make a difference.

Janela para o futuro

And for this selection, we leave here some long-term paths. Windows open with the latest episodes of the podcast:

- Need for global debt relief;

- A gradual transition to equity financing, ie equity;

- Greater importance for real assets (raw materials, land, real estate, art, gold, stocks and other alternative assets);

- Focus on regions and countries with demographic expansion and technological appetite;

- Disruptive trends related to technology, namely, artificial intelligence, automation, innovation, digitalization, cybersecurity, among others;

- Health and well-being, food, energy transition and sustainability as key factors and sectors;

- Higher interest rates and inflation above the target defined in recent decades by central banks, which means more volatility in the market and, consequently, in the portfolio;

- Less importance of indicators such as GDP, which no longer fit the economy of the future, and greater focus on indicators such as inequality;

- Increase in the remuneration of human capital as a result of demographic and life cycle changes;

- The setback in the process of globalization and the rise of populisms with the decline of democracy.

It is not necessary to be looking for a needle in a haystack. The best thing is to stay right away with the haystack or with several. Everything depends on the defined strategy, whether more active or passive, whether based on indices or individual assets, and, there it is, on our personal situation and the ability to assume our difference.

The 60/40 or 30/70 or 50/50 portfolio is not important. It is just a theoretical assumption to analyze results, as most investors have other assets in their portfolio.

What does it matter if all investors are investing this way or that, if all journalists and commentators are then saying that we are going to have a recession or that stocks are expensive or cheap? Will anything change in our ability to save and in the time we have available? Can we control these factors? Not.

The best thing is to do it differently. Don't go after the "herd". Doing different just means following the defined path and adjusting expectations if something has changed in our life (job, marriage, divorce, children, sale of a business, inheritance, early retirement).

No investment strategy will always produce highly successful and positive short-term results. None. But only our strategy, the one that adapts to our reality and that is adjusted to market expectations, will be successful and produce positive results in the long term.

To learn more, we recommend:

- What Happens When Diversification Disappears?

- Is the 60/40 Really Dead This Time?

- Has Inflation Affected the Bond-Equity Relationship?

We want to help you be a better investor:

- We help you develop your Investment Policy Statement;

- We develop individual or group training on investments and savings;

- We quantitatively analyze your current portfolio with Future Analyzer's computational technology and finances;

- Request more information about the investment advisory service provided through Banco Invest.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.