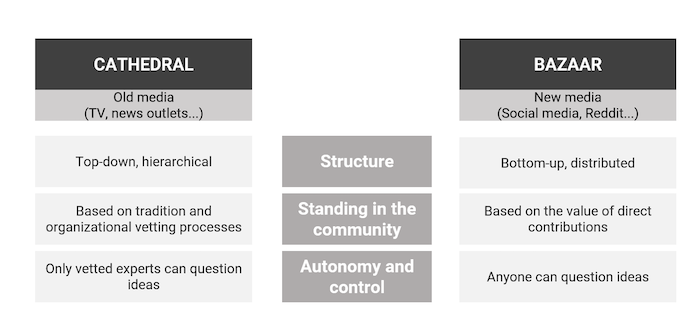

Should we read Reddit like we read the Financial Times?

Reddit is a social network created in June 2005. The name itself comes from a pun in English, “read it”. It is divided into several communities (subreddits) and the user follows the ones that interest him. Within the “subreddits” the user can post, comment and vote up or down – this is where the interesting part comes in – a user who has a good opinion and posts or comments with some regularity. Receiving upvotes will contribute to the “karma” of your profile. The “karma” is the balance of votes that the user gets in all interactions on reddit. Although 99% of profiles are anonymous, we can see a user's credibility by their “karma”. In my personal experience, before reading an important review, I tend to look at that user's “karma” to see if they are a person with a lot of positive interactions. Users with high “karma” usually have their opinions and posts more accepted in the medium.

Source: Firstmonday.org

There is a difference between the average investor, a person with an 8-17 job who reads the headlines of the Financial Times and then goes to see a series on Netflix, and the investor whose profession and career success depend on how he perceives the market. and how he manages to turn certain ideas into profit for the company. But passion for the market may not be enough to come to work in a hedge fund or in companies directly linked to the market. It is a career with a lot of competitiveness and a lot of pressure. Market professionals mostly use a tool called “Bloomberg terminal” – a software provided by Bloomberg that allows you to analyze, monitor market data in real time and make market offers. This software costs around $2,000 per month. So what does this mean? It means that the common investor is always behind, that is, he is in a race in which he starts at a disadvantage every day. By the way, why does the average investor, when he reads a breaking news about the markets, feel that he is in the power to profit? The journalist who wrote the news is way ahead of him. It is this weakened power that the average investor feels.

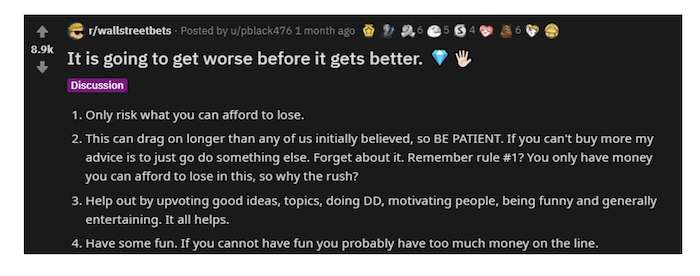

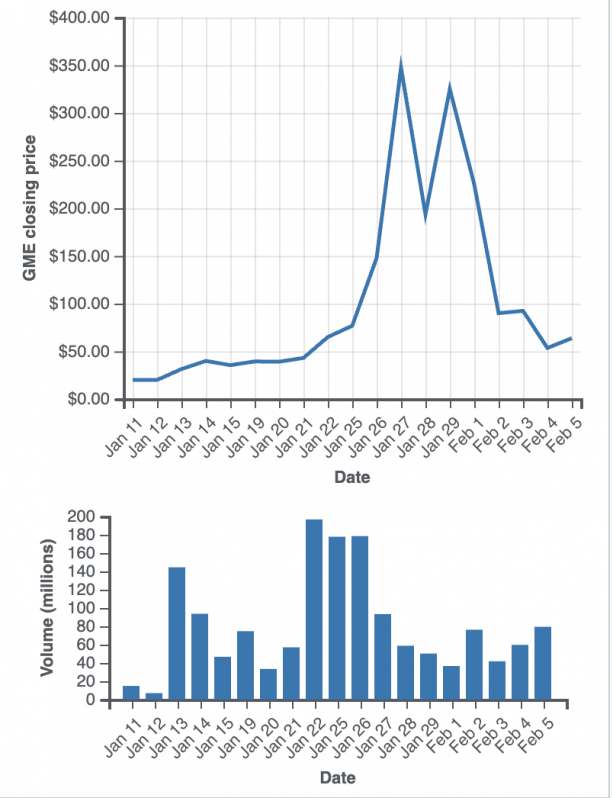

But what does the common investor represent in society? An article written in 2022 on Gallup.com states that 58% of Americans say they own at least one stock. It has been growing, but not significantly. Clearly, in the rest of the world the percentage of stock owners should be lower. Can we conclude that there is some power here to manipulate the market? Yes and no. We all know about the Gamestop $GME case. This was a great chance for Hedge Funds to make easy money by “shorting” the stock and waiting for it to sink. Ordinary investors all came together on reddit, on the “WallStreetBets” subreddit, which has 12.9 million followers, to try to take down hedge funds that had very high Gamespot shorts.

Source: Firstmonday.org

Source: wallstreetbets

This is the example that when ordinary investors get together they can really achieve something. But with so much information on the internet and in the media, so much investment advice on Youtube, how can we filter what really is good? In my opinion, there is no good advice, there are more informed and educated people who get it right more regularly than others. Nobody is psychic and the more you try to guess the market the more you fail. You have to look at the market with a broad perspective and think about the long term.

The influence of social networks and knowledge

Going back a bit, it is almost impossible to calculate and quantify the market choices that are influenced by social networks. Nowadays it is all too easy to invest with access to a smartphone and social networks. The “pump & dump” scheme itself became famously known by cryptocurrencies, large “influencers” who made posts on their social networks talking about a new project, and their followers invested in this very cryptocurrency as if it were the next bitcoin and after a few weeks had their accounts to zero.

These new schemes give investment a bad name, and they also bring with them the illusion that anyone can become a millionaire overnight just by following the advice of an “influencer” who seems to know what he is talking about. In my age group, it is very easy to find myself at the same table on the terrace with someone who calls himself an investor, but he has never picked up a book that talks about investments, and this is a very gloomy indicator of the future of the markets.

This lesser-known side of the internet has already proved to the world that it is possible to organize ordinary investors and really wreak havoc on the markets. It was so notorious that Netflix has already released a documentary on this subject called “Eat the Rich: The GameStop Saga”, in which many reddit users show their faces and talk about their trades. In my opinion they are romanticizing the idea that anyone can succeed in the markets just by reading reddit, but it is also important to talk about the thousands and thousands of people who lost their savings by following advice on the internet.

One in five investors are just using social media to research new investments, we're talking about 38% of 18 to 34 year olds. It is undeniable that social networks contain good and precious information and can be an ally for those who invest, but they can never be the only source of information we are looking for.

Certain brokerages have already introduced a system, as if it were a “test” with several multiple choice questions about the market, in order to protect these new investors. Will that be enough? What will be the consequences of this phenomenon in the future? Easy access to information, in theory, should be a good thing, but it also brings complications.

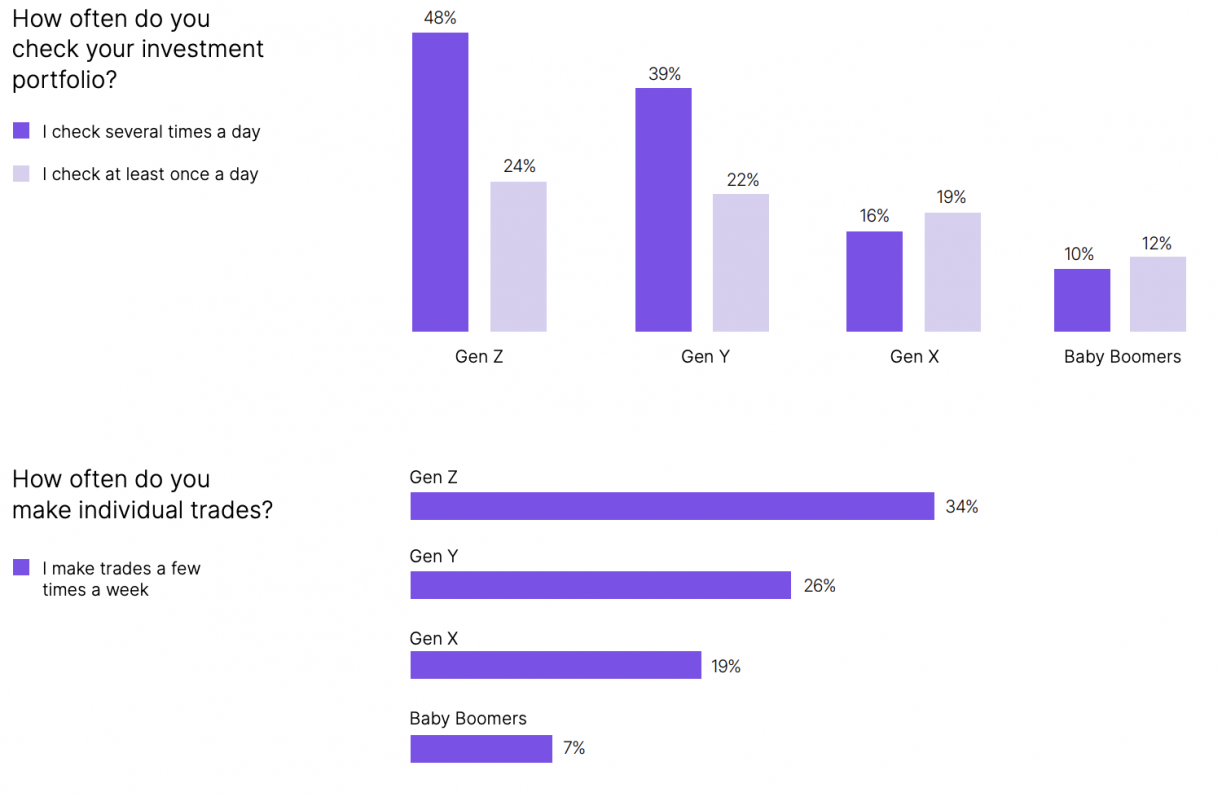

A recent survey conducted by Nasdaq in partnership with Morning Consult addresses a pertinent question:

- How regularly do generations check their investment portfolio?

In my opinion, this too frequent verification can lead to more hasty decisions.

Source: Nasdaq.com

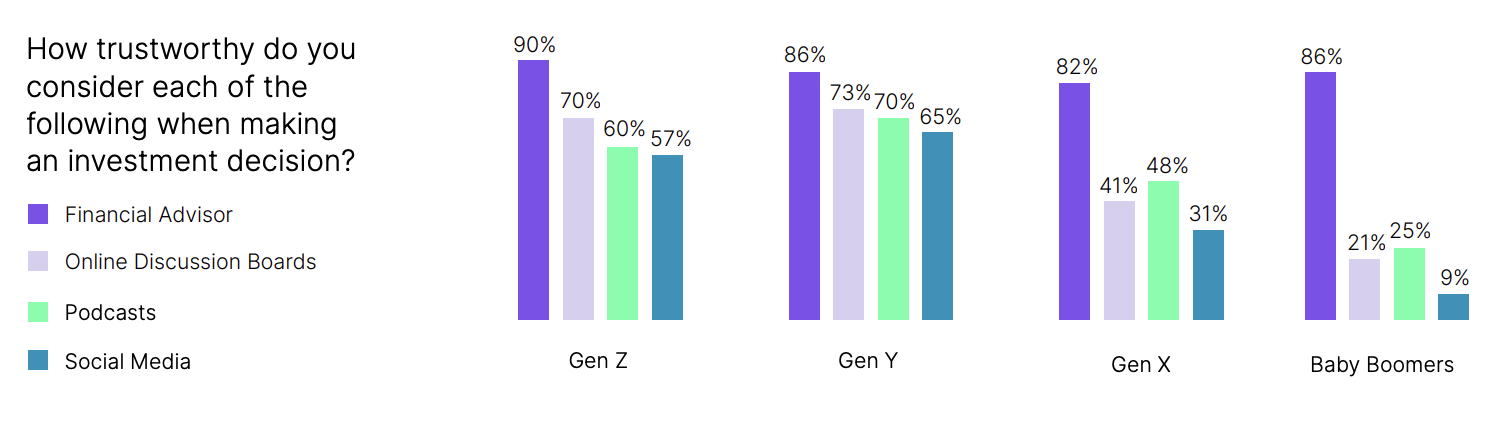

And in this graph we can see that the younger generations give much more credibility to social networks when it comes to investment decisions:

Spurce: Nasdaq.com

So, we have to get an idea of what's going on in the markets from the perspective of other people, and there it makes perfect sense to follow social media with some attention, but we can never replace financial advice when it comes to decisions about our capital at risk. It is quite common for younger generations to be asked “How much are you earning?” when we say that we invest, but that is not the central issue. The question is what are our plans for the long term? How many years do we want to save money? What are we saving for? It takes more sense that investment is a savings and an option about our future, not a casino game. Long-term investors don't need to sleep less at night if Apple's stock goes up or down 8% in a day, or if Tesla is going to open a new factory in Europe and what that will mean for other car companies electrical. Long-term investors need to educate themselves about the markets first, look for good sources of information and be focused on the most important thing: time.

FAQ

- GameStop is a company that sells games in physical format, which would follow the path of Blockbusters (insolvency), with the emergence of online game sales and streaming.

- “Short” is a position in the market, which is basically a sale of a stock that does not hold. Investors who sell “short” positions believe that the price of this stock will go down in value. If the price goes down, you can buy the stock at a lower price and profit.

- Gen Z – People born between 1996 to 2012

- Gen Y – People born between 1981 – 1995

- Gen X – People born between 1965 – 1980

- Baby Boomers – People born between 1946 - 1964

Natural de Coimbra, aluno da Licenciatura de Gestão no Instituto Superior Miguel torga e atualmente coordenador do departamento financeiro do ISMT Business Club.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.