Put your money to work

We have all heard the expression “time is money” or that it is necessary to “put the money to work”. In either case, the conclusion is that stopped money is lost money.

There are many people who, managing to save, keep the money in a current account or, less and less often, kept at home or in a safe. The reasons for this to happen are several, among which the following stand out:

- Inertia. As a principle of physics, it means absence of activity or movement; impassivity, inaction, inactivity, immobility;

- Fear of investing. The fear of losing money, of investing in the wrong assets, of not understanding where we are investing or the risks we might incur. Financial products have become more complex. Insecurity and lack of trust in the system and its stakeholders also contribute to this feeling;

- Waiting for the best opportunity. We all know this reason. We all like to invest at the right time, but we have to understand that the right time is not the same for everyone. On the other hand, while we wait, we will always be losing opportunities and having less and less time to build savings that help us achieve goals and financial independence;

- Need for short-term liquidity. This need could result from a significant purchase that we plan to make or even from an investment that will be available soon. However, this short term often turns into years and we are postponing the execution of the investment plan.

All these reasons are valid in a given time and context. In fact, we must maintain an emergency reserve corresponding to 6 to 12 months of our current family expenses. And this reserve must be easily available in a low-cost current account or in a short-term treasury investment, easily mobilized and also with low volatility and risk. But after accomplishing this goal, we can free up capital for other, longer-term goals.

Therefore, we can conclude that in most cases, these reasons seem more like an excuse. We avoid doing homework and put off making a decision until later. And so the money stands still…and losing money!

Why is this happening? We highlight two reasons:

- Stalled money does not generate any income and, in some cases, it is even subject to maintenance and custody fees that many institutions charge, which means losing money;

- The inflation effect, that is, the loss of purchasing power in the future. If with the same money we can buy fewer goods and services in the future, it means we are losing money.

We often refer to inflation as a silent tax, a dangerous mechanism when out of control or with rates of change above the targets set by central banks. We have already written here about inflation and introduced the theme of real interest rates in this article on savings.

A practical example:

If we have our money in a checking account yielding 0% and if the inflation rate is 3% (the latest data point to a higher value), it means that we are effectively losing 3%. Translating this result into financial language, we are obtaining a negative real rate of return of 3%: 1,000 euros in a year's time “worth” only 970 euros.

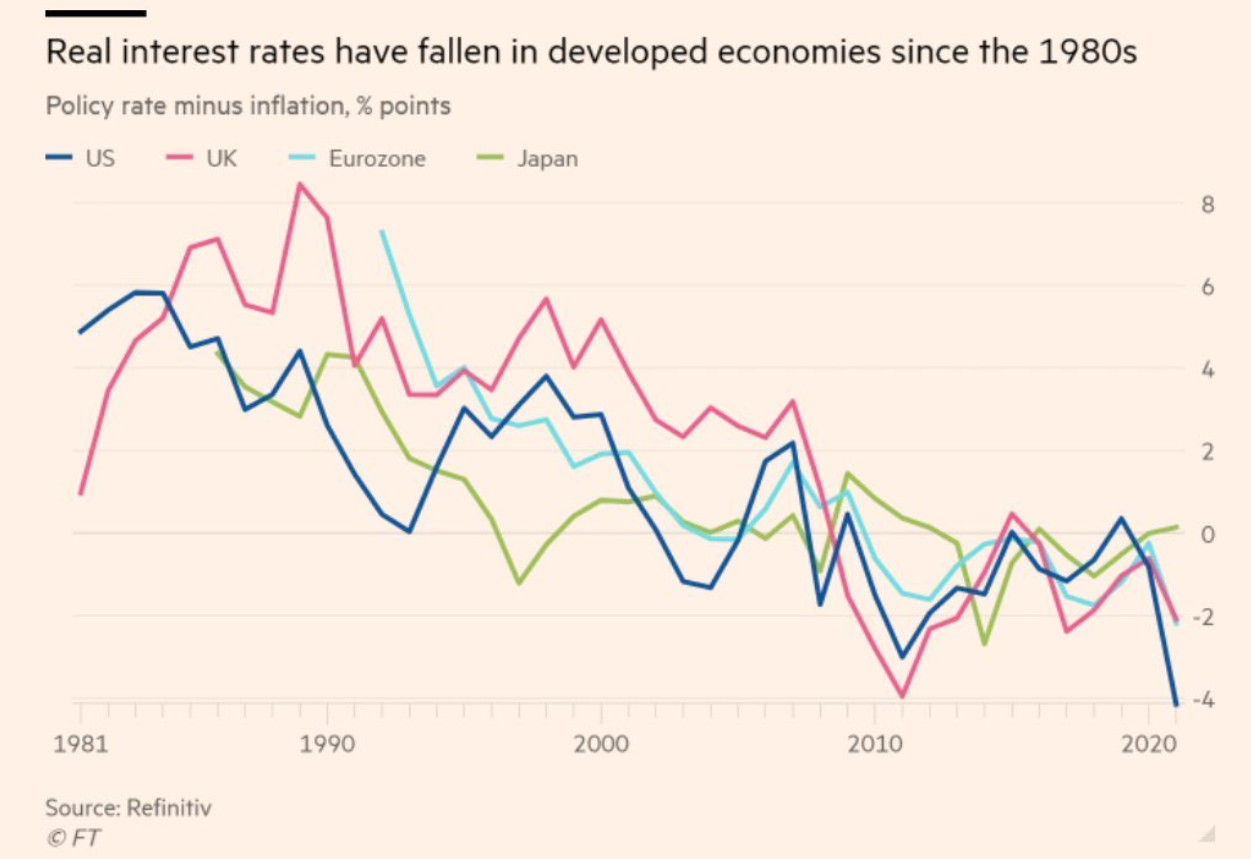

In fact, with historically low interest rates, traditional financial investments no longer minimize the impact of our inertia. For a few decades, it was enough to invest in a term deposit or in a treasury or savings certificate to obtain a rate of return above the rate of inflation. However, in recent years, this has not happened. Note, below, the evolution of real interest rates in the last 4 decades:

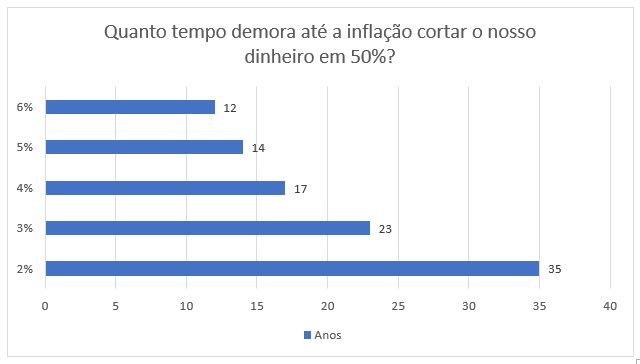

Inflation may seem like it doesn't affect us directly, but in the long run, even in the case of a controlled inflation rate, its effect can be devastating. See the chart below:

There are already countries and regions in the world with inflation rates in the last year above 5%. If this scenario holds for a few years, it means that 1,000 euros today would have a value of 500 euros within 14 years. Nothing to do. Keeping the money in order or under the mattress.

What to do?

We need more information and knowledge about different financial products available on the market. We have to define our objectives, preferences and restrictions very well, as well as our risk profile and select the financial instruments available on the market to monetize time and fight the disease of idle money.

This involves taking decisions, understanding the meaning of nominal and real interest rates, understanding the effects of inflation, knowing the importance of the capitalization effect of interest, defining habits and goals for saving and investing, knowing our profile and not letting ourselves be influenced .

The current situation of interest rates is worrying for the traditional investor who invested their savings in term deposits, savings certificates, treasury certificates or other guaranteed capital instruments. The concept of investing money safely has changed and can no longer be seen as “investing money with guaranteed capital”. If we think of security as the need to maintain purchasing power and living standards in the future, then we will necessarily have to look for other financial instruments.

We don't need to go from a portfolio of 100% savings certificates to 100% equities. None of that. We need to build a tailor-made and personalized portfolio.

Investment alternatives may not be obvious, but today there are several solutions that allow us to build a diversified investment portfolio in line with our preferences and restrictions. With a small initial portfolio and periodic savings, it is possible for us to diversify our investments across different regions of the world and different asset classes.

This is also why we defend the importance of the financial advisor. The person or institution who will be by your side to clarify the various financial products available. Through the reception and transmission of orders, which Future Proof makes available as a linked agent of Banco Invest, we provide the following auxiliary services:

- Receiving, transmitting and executing orders for financial products;

- Placement and provision of information on financial instruments;

- Information about the services provided by the financial intermediary.

Invest in the future. Stalled money is lost money!

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.