How to avoid greed

What many investors have achieved in recent decades may not be possible in the future. At least the way we thought it would be. This adaptability is typical of human beings, but will we be able to resist the strong emotions of greed and fear?

The concept of excess savings

A recent article in the Economist, Why the world is saving too much money for its own good, alerts us to excess savings and the problems that come with it.

There is an inequality problem with countries and parts of the population that have achieved better savings ratios and made better investment decisions. On the contrary, others do not save and do not benefit from the investment and capitalization mechanism.

With the rise in the value of financial and real assets, these savings grew even more, having tripled in 20 years, according to McKinsey data, reaching 610% of world GDP.

This would have been one of the main factors that made possible the development of the FIRE movement (financial Independence, withdraw early), that is, the will of a generation to live in a more free and uncompromised way. We have already discussed this movement here, in the article on the importance of savings. It emerged in the USA and, in a simplified way, seeks to guarantee financial independence through aggressive savings, frugality as a way of life and the construction of an investment portfolio that tends to be passive and allocated to the stock market. It is a movement that constantly tests rationality, patience and optimism.

But this excess of savings is not transversal. In Portugal we need savings, we need capital to improve the current and future economy and living conditions.

With the recent evolution of several factors, such as inflation, interest rates and the geopolitical environment, the capacity to save becomes more important, defining it as a priority. This will be even more fundamental for the achievement of objectives and for us to go through the coming years at the mercy of perspectives of more volatility, instability and risk in the holding of assets of any nature.

We must look at the economy in a global way. By encouraging savings among countries, families, individuals or organizations that do not save, we are not destroying the economy, we are building the foundation for a stronger and more resilient economy in the future.

Greed and Fear

The concept of greed in financial markets is closely related to fear. In fact, the two concepts are seen as contradictory emotional states that cause unpredictability and volatility in markets. When sentiment is positive, assets rise far above their intrinsic value. On the contrary, if the sentiment is negative, fear conditions the taking and decision and the securities fall to values well below their fundamental value.

The intelligent investor (title of the seminal book by Benjamin Graham) must assume a position of balance and satisfaction of their goals and preferences, always taking into account their emotional state, experience, knowledge, financial situation and economic and market environment. Greed in an investment portfolio can be quite destructive.

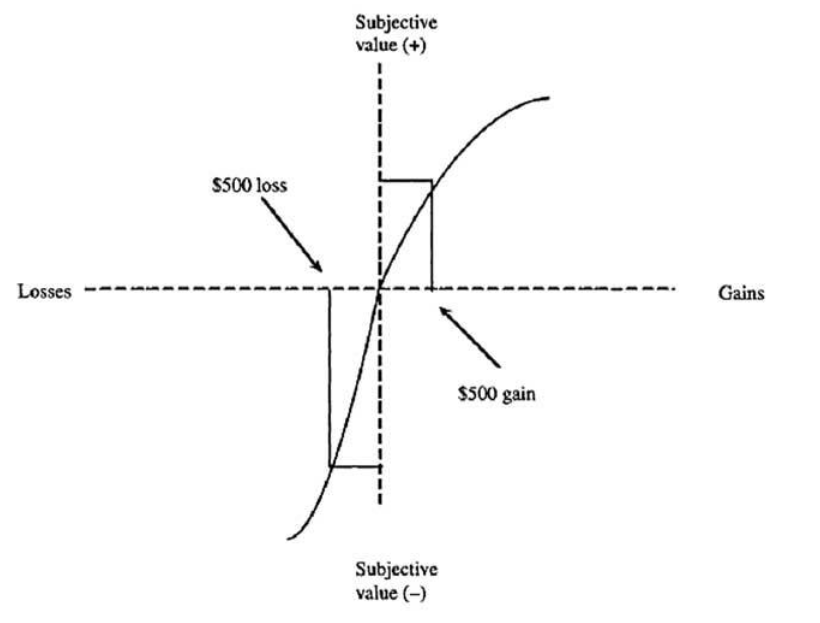

The existence of an investment plan or policy safeguards the investor from these emotional temptations. It is very difficult to see other investors celebrating their big deals in the purchase and sale of assets and us sticking to our plan, without fuss, as strictly as possible. Social influences are normal and we have to be able to deal with them. The same happens with losses, but in this case, discretion is greater. Investors are typically less expansive in a loss situation, but as Kahneman and Tversky in Prospect Theory find, losses have a greater emotional impact than an equivalent amount of gain – loss aversion.

This example taken from wikipedia is revealing:

Some studies have suggested that losses are twice as powerful, psychologically, as gains. Loss aversion implies that one who loses $100 will lose more satisfaction than the same person will gain satisfaction from a $100 windfall.

In the coming years, as we have already seen in this article on macroeconomic alignment and trends, we expect lower returns and greater instability. We will have to be less greedy in our ambitions. In other words, we will have to have a more flexible attitude that is in line with reality, better controlling fear and greed.

These emotions can, in fact, prevent us from making the best decisions.

A rebalancing strategy to control emotions

Notice, if our plan indicates 30% allocation to equities, with a margin of plus or minus 5%, it means that, if at a given moment, the portfolio has 40% allocation to equities, we will have to be able to decide to bring it to the set target. This decision has to do with our rebalancing strategy. If the rebalancing strategy is the famous buy-and-hold, it means doing nothing. That is, let the portfolio fluctuate according to the market.

There are several rebalancing options. Even in a buy-and-old strategy, there may come a point when age becomes a decisive factor in decreasing or increasing the allocation to a certain asset class.

By imposing targets in the allocation of the various asset classes, we will be managing risk, opposing the search for returns only, which, in themselves, can lead to incurring more risk, unnecessarily.

Atenuar o ruído para evitar a ganância

Não há soluções definitivas. Há, sim, flexibilidade e decisões a tomar. E estas terão de ser de acordo com os nossos objetivos, preferências e restrições e não com aquilo que os analistas ou os jornais dizem. Eliminar o ruído na tomada de decisão é fundamental também para eliminar os efeitos destrutivos que podem ter a ganância e o medo.

Depois há as questões económicas do momento. Quem viveu nas últimas 4 décadas provavelmente pouco saberá de inflação. Vivemos um ambiente de economia “Nice” (non-inflationary, consistently expansionary). Mas agora, é essencial estarmos preparados para uma mudança de paradigma. As taxas de juro baixas, condições geopolíticas instáveis e aumento significativo da volatilidade em instrumentos tradicionalmente mais estáveis (obrigações), significa, de forma nua e crua, que a história não se repete. Mas também significa que nem tudo é mau. Como refere Morgani Housel, “nothing is as good or as bad as it seems” (nada é tão bom ou tão mau quanto parece).

Fear & Greed Index

When it comes to greed, we immediately recall a famous quote by Warren Buffett: “Be Fearful When Others Are Greedy and Greedy When Others Are Fearful”. This view of Buffett denotes a certain contrary attitude that the investor must have in certain market moments.

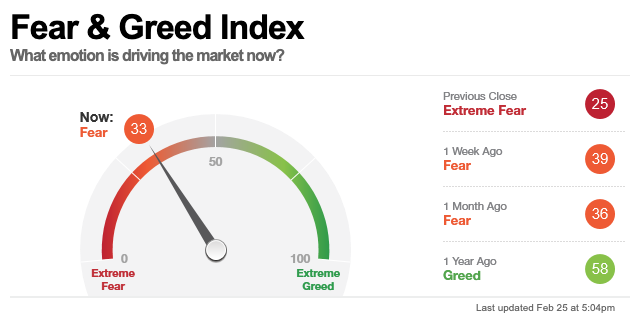

What emotion is driving the market right now?

The Fear and Greed index helps us to better understand what's going on. Through a set of 7 technical indicators, you can monitor investor sentiment. The indicator also has an educational logic. As investors are very emotional, this indicator serves to contextualize the market moment and detect exaggerated optimism or high pessimism.

In addition to forecasting machines, financial markets are emotional intelligence machines. To dissociate the evolution of an asset from feelings such as fear or trust, from the ability to motivate or influence, is to deny the essence of human behavior.

John Maynard Keynes, at a conference in Cambridge in 1929, said that the wealth in the future would be much greater. The economic problem would be solved. Everyone would have clothes and food and we would dedicate much more time to leisure, reading, family. Perhaps the path is being followed in that direction, but they are not all on the same path. What happened?

Greed and fear are likely to play their part in this unbalanced process. Will we be prepared to earn and consume less? Do we really want to embrace sustainability as a way of life?

It seems to me that the keyword here is: balance.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.