Financial products to invest money in

Where to invest money? A nice question, with a somewhat complex answer.

With the technological development of recent years and the financial innovation in terms of investment products, it is correct to mention that we are witnessing the democratization of financial investment.

This evolution has brought us trading and investment platforms, digitization, ease and power to decide where to invest money.

In terms of financial products, a very wide range of instruments is now available to any investor, such as:

- Mutual funds, index funds and exchange-traded funds (ETF);

- Retirement Savings Plans, in the form of insurance, investment fund or pension fund;

- Seguros financeiros de capitalização ou seguro de investimento, seguros ligados a fundos de investimento, como os Unit Linkeds;

- Structured products and structured deposits;

- CFD and derivative contracts such as options, covered warrants, futures and forwards;

- Direct investment in stocks and bonds;

- Peer-to-peer and crowdfunding platforms (collaborative funding);

- And the traditional time deposits and savings and treasury certificates.

Complex Financial Products and PRIIP

It should also be noted that some of the instruments mentioned above can be considered complex financial products (CFP), which is an important concept when preparing to make an investment decision. About this, it is recommended to read this CMVM guide. In the guide you can find out which products are considered complex, their main characteristics and risks.

In short, a complex financial product is a “financial instrument that, although taking the legal form of an existing instrument, has characteristics that are not directly identifiable with that instrument”. This complexity results, above all, from the fact that CBPs incorporate the risks and characteristics of two or more different financial instruments, despite appearing to be a single financial instrument. For example, covered warrants, structured products and insurance linked to investment funds are considered PFC as their value depends on the evolution of 2 or more financial products and on various parameters and risks such as volatility, interest rates, date of maturity, among others. On the other hand, shares admitted to trading on a regulated market, bonds that do not incorporate derivatives and harmonized investment funds are examples of non-complex financial instruments.

Information regarding PRIIPs, ie packages of retail investment products and insurance-based investment products, is also recommended. The CMVM provides a FAQ and a guide for non-professional investors on PRIIPs. For example, structured deposits, structured products, derivative instruments and insurance linked to investment funds and some investment insurance are classified as PRIIP.

Given all these instruments, where can I invest money?

Despite all the diversity and solutions, we want to highlight Investment Funds, ETF and PPR. They are instruments related in their form, as they are considered collective investment undertakings that constitute an autonomous asset. In this type of instrument, investors deliver their money to a management company which, in exchange for commissions, invests according to a previously defined investment policy.

At the PPR level, the great advantage of this structure is the tax component, as it provides annual benefits in the IRS according to the amounts invested, as well as in the long term at the time of redemption, with the reduction of the IRS rate that is levied on the capital gains, as explained on the Banco Invest page regarding Retirement Saving Plans taxation.

As for investment funds and ETFs, of the various classifications they may have, we highlight the one related to regulation and the distinction between harmonized and non-harmonised. Harmonized funds comply with national legislation subject to community rules on investments, namely in the rules on diversification and the risk assumed by the funds. Compliance with these rules allows funds to carry the UCITS seal (Undertakings for Collective Investment in Transferable Securities Directive) and to be traded freely in the European Union. The same is true for ETFs. The rest are considered non-harmonised, and in this case we have examples of real estate funds, special investment funds and closed-end funds.

Then, in terms of investment policy, both investment funds, such as ETFs and even Retirement Savings Plans, can invest in various financial assets such as shares, bonds, other investment funds or ETFs, currencies, raw materials and other investments alternatives. It all depends on the defined investment policies.

A note for ETFs that present as an essential difference compared to investment funds: that they can be traded intraday. They are a kind of listed funds. Mutual funds and PPRs in the form of investment funds are traded through units whose quotation is normally calculated daily. There is only one daily price that can be used for subscription or redemption. In the case of ETFs, the Service Design quotation presents the structure of securities such as shares or bonds, that is, a purchase and sale price, which may be different from their net asset value.

Advantages of these instruments

Putting tax issues aside, investment through these instruments has several advantages:

- allows you to diversify assets in a simple and effective way, reducing the risk in building the investment portfolio;

- controlling portfolio costs when compared to the transaction costs an investor would have to pay to replicate the fund's portfolio;

- enables access to professional and specialized management;

- possibility of accessing companies, businesses and markets around the world, in a simple way and with low investment values. Access to a wider range of markets that would otherwise not be accessible due to the large amount needed;

- high flexibility and almost immediate possibility of liquidity according to market conditions.

Thus, using these instruments, you can invest in different asset classes: treasury, money market, bonds, stocks, real estate, raw materials, cryptocurrencies and other alternative assets, in different regions of the world and serving different styles, such as investing in value, growth or passive and active investment, your investment time horizon, objectives and preferences.

Many investment funds and PPR allow investment from very low amounts and adapted to each investor. The minimum investment amounts can reach 1 euro, which allows a lot of flexibility and the democratization of investment that we have already mentioned here.

However, you should always do your homework. Analyze the risk, read the information documents and compare the different solutions. At the risk level, analyze interest rate risk, liquidity risk, market risk related to asset price fluctuations, country risk, counterparty risk, operational risks, among others. The selection of an investment fund, an ETF or a PPR must be very careful and following objective investment criteria.

Consulting websites such as Morningstar or PortfolYou, for example, can make comparisons between investment funds and ETFs. It is important to select multiple options within the same category and analyze the various metrics available.

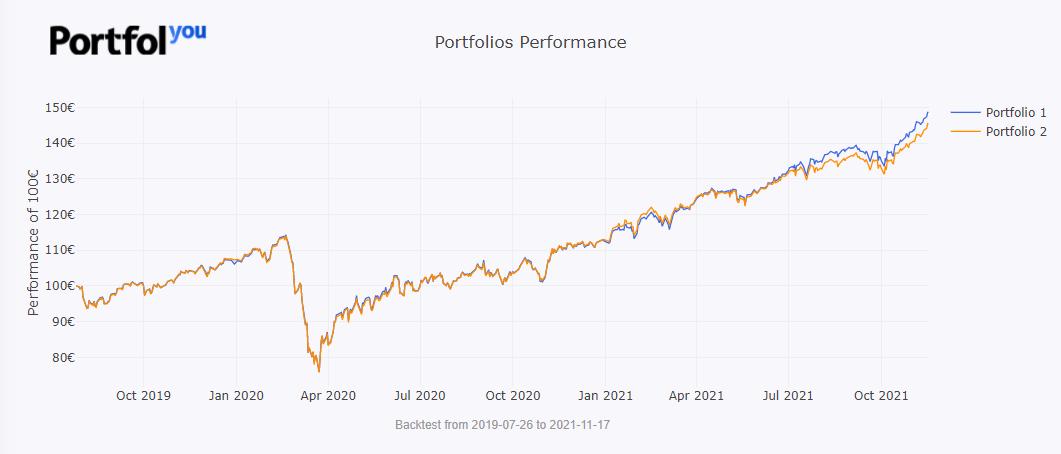

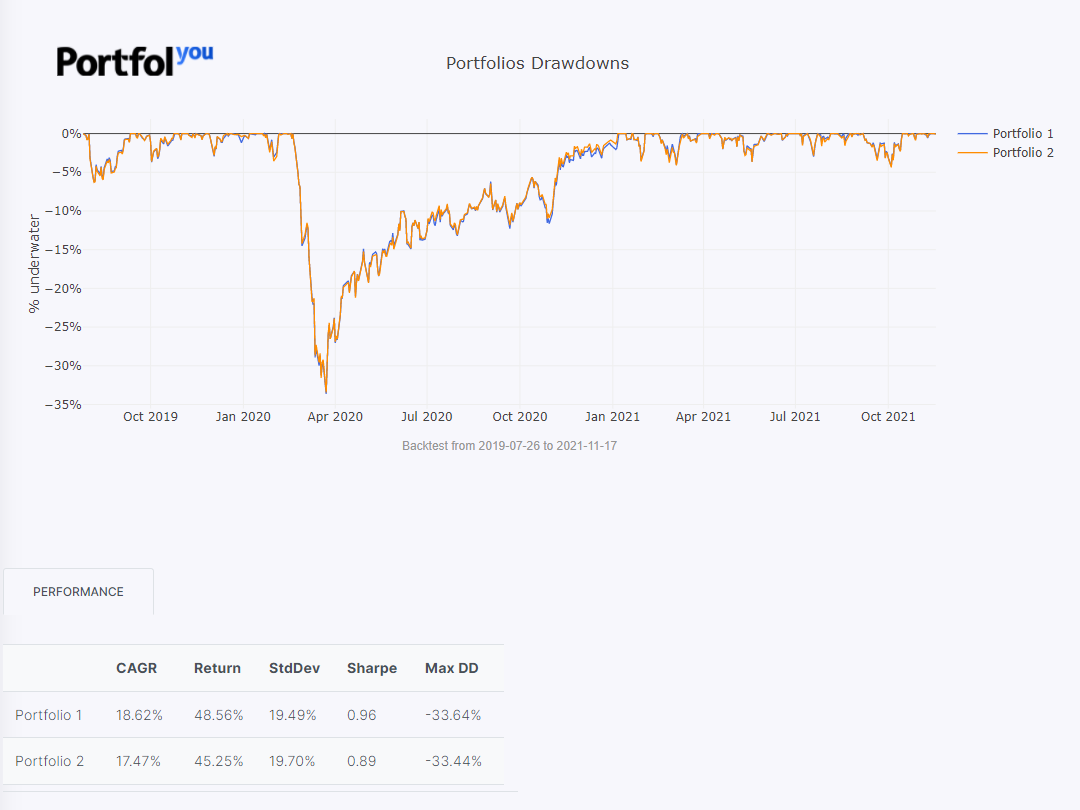

As an example, note this comparison between two ETFs whose strategy is to follow a world stock index, in this case iShares Core MSCI World UCITS ETF USD (Acc) and Vanguard FTSE All-World UCITS ETF (USD) Accumulating:

Source: PortfolYou

Despite all the goodness and diversity of solutions, not all are good choices. And an ETF or mutual fund for one investor may not be a good fit for another.

Look for financial intermediaries that offer a wide choice of transparent solutions, whose registration of participation units or securities is even registered in the investor's name and that are competitive in terms of pricing, particularly in the case of ETFs, as there is an associated transaction cost .

Future Proof, as an agent linked to Banco Invest, provides access to an open architecture of solutions that can adapt to each individual strategy.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.