Will Artificial Intelligence be a game-changer in investment?

Technology evolves at a frantic pace. But I believe that more and more we need to stop and reflect on what surrounds us. State-of-the-art technology brings very good things, but it also has its disadvantages and in order to make the most of all these innovations, we have to be able to keep our feet firmly on the ground and think for ourselves.

In this text, I will give my opinion on OpenAI's latest tool, ChatGPT, and what are its advantages and disadvantages, as well as its risk for society and the economy.

By today, we should all be familiar with ChatGPT, as it was a news headline practically everywhere. Which is fascinating, because 90% of the news headlines in which this software was highlighted were something like “ChatGPT will replace job x”, that is, the classic click-bait. It is normal that there is this euphoria, as we are talking about an Artificial Intelligence (AI) system that answers everything we ask, despite there being no sources, as in a Google search. However, there is a clear risk, as it is not 100% certain and most users think that they have the easy answer to everything there.

Microsoft will invest in OpenAI, the creator of ChatGPT, incorporating this AI technology into its “Bing” search engine to compete with Google. This technology is not new, what is new is its accessibility by ordinary “mortals”. Could it be for this reason that ChatGPT took only 5 days to reach 1 million users?

You will find more infographics at Statista

You will find more infographics at Statista At first, I confess that I didn't quite understand OpenAI's business model. I thought they got what they wanted when Microsoft announced the $10B investment, but now it makes more sense when they launch a more advanced plan that costs $20 USD per month and gives you access to new features. Therefore, I believe it will be a success.

One of the limitations of ChatGPT is not having access to the internet and all its knowledge is limited until shortly after 2021, that is, all the feedback that this software gives us is knowledge already acquired by it. Using “deep learning” and “machine learning”, he learns while interacting with people, which opens the door to manipulation.

However, the fascination is clear when a user starts using ChatGPT, as it is a chatbot capable of solving complex exercises, programming code in a few seconds, dictating nutritional plans, writing poems or even summarizing news.

What about financial investments? We were able to ask him to summarize a company's earnings presentation, but is that enough for us to make a decision on where to invest? I would say that it is one more tool to support decision-making that did not exist before.

So what are the advantages or disadvantages for the user in the investment landscape? There it is, we can save a lot of work in calculations and research summaries and presentations of company results, but this will only be useful for the user if he has confidence and knowledge. That is, it is an advantage if we use it as if it were a personal assistant and not as if it were the “holy-grail” of the investment. It is important to realize that the technology that is appearing now is meant to assist us and make our work easier, not to “turn off” our brains and make decisions lightly.

Which leads to an insightful question - what if in the future the market was controlled by artificial intelligence? The market, in my opinion, would cease to exist. The market is a reflection of human behavior, the fear of losing or the greed of winning. As a general rule, those who buy a share believe that they will profit from it, and those who sell believe that the same share will no longer serve to profit. The market works on a supply and demand basis and on errors in decision making. If we have robots calculating all sentiments and all their percentages, with top-notch algorithms, the idea of a market will disappear and the market, as we know it, will stagnate.

Financial advice in the age of AI

In this enchantment phase, the system becomes complex, as people deposit a lot of credibility and follow it blindly. Through observation on social media, I could see that a lot of people started asking ChatGPT for investment advice. Obviously, this software, in order to avoid legal problems, is programmed to explain to its users how the market works to the best of its abilities and to warn them that they should seek financial advice from professionals.

For example, a response type: “I am a language model and I don't have the capability to provide personalized financial advice or give any recommendations on buying or selling stocks. It's important to conduct thorough research and consult with a financial advisor before making any investment decisions. It's also important to consider your personal financial situation, risk tolerance, and investment goals before making any decisions. Investing in the stock market always comes with risks, and it's essential to be aware of these risks and to invest only what you can afford to lose.”

Example of a ChatGPT financial advice:

Source: I Asked ChatGPT for Financial Advice; Here's How It Went | White Coat Investor

Acredito que esta resposta terá deixado muita gente dececionada: esta “força ilusória” das pessoas acharem que iam ficar todas milionárias com conselhos de um software de inteligência artificial cujo seu propósito é acertar 10/10. O que me leva a pensar: se realmente as pessoas conseguem seguir cegamente um software, que aos olhos delas, acerta tudo, o que impede o ChatGPT de manipular o mercado? Esse é um perigo real.

Facilita muito trabalho e pode ser um aliado para quem o saiba usar bem, mas não se pode depender totalmente dele para fazer tudo. Este poderoso software irá num futuro próximo eliminar indústrias e criar outras. Por exemplo, há 30 anos, cerca de metade das empresas inseridas no S&P500 não existiam. O mercado está em constante mudança e evolução, e confesso que esta ferramenta poderá marcar os próximos anos.

Apesar de ainda ser muito cedo, estaremos perante uma nova “Dot-com bubble”?

A few years ago, several companies associated themselves with Blockchain technology with a single purpose: to gain popularity. Today the same is happening, but with artificial intelligence. BuzzFeed, an American news company that pays special attention to viral content, has publicly announced that it will use ChatGPT to produce content, after laying off 12% of its employees. The stock result was this:

Source: BZFD $ 1,67 (▼1,79%) BuzzFeed | Google Finanças

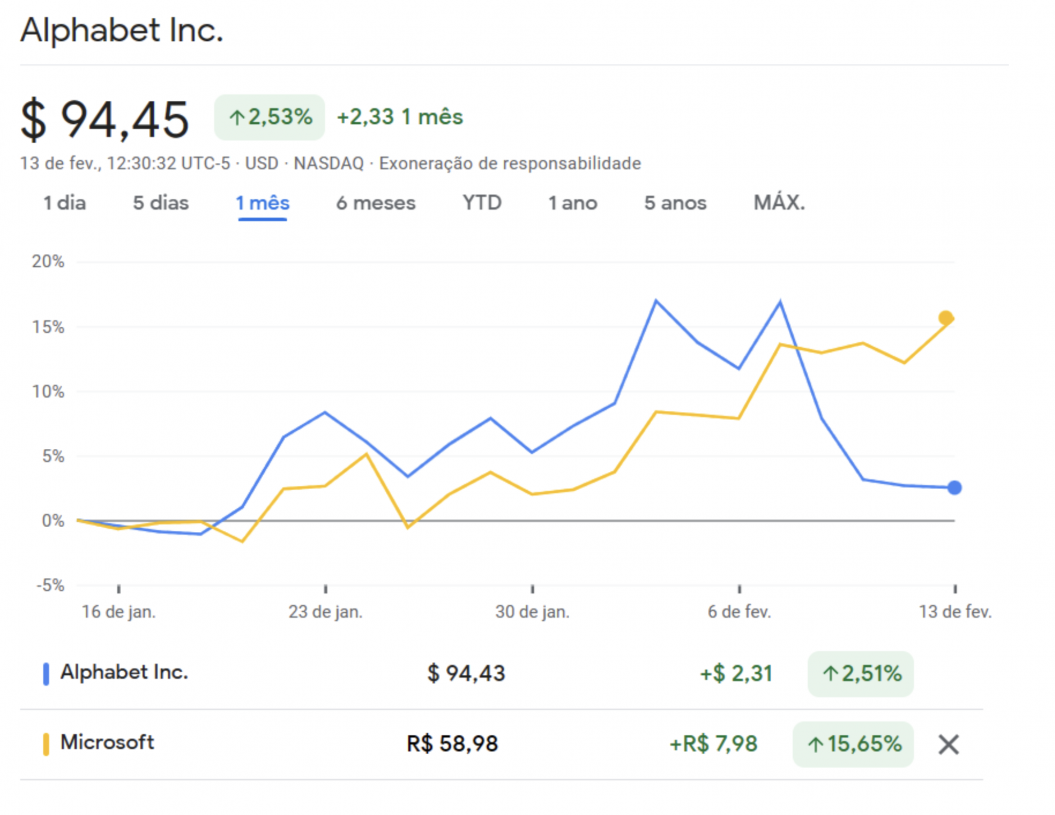

It is also symptomatic of what happened to Google after it tried to compete with Microsoft. Google introduced software similar to ChatGPT, called Bard, and in a presentation video Bard was caught incorrectly answering a question. This cost Alphabet $100B in market value.

Source: GOOGL $ 94,44 (▼0,14%) Alphabet Inc. | Google Finanças

Source: GOOGL $ 94,47 (▼0,11%) Alphabet Inc. | Google Finanças

Source: GOOGL $ 94,47 (▼0,11%) Alphabet Inc. | Google Finanças

Despite these ridiculous situations, investors need to know that many business ideas and new opportunities will emerge around this industry. Just look at the not-too-distant examples. Uber, for example, brought with it similar business models and with other aspects, such as Uber Eats or Glovo, which currently dominate 8.5% of the courier business in Portugal.

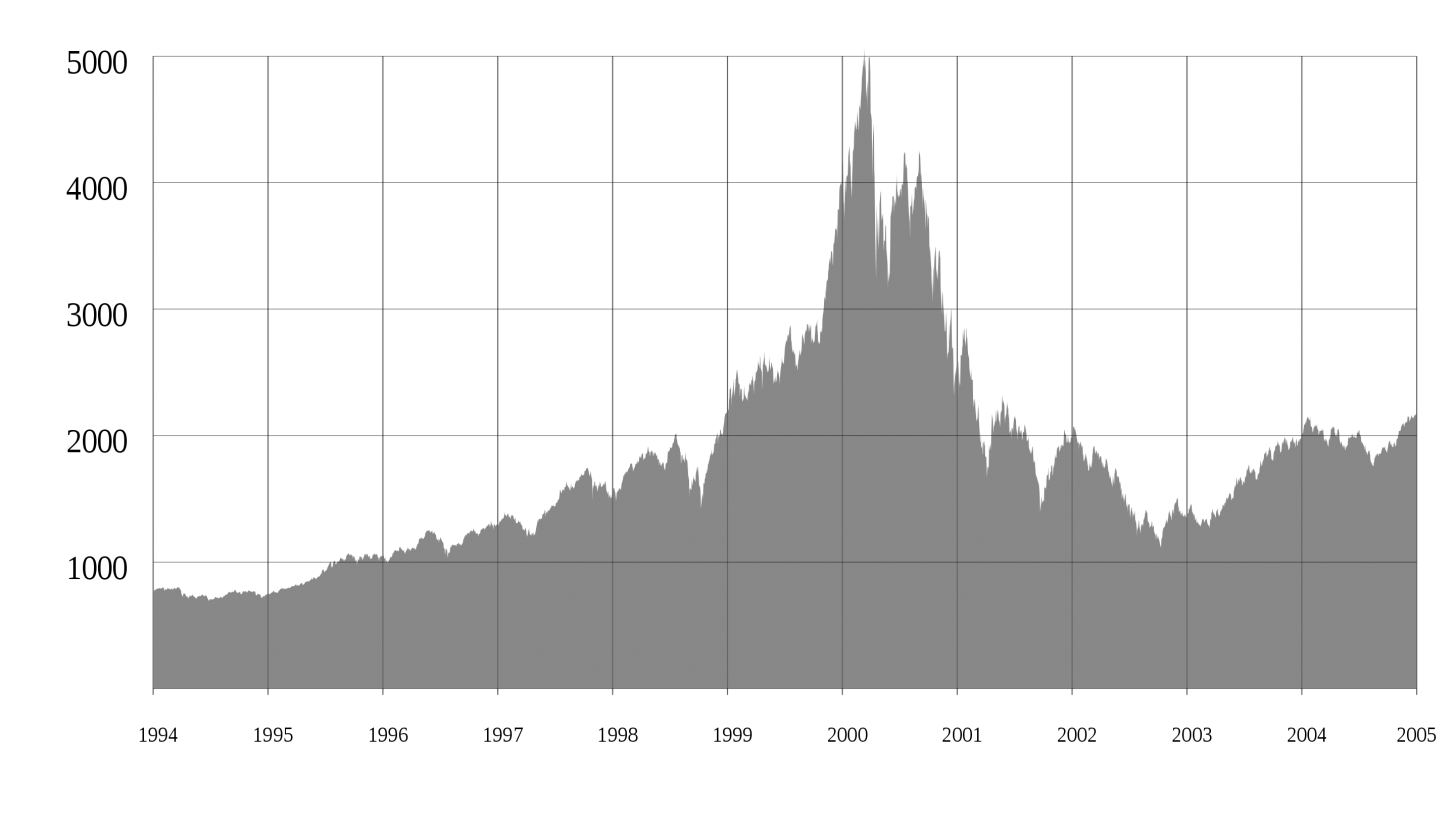

It is important to compare these times with the “dot-com bubble”, a bubble that began to appear in the mid-1990s, with several overvalued start-ups due to the popularity of technology and the rapid spread of the internet, accessible to anyone. Between 1995 and 2000, the Nasdaq index rose 400%. By 2002 it lost 78%, returning to the same level. Some survivors were for example Amazon and Ebay.

The NASDAQ Composite index spiked in the late 1990s and then fell sharply as a result of the dot-com bubble.

Source: Dot-com bubble - Wikipedia

On the side of the economy and society, there are also risks with the accelerated growth of Artificial Intelligence. One of the most pointed risks is the increase in unemployment in the short term. Yes, with the popularity of AI, many jobs could be replaced and this will increase economic inequality. When running a business, efficiency and effectiveness are key to success. Having someone who works 24/7 and doesn't make such human mistakes is a perfect marriage for the growth of any industry, but this obviously comes with problems. The problem here is that there are a lot of people educated in how to create artificial intelligence, but not many managers educated in how to use it for the benefit of their company without creating social gaps. AI needs to be very closely monitored and needs constant revision.

The evolution and enthusiasm for this technology require special attention so as not to let ourselves be influenced by these types of events in the market. Yes, it is a fact that AI is reaching more and more people, and it is becoming a very convenient work and research tool, but we must be aware that we cannot use it blindly, and we will have to be prudent when accepting any advice. When it comes to financial advice, a professional will assess your individual financial situation and take into account that each investment is different for each type of situation.

- ChatGPT: Chat Generative Pre-trained transformer, is a prototype of an artificial intelligence chatbot. It was released in November 2022;

- Alphabet: is the parent company of Google and its subsidiaries. It was created in 2015.

Natural de Coimbra, aluno da Licenciatura de Gestão no Instituto Superior Miguel torga e atualmente coordenador do departamento financeiro do ISMT Business Club.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.