What is ESG and Sustainable Investment?

Sustainable Investment, or ESG Investing, is an approach to investment that includes environmental, social and corporate governance criteria in the decision-making process with the objective of achieving the long-term goals of the investor and a positive impact on the planet.

In this article, we cover:

- What is sustainable investment, ESG, and its evolution;

- Main criteria or factors for decision making;

- The different sustainable investment strategies;

- The most important questions before investing.

WHAT IS ESG INVESTING?

Investment based on environmental, social and government criteria is much more than an acronym.

ESG, which stands for Environmental, Social & Governance, is not a recent trend. The approach was born in the 60s of the last century, through the designation of socially responsible investment.

More recently, ethical considerations and environmental values have also gained attention and today, these criteria are part of the decision-making process, alongside financial factors.

The COVID-19 pandemic accelerated the affirmation of these criteria in the investment process, with investors, companies and the financial industry as a whole recognizing this philosophy as fundamental for economic and social development and for the preservation of life on the planet.

ESG factors are then a set of criteria that can be used to rank companies and investments along with traditional performance metrics.

Jean-Xavier Hecker and Hugo Dubourg, Co-Heads of Sustainability & ESG Research at J.P. Morgan, believe that “pandemics and environmental risks are seen as similar in terms of impact, representing an important warning for decision makers. The impacts of the COVID-19 crisis on the real economy and the financial system highlight the limits of most forecasting models, which do not deal well with non-linear complex systemic risks”.

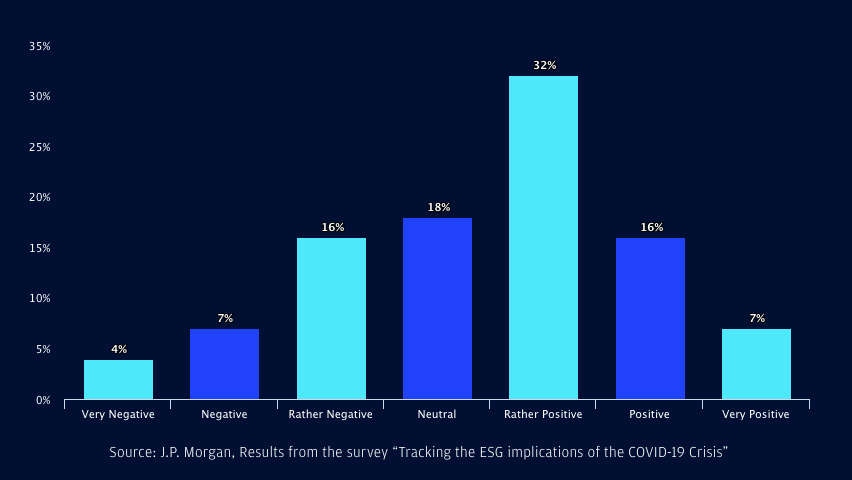

In a questionnaire carried out by JP Morgan to investors on the implications of the COVID-19 crisis on the moment of ESG investment for the next 3 years, the responses confirm this positive spirit and demonstrate that expectations are high.

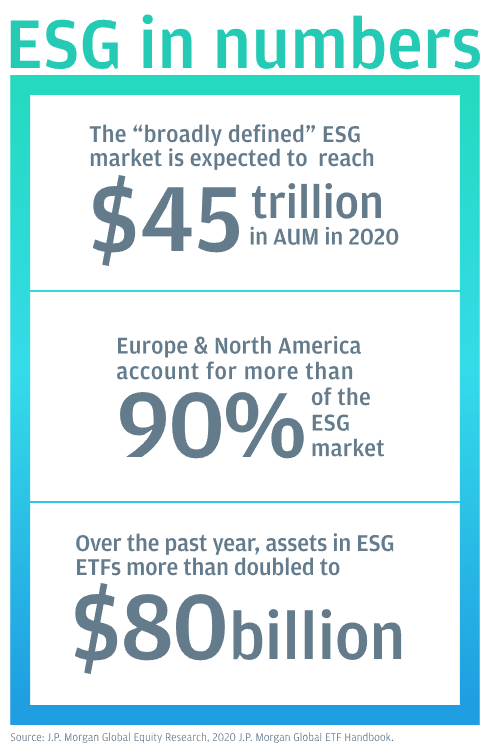

The growth of the ESG has been remarkable. In 2020, approximately 45% of assets under management worldwide indicated that they followed ESG principles.

MAIN CRITERIA OR FACTORS FOR DECISION MAKING

In the wide variety of concerns, we can find humanitarian, ethical, anti-corruption, environmental, education, climate, demographic, social or data security issues, as shown in the map below made available by MSCI.

Looking now at the three components of the ESG used to evaluate companies, we have:

- Environment. What kind of impact does a company have on the environment? It should include the carbon footprint, use of chemical products in the production process and sustainability efforts in its logistics chain. The areas of intervention are climate change, natural resources, garbage and pollution.

- Social. Improving social impact includes equity, equality, diversity and the pursuit of social well-being. Special attention to aspects such as human capital, responsibility for the product or service and social opportunities.

- Government. How management positions itself for positive change, ethical principles, diversity, executive management remuneration system and interaction with shareholders.

THE DIFFERENT STRATEGIES OF SUSTAINABLE INVESTMENT

The term ESG investment is often referred to across the board including sustainable investment, socially responsible investment and impact investing in the same acronym.

Although related, there are some important differences between these strategies:

- ESG Investing: An approach focused on companies that make an active effort to limit their negative social impact or deliver benefits to society. Good practices include behavior at the environmental, social and governance levels of the companies themselves.

- SRI – Socially responsible investment: It means choosing investments that exclude businesses and companies that conflict with the investor's values. The most common SRI exclusions are non-renewable energy, weapons, tobacco, gambling or alcohol companies.

- Impact investing: Investing with impact is characterized by a direct relationship between priorities based on values and the use of investors' capital, with the objective of generating and quantifying a positive social impact. Investing in economic development in low-income communities and societies or in reducing the carbon footprint are some examples.

THE MOST IMPORTANT QUESTIONS BEFORE YOU INVEST

Whether through brokers, asset managers, banks, financial advisors, or even through a do-it-yourself analysis, there are several ways to identify investments that meet the defined objectives.

Although the criteria are far from normalization, companies and management companies already provide a variety of information, either through ratings and the scoring system or through investment policies aimed at these criteria.

- Should I implement a sustainable investment strategy? Which strategy is right for me?

Sustainable investment represents the entire set of strategies based on ESG investment, impact investing and socially responsible investing. Based on the defined objectives and preferences and restrictions, we must select the criteria that best promote respect for our principles and values. This without compromising performance.

- What kind of information and where to find the information needed to invest according to the ESG criteria?

By consulting the websites of the evaluated companies or specialized entities. Morningstar, Refinitiv, Bloomberg, MSCI, FTSE, Euronext or S&P Dow Jones are among the most important companies that already present forms of research and selection of possible investments. The analysis, scoring and variables considered systems may vary according to the company, which makes decision making difficult.

Investment fund and ETF management companies also already provide their own information both in prospectuses and in fact sheets where it is possible to assess the metrics of an instrument that calls itself a sustainable investment fund or ETF ESG, for example.

- How will these criteria affect the portfolio's risk-return profile?

The truth is that companies with better sustainability scoring can access cheaper financing (lower cost of capital), are less exposed to systemic risks, less volatility and therefore have a higher return potential.

THE GROWTH OF ESG INVESTMENT IS NECESSARY

Investors are increasingly determined to include these practices in their investment policy and to know how they can do it efficiently.

But despite the notoriety of the topic and the demand it arouses, the truth is that there are still dangers and warnings. From the outset, the existence of unclear and even ambiguous criteria to assign certain ESG metrics and the use of the momentum to position themselves.

There are even those who consider that these terms and criteria create an idea that everything is being done to protect the environment, ethics and society, but in reality they may just be giving a false perception, a kind of placebo.

Therefore, it is important to investigate and do your homework. At the same time, the industry is expected to evolve and to create clear and universal rules for investors to be able to make a decision that is adequate to their motivations and interests.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.