The impact of duration on bond investing

Is your bond or bond mutual fund seeing a big drop this year? You've certainly wondered why. One of the main reasons lies in a concept not always known and not always easy to understand: duration (or duration).

With no calculations and no complicated math, in this article, we will try to give you tools to understand and use this concept in the future.

This year, mutual funds and ETFs that invest in bonds are making significant losses. One of the concepts that best explains what is happening and that is not always easy to understand is the concept of duration.

Key Takeaways:

- The price of a bond and its yield (yield) move in the opposite direction, that is, if the price of a bond goes down, the yield increases and vice versa;

- Maturity and duration are different concepts, but often confused;

- Duration is a measure of the sensitivity, in years, of how much the price of a bond will go up or down given interest rate movements;

- Maturity is the time remaining until the bond is fully repaid and extinguished;

- In an environment of rising interest rates, we can expect bonds with shorter duration to perform better.

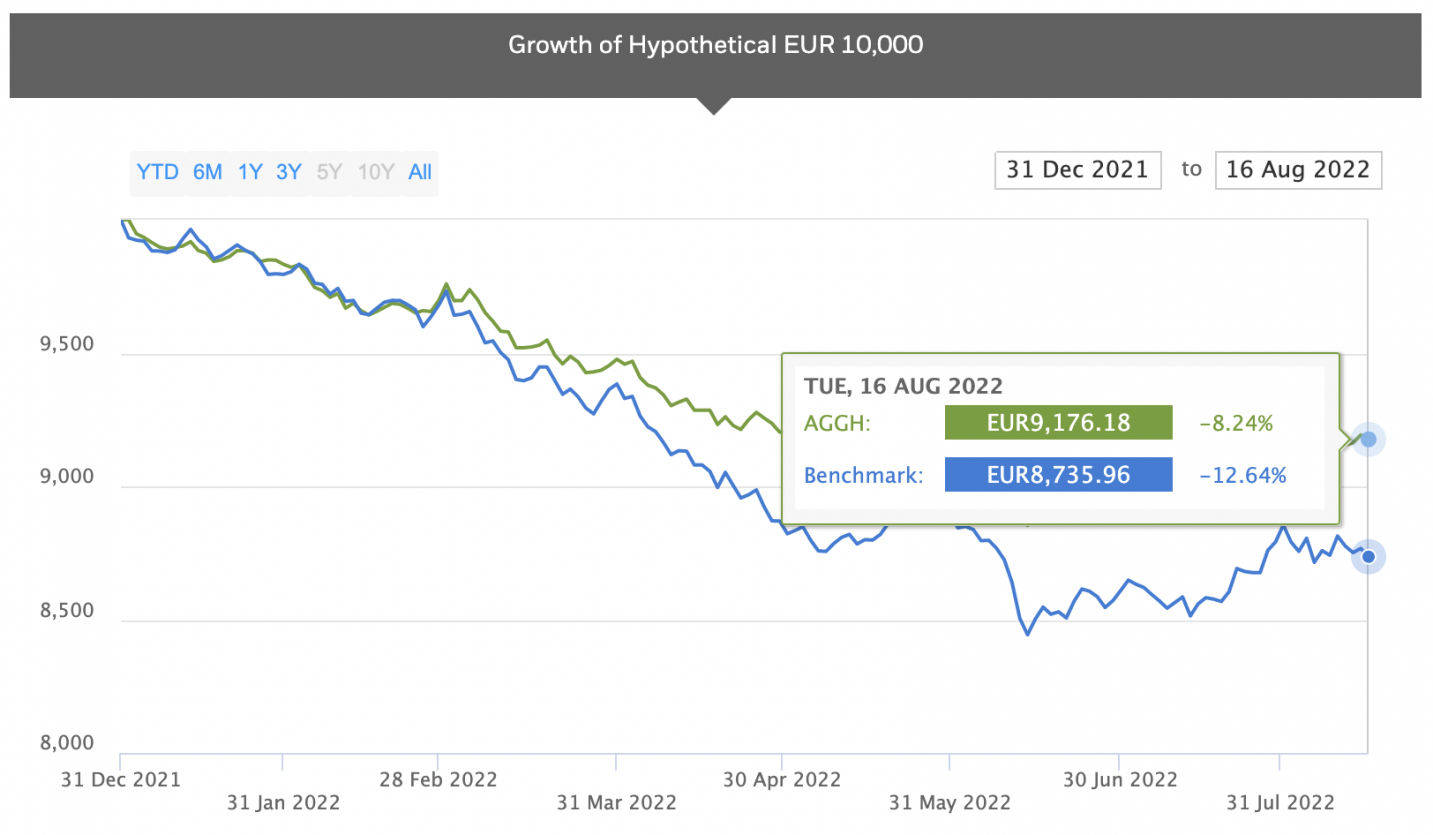

In this article, we will take this ETF as an example: iShares Global Aggregate Bond UCITS (AGGH)

The ETF seeks to track the investment results of an index composed of global investment-grade bonds:

- Direct investment in public, government, corporate and securitized bonds;

- Diversified exposure to the global fixed income market;

- Exposure to investment-grade bonds.

The benchmark is the Bloomberg Global Aggregate Index, which is a flagship investment-grade global debt index of twenty-four local currency markets. This multi-currency benchmark includes fixed-rate treasury, government, corporate and securitized securities from developed and emerging market issuers.

Source: Ishares

Even in the case of mixed portfolios, with stocks and bonds, the situation is similar. But to analyze this situation of the diversification effect of a portfolio of bonds and stocks, I suggest revisiting the article “The 60/40 portfolio”.

Why bonds are falling?

In fact, there are several factors that justify this very negative performance. However, we can mention that one of the main factors is inflation.

Inflation has today the stage, it is the centre of all attention. In 2022, stocks are plummeting, bond interest rates are rising, crypto assets have imploded, and no one is quite sure where this will end up.

Mutual funds and ETFs buy bonds for their portfolio in accordance with the defined investment policy. Suppose it is, for example, the AGGH ETF, which we have already mentioned above and which follows the Bloomberg Global Aggregate Bond index. In that case, the listed fund is composed of bonds from countries and global companies with a rating above investment grade (which means lower credit risk).

Let's take one of the ETF bonds as an example, the German treasury bond due February 15, 2030.

Bond features:

- 0% annual coupon;

- Date of issue, 01.08.2020;

- Maturity 10 years, at the time of issue, with maturity date on 02.15.2030;

- Current duration 7.48.

Source: Deutsche Finanzagentur

As can be seen, the bond was issued above par, that is, with a price above 100, and with a negative yield. Investors, in January 2020, had the expectation that the interest rate could still fall further and that inflation would not be an issue.

But the truth is that if we expect higher inflation in the future, it means that we will also have higher interest rates. This mechanism is normal, as inflation above target or expectations means that central banks will act by withdrawing stimulus and raising interest rates to cool the economy and bring inflation closer to target levels.

This German treasury bond has shown a negative performance since the beginning of this year: it went from a quotation of 102.61% - on December 30, 2021 - to a quotation of 94.74% on August 15, 2022. The bond's price incorporated the impact of the expected rise in inflation and the corresponding expected rise in interest rates and investors began to demand a higher interest rate from Germany for its debt securities in order to compensate them for expectations around the inflation. In this case, as the interest coupon is fixed, for the implied return on the investment (yield) to rise, the bond price must fall (the price and yield of a bond move in the opposite direction, that is, if the price of a bond goes down, the yield goes up and vice versa, as we can see in the graphs above). This security is now priced at 94.74%, which means that since the beginning of the year it has fallen by 7.7%. The yield went from negative, -0.32% at the end of 2021, to 0.72% on August 15, 2022, an increase of 1.04 percentage points (pp).

Thus, and going back to the example of the AGGH ETF, its daily quotation reflects the quotation of all bonds of the portfolio. Therefore, this fall reflects the bond prices on the secondary market so that the bond yield adjusts to the new conditions demanded by the market in view of inflation expectations and interest rate hikes.

The concept of duration

One way to look at the interest rate risk of a bond or, in this case, a bond mutual fund, is to look at its duration.

This concept is very important because it means the degree of sensitivity of a bond, or a portfolio of bonds (as is the case with mutual funds and ETFs), to interest rate movements.

In a straightforward way, we can say that if interest rates rise by 1pp and duration is 7.48 (example of the bond above), everything else being constant, it means that the price of the ETF or mutual fund or bond should fall also about 7.48%. As we saw above, in view of a 1.04 percentage point increase in yield, the price of the bond fell by 7.7%.

The lower the fixed interest coupon and the longer the maturity, the greater the impact of duration on the bond price.

In an environment like the current one, with high inflation and rising interest rates, it may be preferable to have bonds with lower duration in the portfolio. This may mean opting for short-term bonds, bonds with a variable interest rate and even bonds indexed to inflation, albeit with some reservations in this case.

The case of floating rate bonds is interesting, as the duration is usually low. It is the t time until the next interest coupon payment. If the interest coupon is semiannual and there are 6 months left to pay the interest, then the duration is 0.5.

Investors with a shorter term horizon are mainly looking for shorter maturities and lower durations, in order to minimize price volatility and interest rate risk. However, investors with longer-term goals may look for longer terms, aiming for greater financial stability (constant cash flows). Duration is therefore also an expression of volatility: the longer the duration, the greater the volatility of the bond price around interest rate movements.

There are several concepts of duration. Without wanting to confuse, we can have the modified duration, Macauly duration, the effective duration, among others. But it is important to emphasize, in a conclusion that cuts across all concepts, that the longer the duration of a bond, the greater the interest rate risk to which the investor is exposed.

Don't confuse duration with maturity

Duration is a measure of interest rate risk, in years, and is based on a mathematical formula that involves, among others, the bond's price, yield, maturity and interest coupon. Thus, duration considers all flows generated by the obligation (principal and interest), as well as the moment in which they are generated and is defined as the weighted average of these flows generated over time discounted to the present value of the obligation.

Maturity is no more than the time remaining until the bond matures, that is, until its repayment and termination.

In this example that we are analyzing, as the coupon is 0% and the yield is also close to zero, it is natural that the duration and maturity values are very close.

Both duration and maturity decrease as the bond approaches maturity.

Other factors to consider

When analyzing an investment fund or ETF, it is useful to analyze the duration of the fund's portfolio and compare it with the duration of the benchmark. The fund manager can choose to follow the benchmark or take a more active approach and move away from the duration of the benchmark portfolio.

These decisions influence the performance of the fund or ETF. If the manager opts for active management and for a duration greater than the benchmark, the level of volatility and interest rate risk will be higher.

The term “short-duration” or “long-duration” often appears in the name of investment funds or ETFs. It is expected that “short-duration” funds have less risk and less return. “Long-duration” funds tend to have higher risk and higher expected returns.

However, there are other factors to analyze besides duration, of course. We must pay attention to the geographic area to invest or the types of issuers: government, government or state entities and companies. But also to the market segment, namely that related to the rating: investment grade (higher rating) and high yield (lower ratings). In the case of investment funds or ETFs that invest in bonds with a speculative rating (high yield), we will normally have lower durations, as the market demands higher interest rates and shorter maturities from these issuers. In other words, we may mistakenly assume less risk and less volatility, which is not true, as default levels are also higher.

Funds and ETFs are required to disclose their investment policy and all these factors must be described in this document.

Do not draw conclusions from the securities of the funds or ETF alone and do not use past performance to assess the quality of the manager.

The bottom line

In recent years we have lived with very low-interest rates and low expectations of returns on traditionally and more conservative instruments. The reversal of this cycle, which is very painful and penalizing for the most conservative investors, also means better prospects for the coming years, with higher interest rates and positive expected real interest rates - which is currently not the case.

We do not know whether this adjustment has been fully priced in or not, it all depends on the evolution of inflation expectations, central bank policy and the economic scenario itself. If the economy shows signs of slowing down and if supply chains, energy and geopolitical problems stabilize, it could be the case that inflation will be less aggressive and central banks will not need to raise interest rates much.

Consult the portfolio information that mutual funds and ETFs disclose and analyze the duration of the portfolio. This can be a determining factor in selecting the most appropriate investment for your situation and your investment goals and risk tolerance.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.