The great debate on Inflation

In the Roman Empire, instead of coins made only from silver, some emperors began to issue coins with a smaller percentage of silver, mixing it with other metals. With this they were able to “print” more currency and increase the money in circulation. This process caused periods of great inflation. Eventually, this ancestral “quantitative easing” could have been one of the reasons for the collapse of the Roman Empire.

Recently we have examples of high inflation, such as the hyperinflation of the Weimar Republic in Germany in the 1920s. But after a period of also strong price inflation between the 50s and 70s of the same century, we had a period of disinflation that, however, took inflation to zero and even to deflation in recent years.

But what is the definition of Inflation?

Inflation is defined as the general rise in prices and not just the rise of a particular product or service. That is, we can have a large increase in the price of a specific item and not have inflation.

Deflation, on the contrary, is a generalized drop in prices, that is, as time goes on, money is worth more. Disinflation corresponds to a process of reducing inflation (decreasing inflation). It is important to realize that today's euro is not the same euro as it was 2, 5 or 10 years ago. Just as it won't be the same euro 10 or 20 years from now. Coins are unstable by nature. As Irving Fisher points out, in a book published in 1928, we live in a monetary illusion. We think our currency doesn't change. The others change. But that is not true.

After the outbreak of the crisis caused by the pandemic, we developed some articles related to the topic of inflation. We started by publishing “What the bond market is telling us”. Then we asked: Inflation or deflation? The debate promised to be tough with arguments from both sides. Finally, we launch gold into the debate with real interest rates.

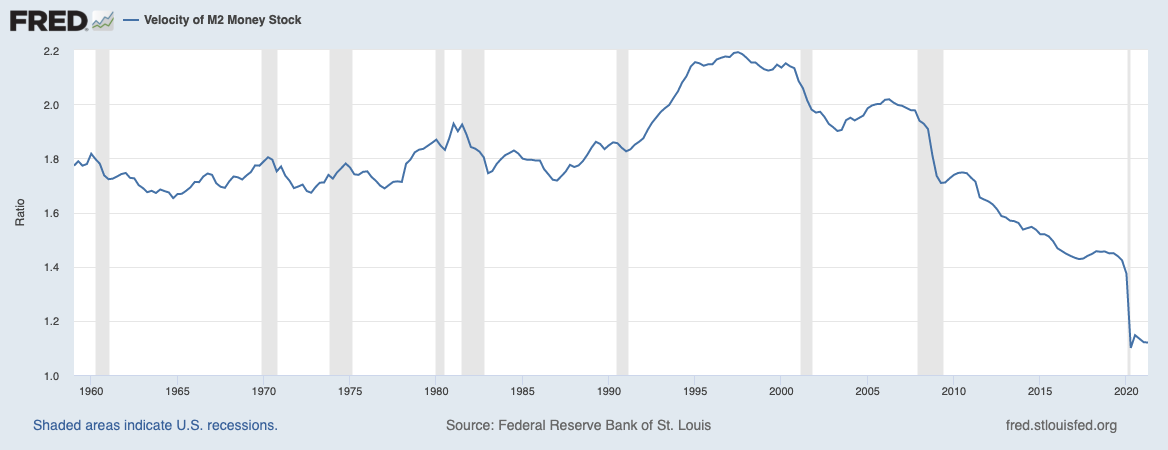

But a year later, it is worth updating the chart below, where you can analyze the evolution of money supply (M2) and the speed of currency circulation (M2V). The money supply soared, but the speed of circulation plummeted. This partly explains the lack of inflation of goods and services in recent years and the strong appreciation of financial assets.

Source: FRED

With the strong monetary expansion and fiscal stimuli launched after the COVID-19 crisis, inflation gained even more prominence in the face of a monetary experience with unpredictable consequences, in which central banks basically monetized the risk.

The dice were cast for the current debate: transient or persistent inflation?

Rising commodity prices, constraints in supply chains and turmoil in the labor market are causing instability in the prices of goods and services globally, also impacting valuations of financial assets. This instability may be the natural recovery after the strong impact of the economic shutdown for many months.

But according to a book by Charles Goodhart and Manoj Pradham, The Great Demographic Reversal, we are facing a structural change in the economy and society: the demographic trend of an aging population, coinciding with a growing retreat of globalization.

This major reversal, according to the authors, will lead to higher inflation and interest rates, bringing problems to heavily indebted economies, but increasing the valuation of labor income and, consequently, reducing inequality. It is a long-term vision of how economies can evolve in a more technological future (disinflationary force), but also more indebted, aged and politically more closed.

What would happen if there was no inflation?

It is worth noticing what has been going on in Japan.

It was a long period of low interest rates and deflation interspersed with low inflation, mainly from the beginning of the 1990s of the 20th century. The stock market had a very negative performance. The central bank with its aggressive monetary policy was not able to stimulate the economy. However, the level of unemployment remained low and, despite the high debt, it was possible to keep the country healthy and with a good standard of living.

So is inflation really that important?

If there is deflation, it can happen for several reasons. Impulse from consumers and investors would be to wait for lower prices to buy and invest. Holding money would always be better because at the end of the year it would be worth more in real terms just for the simple fact of having it.

But we can also have lower prices (disinflation) or persistent decline (deflation) as a result of significant technological advances, achieving lower production costs and more efficiency.

In this case, equities and real estate would stop going up just because of liquidity and less debt would be needed. So less money creation.

But inflation has a motivating psychological effect of seeking greater efficiency, more with fewer resources. Inducing economic growth via rising financial assets can create bubbles, but also wealth, as it will then be spent. A snowball. A pendulum of world stability. Will it be sustainable?

Bitcoin's relationship to inflation

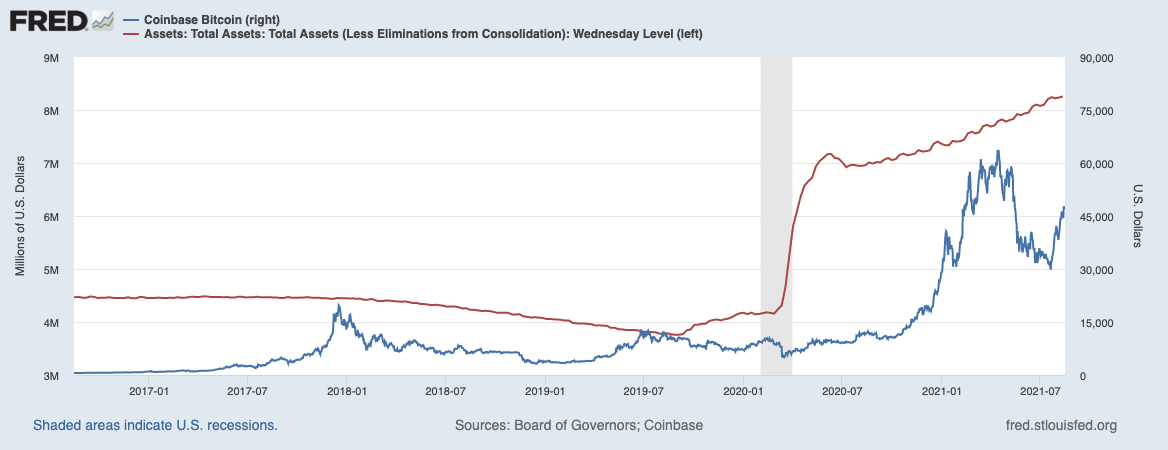

Source: FRED

When there are problems in the economy, money is printed. Citizens cannot control, as decisions are in the hands of governments and central banks. Before, gold and other metals were a kind of store of value, a safeguard for this printer. And now?

It's expensive to keep gold. And gold also has inflation, as we are always finding more gold.

Bitcoin appears as an answer to this monetary policy, where central banks can print money at will. It's just that there can't be more than 21 million bitcoins. Furthermore, it is native to the internet and is not in the hands of governments and central banks.

It is a deflationary structure, whose system prevents the uncontrolled issuance of currency, and the consequent loss of value, as happens today in the monetary system.

Back to Fisher and the Money Illusion: Are prices going up or is the currency going down? The truth is, no one remembers that money loses value.

The Big Mac Index

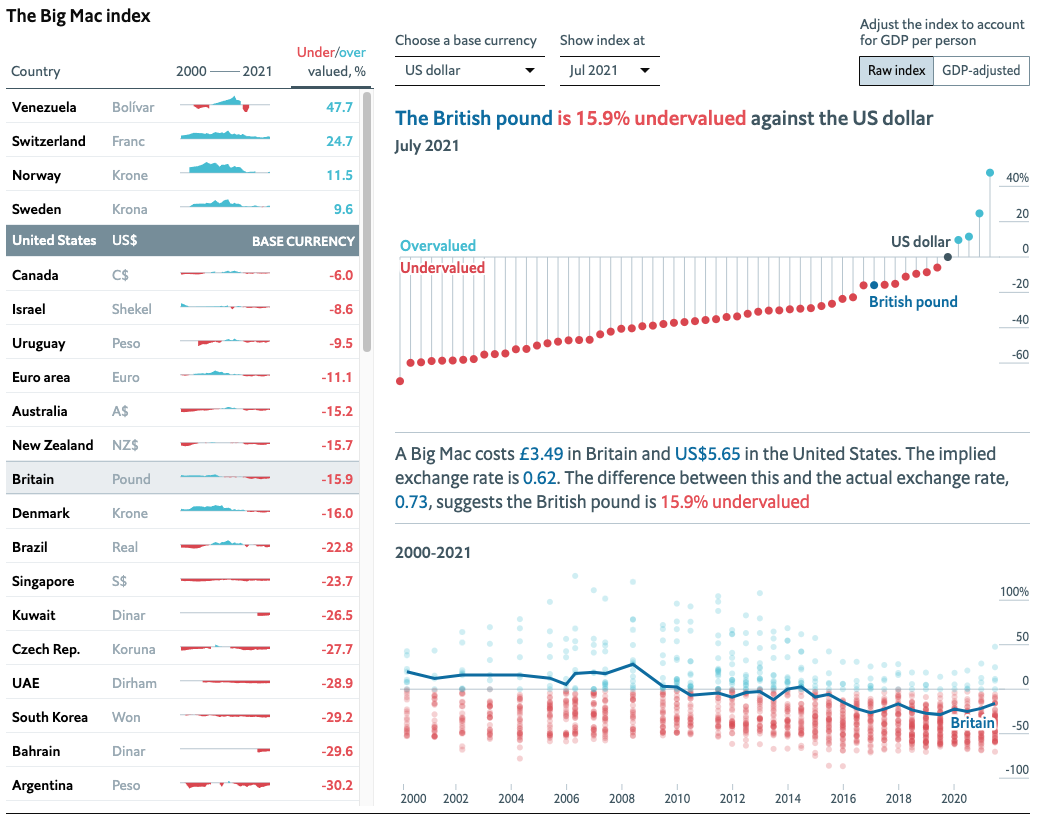

When The Economist magazine invented the Big Mac index, it aimed to see if currencies were at their correct level, based on the theory of purchasing power parity (PPP). The notion that, in the long run, exchange rates must move towards the rate that would equal the prices of an identical basket of goods and services (in this case, a hamburger) in any two countries.

Source: Economist

According to this indicator, the euro was undervalued by around 11% against the dollar in July 2021. This difference implies the different nominal and real exchange rates between the two economic blocs and, therefore, the inflation rate.

The impact of inflation on financial assets

As we have already seen, the strong monetary expansion of recent years has led to an expressive valuation of financial assets.

In stocks, when inflation rises moderately, it tends to make stocks rise. In inflation, companies can raise prices. It's a symptom of economic growth, which is good for companies. But in the future, if inflation continues to rise beyond expectations, it will lead to a rise in interest rates, which will lead to a fall in stock prices, as a slowdown in economic growth is expected.

Commodities have a complex effect on inflation. If businesses and consumers pay more for essential goods and services, they will be forced to spend less on other products. Therefore, the long-term effect of an increase in commodity prices is deflationary. But the short-term effects are inflationary.

The cognitive dissonance that the inflation concept provides should come as no surprise.

As Irving Fisher said: "Instead of thinking of a high cost of living as a rise in the price of many separate goods, which by chance of simple coincidence rise at the same time, we should instead see that it really is the dollar, or any other currency, which varies."

Being such an important concept in our daily life, do we really know what inflation is?

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.