The emotional cost of Investing

Something that a good number of investors, when they start investing, don't realize is the emotional cost of investing.

What I call “emotional investment cost” is the emotion that comes from not knowing about the future, about risk. Risk is what the market rewards. If there was no risk, there would be no return associated with the investment in the capital market.

At no time do we feel this risk better than when we are losing money. After a market crash. When we ask ourselves when the fall will end, IF it will end or if we had the worst timing ever and invested at the top and that, however, it will be years before we review our capital, let alone earn.

Of course we never know the future. Much less in the short term, and in the long term we only have expectations, never guarantees, of returns. But to get to the long term, we will, of course, go through very complicated periods, and not only deep, but long falls.

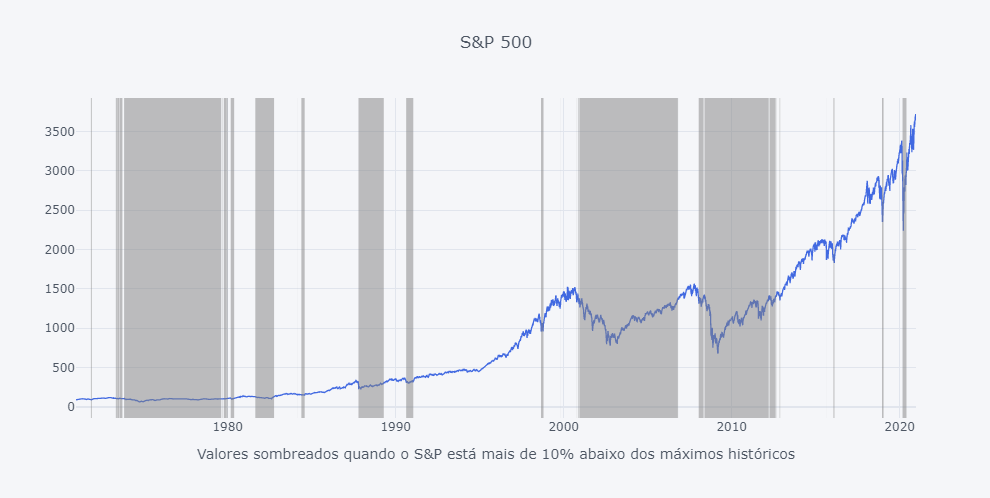

In fact, if we consider periods when the S&P is more than 10% below maximums as “correction”, in the last 50 years the S&P 500 has spent 42% of its time in “correction”.

As we can see from the shading, there are in fact periods of several years when the S&P is below the highs and takes a long time to recover.

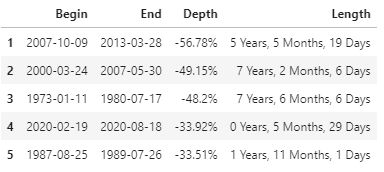

We can also see it in this table:

The two biggest corrections (in depth) came one after the other and both took several years.

This is the true price of investing. If we want to get the returns that the stock market gives us, we have to accept this kind of risk. To make matters worse, the S&P 500 is one of the most successful indices in the world. In other words, this is one of the best cases. We have more complicated investment situations in Japan or even in Europe, making geographic diversification mandatory.

Even after I show you this many new investors will think, “Okay. I understand that I have to accept the risk, but the stock market has always recovered and my time horizon is extended”. But in fact, there is no chart that can convey the feeling of losing 50% of our investment, as happened 3 times in the last 50 years at S&P, twice in the last 20 years.

If we consider as "correction" periods when the S&P is more than 10% below the highs, in the last 50 years the S&P 500 has spent 42% of its time in "correction".

This is not intended to discourage anyone from investing. I believe that investment in capital markets, particularly in terms of shareholders, is an excellent form of capital accumulation and growth. But that will only happen if investors understand the “rules of the game” and are willing to accept and take the risks.

The damages of not knowing the risks of our investments, and a potential early exit, are sometimes irreparable.

Risk is the admission price. Only invest if you are willing to run it.

➤ Python code here.

➤ Doubts? Opinions? You can discuss this article on linkedin.

With a degree in economics (2006) and a postgraduate degree in Finance from Universidade Católica do Porto (2010), he later realized that he shared the same enthusiasm for programming.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.