The difference between an asset being quoted in euros and having currency hedging

Whether or not we should have currency hedging on our investments is a complex decision. There are a number of good articles about this, of which I highlight one from Vanguard.

While it's something we plan to delve into in future articles, this one in particular isn't about whether or not we should have currency hedges, but rather whether the assets we buy have currency hedges or not. This recent dollar devaluation at the same time as the S&P 500 made new highs left some investors amazed that the ETF or mutual fund they invested in is not appreciating.

Note: You should turn the phone over for a better view of the image

This is because they bought these assets quoted in euros and intuitively thought they had no exchange risk. However, the currency in which the financial asset is quoted is not necessarily linked to whether or not that asset is currency hedged.

Very briefly, an asset may be quoted in euros and not be currency hedged. Likewise, it can be quoted in euros and have currency coverage. There is no direct connection. It is just the currency in which the ETF or investment fund is quoted.

Currency hedging should be something we should take into account when choosing the asset to invest and that aspect is usually even found in the name of assets.

An asset may be quoted in euros and not be currency hedged. Likewise, it can be quoted in euros and have currency coverage. There is no direct connection.

When people read that US equity markets made highs and that they recovered very quickly from this year's lows, they are reading about the S&P 500 without currency risk and that may end up not being reflected in the performance of the ETF or investment fund they own.

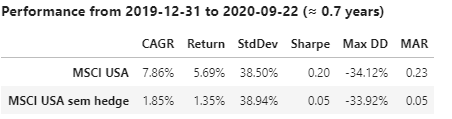

In this way we can hypothetically see an MSCI USA in Euros without hedge/currency hedge vs an MSCI USA in Euros with hedge/exchange hedge performing somewhat differently in the strength with which they are recovering due to the devaluation of the dollar in recent months.

Note: You should turn the phone over for a better view of the image.

Whether or not to have currency hedging is a decision we must make consciously. There are advantages and disadvantages that we will explore in other articles, but it is essential that we know whether or not assets have such currency hedges, before investing in them.

Be it ETFs from Vanguard, iShares, Invesco or investment funds from Goldman Sachs or JP Morgan, we can often find different versions quoted in euros, which may or may not have currency hedging. We must always be careful to read and study to clarify doubts before purchasing any financial asset.

With a degree in economics (2006) and a postgraduate degree in Finance from Universidade Católica do Porto (2010), he later realized that he shared the same enthusiasm for programming.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.