Is this your first bear market? Keep investing!

Bear Market is an opportunity for all generations. Yes, it's true, I'm not kidding.

Whether you are a new Gen Z investor or a Baby Boomer, X or Millennial investor. Bear markets are good opportunities to start investing, to continue investing and to keep investing as long as the decision is made based on the specific situation of each investor and long-term expectations for the financial markets and not on what is the sentiment or emotional swing of the day-to-day of the market.

Most of the best market days happen during bear markets. And it's not worth trying to guess when those days will happen because that decision will only make us lose even more money. Usually, we give up on an investment when we can no longer bear the losses. The pain of loss is unbearable. And that's when a rally begins and the best market days appear. It's tricky, but it's not a surprise.

The surprise effect

The markets are a box of surprises, but that's what we should be expecting, as the future is unknown and unforeseen events are always happening.

Is there anything in common between World War II, the 2007-2009 financial crisis and the Covid-19 pandemic?

These were events that marked our society and the future of humanity and had a major impact on the financial markets and, therefore, on the portfolios of all investors. But there is still another factor in common: they were surprising events that basically no one could predict. It is what Nassim Taleb calls the Black Swan. So, it is best not to waste time trying to predict the next crisis and invest instead.

In the last 22 years we had the dot-com technological crisis at the turn of the century, then the great financial crisis between 2007-2009, followed by the European sovereign debt crisis, the shock caused by the pandemic and now the polycrisis with several conflicting macroeconomic and geopolitical factors.

Even so, from the investor's perspective, it was much better to have bought stocks than any other alternative financial asset, such as bonds, for example. In fact, in the long run, stocks tend to perform better than alternatives.

But if it's dangerous to be out of the stock market, it's just as dangerous and extremely difficult to try to guess the points at which stocks will do worse than the alternatives, that is, market timing.

These facts should not discourage investors from investing in stocks, on the contrary. However, they should make investors who think to buy shares at times like the present think, in an opportunistic and speculative attitude (short term), in the hope that the bear market has already ended and trying to guess what the market (other investors) is think or do. What traders call a bear market rally, a false start in the recovery and which is very natural in times of crisis, can turn into a huge loss.

Source: FRED, St. Louis FED

It is reasonable to assume that in the long term the market will continue to pay well for the rigor and discipline in the investment process. This discipline can be seen in concepts such as invest and hold (buy and hold), follow the course or even the dollar cost averaging, a strategy that allows you to periodically reinforce the investment portfolio based on systematic savings. This strategy will not maximize returns, but it will prevent us from making successive mistakes based on emotional and hasty transactions.

Not knowing which way the market is going today cannot be an investment decision factor when the focus is on a long-term plan. But the simple decision to have an investment plan requires high emotional and cognitive control. Psychological and behavioral factors such as calm, self-control and confidence can prove to be critical success factors in a long-term investment plan, especially in a context of crisis and in the midst of a bear market.

On the other hand, it should be remembered that equity markets are not the economy. In a bear market it is common to see the economy still accelerating and in apparent good health. This temporal imbalance also influences decision making. Markets are a leading indicator of the economy in the future.

The average investor is a bad investor

As I mentioned above, bear markets are great opportunities, but they are also moments that cause great losses for the average investor, namely when you get into the madness of trying to guess the psychology of the market and not the market value. Speculation and market timing are especially prominent in bear markets and cause great losses to investors who try to chase returns and fall into the lure entering the negative spiral of the buy high and sell low strategy.

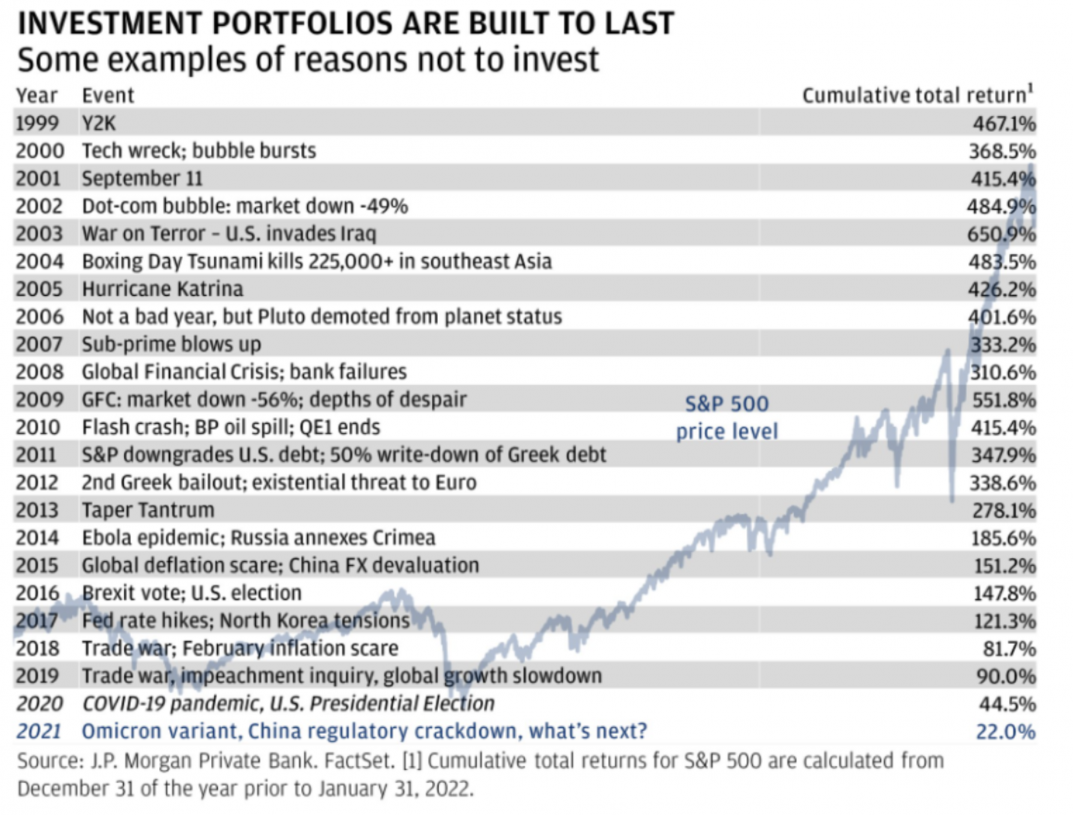

The following chart is a portrait of the evolution of the S&P500 index after the occurrence of unexpected events over the last 22 years. The analysis starts December 31, 1999, or waiting for Y2K (year 2000), until January 31, 2022, before Russia invades Ukraine.

To see the dimension of these errors, look at the performance of investment funds. In a December 2020 article, A Short History of Chasing The Best Performing Funds, Ben Carlson exemplified investors' tendency to pursue returns rather than their goals. One example is the Fidelity Magellan Fund, managed by the legendary Peter Lynch. Lynch managed the fund between the late 1970s and 1991, achieving an annual return of approximately 30%.

However, as Carlson points out, most investors received a return well below the gains generated by the fund. “The average fund investor is said to have earned only 7% a year, far less than the fund’s own returns or the market in general, because investors rushed to subscribe to the fund when it performed well and redeemed the fund whenever he underperformed.”

This is the profile of the average investor – earnings consistently below market. The average investor can be defined as a person who tries to market timing based on emotional influence. By allowing your emotions to interfere with decision making, selling and buying investments tends to follow what most people are doing (herd effect).

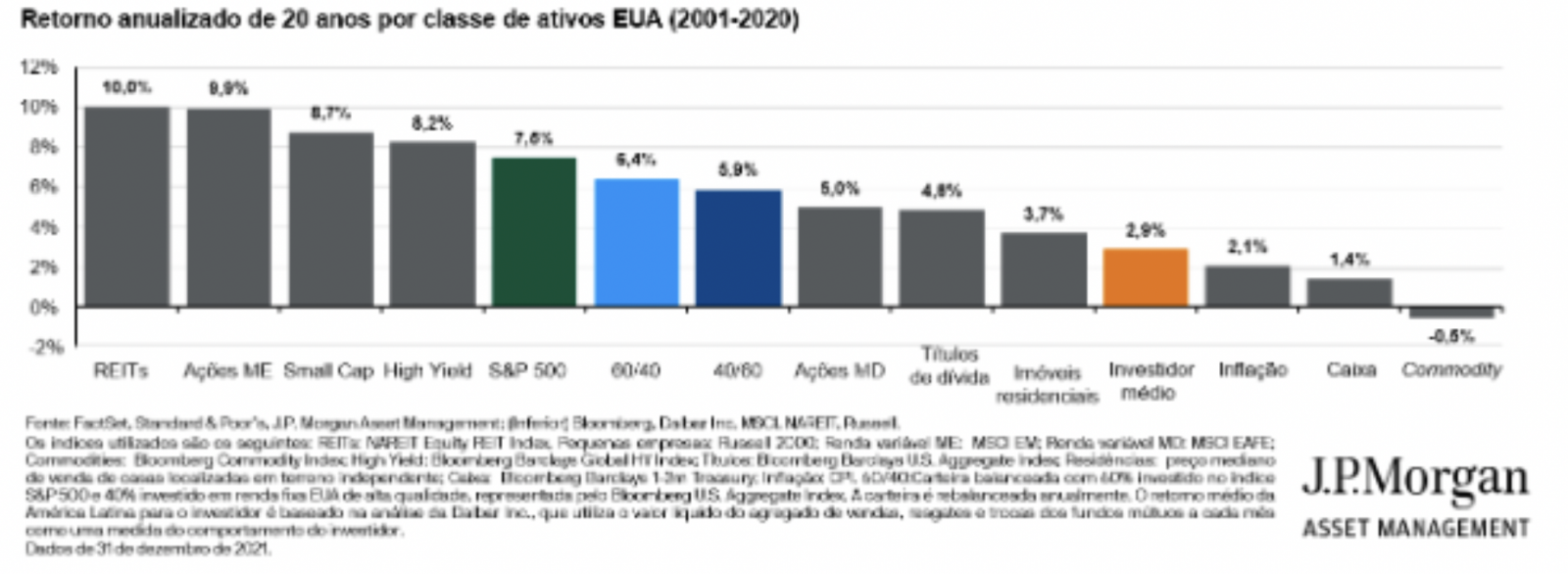

Como se pode ver na análise do JP Morgan com base no trabalho quantitativo da Dalbar, o investidor médio obteve uma rentabilidade muito abaixo, por exemplo, da carteira 60/40. A diferença de 3,5 pontos percentuais é o custo anual e doloroso do investimento emocional.

From FOMO to FUD

Markets are lavish with acronyms and labels. They often accompany long periods of investment and relate the mood of investors under certain conditions. Therefore, in this bear market, the FUD has emerged in opposition to the FOMO or TINA that has been rampant in recent years.

- FUD stands for the propagation of “Fear, Uncertainty, and Doubt” (fear, uncertainty and doubt) through mass media and social networks.

- FOMO stands for “Fear of Missing Out” or the fear of missing out on an investment opportunity. The feeling that everyone is seizing the opportunity but me.

- TINA stands for “There Is No Alternative” or there is no alternative. We were living through a period of very low or even negative real interest rates, so stocks would be the only alternatives for the future, causing, in a way, FOMO.

Conclusion: fear hinders the investment decision. Every crisis is different and there is always something that has never happened before.

The current crisis has several explanations. I will not dissect them, but only contextualize in a purely investment evaluation analysis.

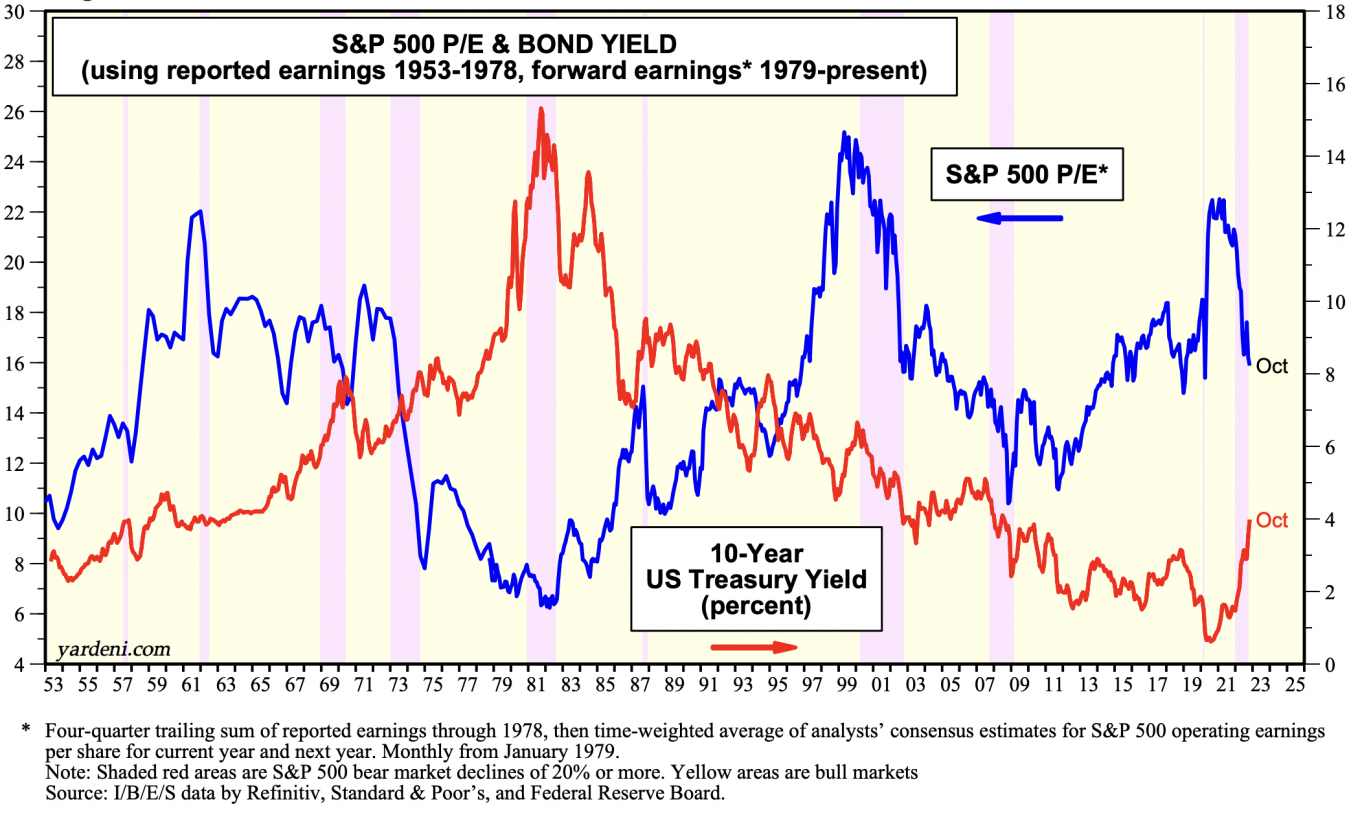

The shock caused by rising interest rates increased the cost of capital for companies and increased the attractiveness of sovereign bonds when compared to equities. Investors no longer want to pay the same price for the same results, causing the price to earnings ratio (P/E) to shrink. The relationship between 10-year US bond interest rates and the P/E ratio, based on expected results for the coming year, reveals the inverse relationship between these two indicators:

Source: Yardeni Research, Inc., November 23, 2022.

One of the biggest interest rate shocks in the modern era can mean a profound change in the expected returns of various asset classes, but it cannot change investor attitude. The portfolio must be adapted to the investor's profile, investment objectives, time horizon, liquidity and other preferences and restrictions associated with each investor. These are the variables that we can control. These shocks and these surprises of new events that are always happening are uncontrollable.

If we can see lessons in history for better investing, it is that it is dangerous to be out of the markets. It is reasonable to assume that in the long term, markets will live up to expectations and deliver the profitability necessary to achieve our investment objectives. Even in a bear market scenario.

So don't worry. Keep investing.

As a friend put it in a recent conversation, the mantra is this:

“To be master of our destiny, to live within our means and to invest our money in a reproductive way”.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.