Investor and Speculator: definition and differences

Investor and speculator: the difference between these two types of agents operating in the financial market lies in the objective that each of them operates. We will try to demystify.

In our daily lives as investors and market participants, we use the term investment across the board. The same goes for the term bet: “I made an investment in ETF X” or “I bet on bond Y”.

This confusion is not merely semantic. It reflects well the difficulty of separating where investment begins or where speculation ends. For example, it is possible for two people to classify differently the same purchase movement of a certain asset. For one it was an investment, for the other it was a gamble.

We can also consider the hypothesis in which the distinction between Investor and speculator would be in the asset or instrument acquired. For example, if we were to buy a share, we would be placing a bet on that security, but if we were to subscribe to a PPR, it would already be an investment.

In fiscal terms, it is common to hear the expression "capital gains from investments considered 'speculative', more specifically securities up to one year". Here, it seems that the existence of two types of investments, speculative and non-speculative, is considered. based on the investment time horizon - in this case one year. Is it time that dictates whether an investment is speculative or not?

The underlying logic may even make some sense, as an investment is usually made for the long term and, by convention, the long term is certainly longer than one year. However, there is a situation of having to put up with a given investment for more than a year for tax reasons, even if it no longer makes sense in the portfolio due to changes, for example, in the investment policy or because of the expectations of results of invested assets were negatively changed. In this case, the investor is penalized fiscally, who continues to have a long-term vision, but had to rebalance the portfolio within a period of less than one year. Moreover, the private investor is penalized as opposed to the professional or business investor.

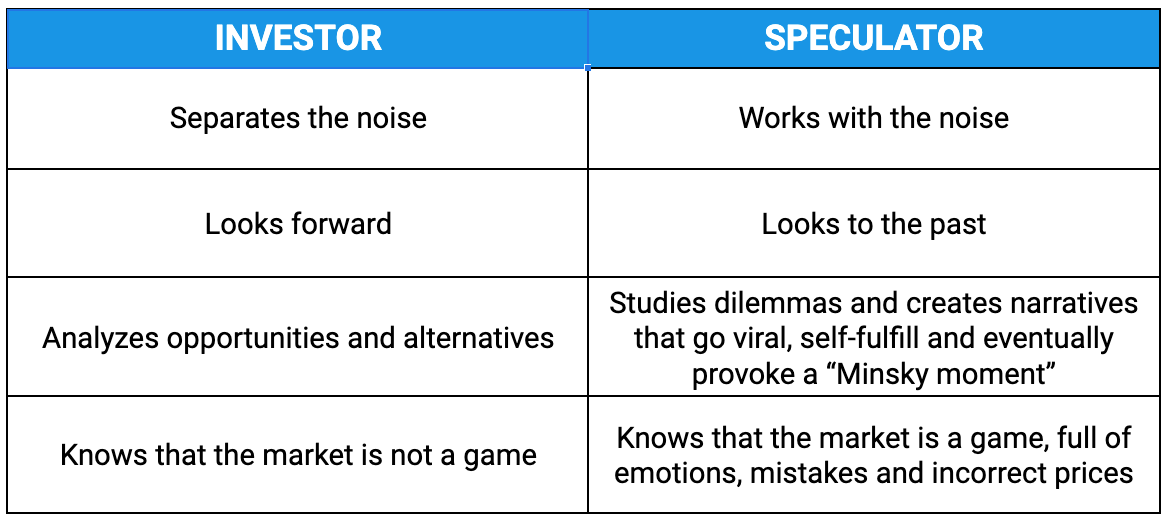

So how can we distinguish between investor and speculator, between investment and speculation?

The task seems easy, but, as we've seen, as soon as we start to do it we understand that it's not and we discover more and more nuances and special situations. Using the organization and structure of the financial markets, we find several market participants: speculators, arbitrageurs, investors, activists, brokers, dealers, advisors, managers, custodians, depositaries, among others.

Keeping our focus on the distinction between speculation and investment, let's take John Bogle's seminal book, The Clash of the Cultures: Investment vs. Speculation, where the founder of Vanguard reflects how speculation has become dominant in the financial world. Bogle argues that, in the minds of most individuals, investment and speculation are now indistinguishable. What we mentioned above is confirmed. The terms are confused and it cannot be said that this confusion has benefited so-called retail investors (individuals or individuals). In Bogle's opinion, investment means long-term ownership, while speculation is more of a short-term trade.

Thus, we can refer that speculators are traders who speculate on the direction of the future price of an asset with the intention of making a profit. It is also correct to say that speculation is more visible in certain markets, such as the commodity market.

John Maynard Keynes also joined the discussion. In his book The General Theory of Employment, Interest, and Money (1936), Keynes decides to attribute the term speculation to the forecasting activity of market psychology, and the term enterprise (a word he used for investment) to the activity of forecasting income. future asset throughout your life.

Perhaps the term speculator is connoted with a less serious and rigorous message, but the truth is that the discovery of the price and value of a certain asset is more correct when this asset is regularly traded in the market and incorporates all available information.

Both the speculator and the investor bring their knowledge and analysis capacity to form together the price of an asset and the expectation of its appreciation. A clash of ideas, a clash of cultures. However, there can be no more incentives for one or the other. Each of the participants, freely and independently, must be able to build and execute their investment strategy.

In this clash of ideas and cultures we have on one side, as we have already mentioned, John Bogle, but also Benjamin Graham, the intelligent investor. Graham accepts the need for speculation, which is human nature. But he distinguishes between good and bad speculation, considering that there is also intelligent speculation. On the other we have, for example, Jesse Livermore, one of the greatest Wall street speculators ever, immortalized in the writing of Edwin Lefèvre and the classic Reminiscenses of a Stock Operator.

For smart speculator Livermore, according to Lefèvre in one of the last paragraphs of the book, no one can consistently beat the market:

No matter how experienced a trader is, the possibility of making wrong decisions is always present because speculation is not 100% safe.

We can counter that the investment, even in the long term, is not 100% safe either. However, in this case, the important thing is not to beat the market. The important thing is to try to achieve the objectives according to individual preferences and restrictions, taking the market as a means and not an end and maintaining a safety margin.

The truth is that it is from the interactions and transactions of millions of market participants that we obtain asset prices which, in most cases, well mirror the real value of that asset. The wills, emotions, algorithms, reasons of speculators and investors enable the existence of an organized market for the transfer of resources between those seeking financing and those investing, even in the case of being a speculator.

As Advisors, we believe the market is more often right than wrong. Investors and speculators are pieces of a complex puzzle that, together, allow us to define our strategy and follow through on the defined financial plan.

It is up to each of the market participants to use the technological, qualitative and quantitative tools available to analyze the portfolio and the market in a rigorous and impartial manner and then decide how we are going to execute the strategy necessary to achieve our investment and return objectives and risk.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.