In the bank, money does not yield anything.

When reading this article by FundsPeople - tell your customers: a bank deposit doesn't solve the problem, it makes it worse - I was reminded of the phrase I hear so often: "In the bank, money doesn't earn anything". The phrase is referred to by different people from different corners of society. This means that this idea is relatively well-established in society.

The truth is that the phrases denote an obvious contradiction: if the money in the bank does not earn anything, why are there around 175 billion euros parked in banks, according to July data from the Bank of Portugal?

To answer this question, we will address in this article:

- The problem with bank deposits

- Alternatives to bank deposits

- More recent studies on financial literacy in Portugal

The problem that time deposits compound

The problem is not having money or having money in the bank. The problem is having the money stopped, financing the institution to which we lend the money for free and leaving it to be confiscated by inflation in a slow, invisible, but definitive way.

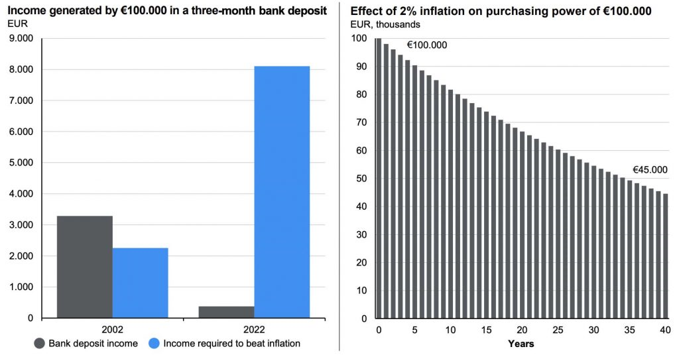

The following graph exemplifies the loss of purchasing power of a portfolio of €100,000 fully invested in bank deposits in a context of inflation at a rate of 2%:

Source: FundsPeople, JPMorgan

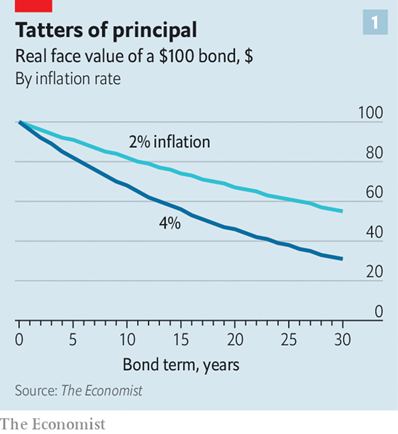

The Economist also recently exemplified the destructive power of inflation on a $100 bond in the case of 2% or 4% inflation:

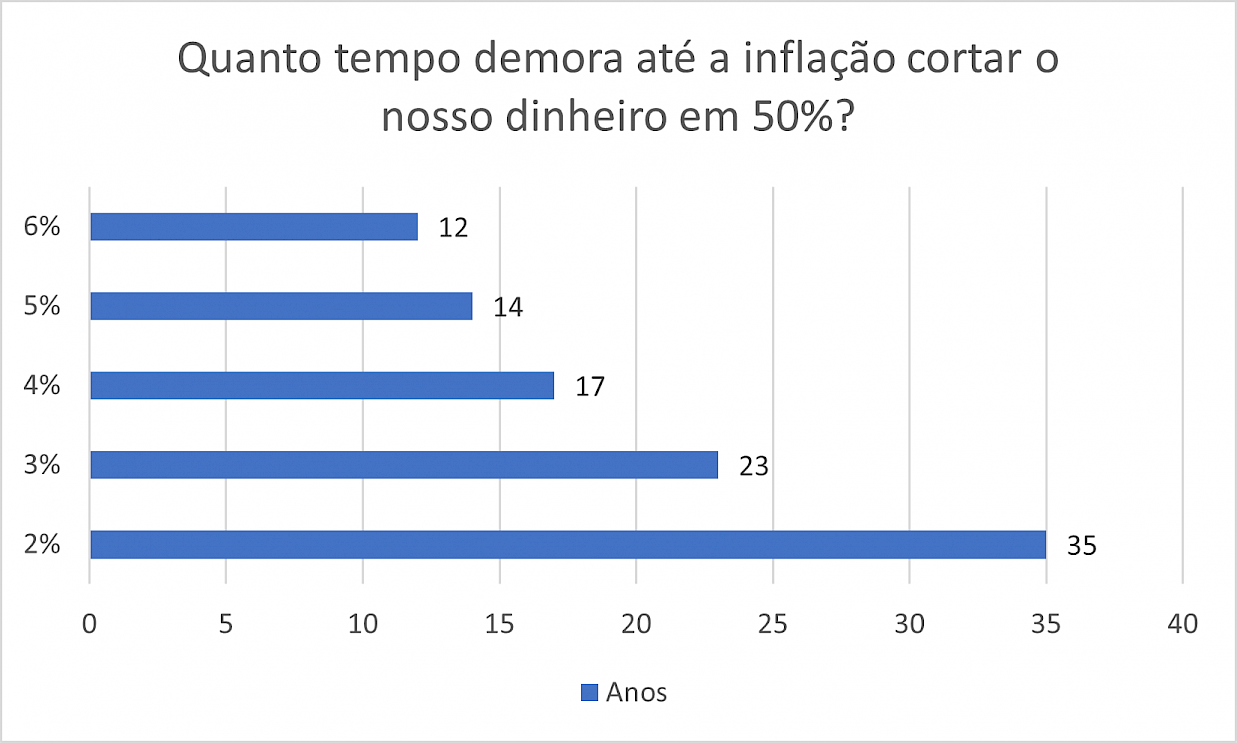

Another example of the ruthlessness of inflation can be seen in the following graph, which answers the question: How long does it take for inflation to cut the value of our money in half?

If the inflation rate is 2% we lose half of our purchasing power in 35 years, but if the inflation rate is 4% it only takes 17 years.

Source: Future Proof

“Money in the bank means nothing”

When they present me with this outburst, I take the opportunity to agree with the interlocutor, and then ask what the alternative is. In this case, there are basically two answers: savings and real estate certificates.

They couldn't be more different. While certificates belong to the same category as time deposits, real estate is an asset class that cannot be classified as low risk due to its nature and types of investment.

It is also common, in certain contexts, for investors to invest their savings in their own businesses. This trend shows an important belief in their management and business development capabilities but has the disadvantage of enhancing the concentration of assets. It is not uncommon for a large part of the assets to be concentrated in real estate assets (self house, for example) and the ownership of a company.

Out of the answers are, almost always, the financial assets. What is the reason?

The various studies on financial literacy in Portugal certainly help to answer this question, but so do the successive crises and financial problems of various listed companies, undermining confidence and willingness to invest in instruments such as shares or bonds.

So suddenly we are already talking about basic options for a well-diversified portfolio oriented towards the investor's objectives: deposits and certificates, bonds, stocks, real estate and own businesses.

Deposits and certificates can be associated with investment in an emergency fund that needs immediate or almost immediate liquidity.

The remaining financial assets, namely direct shares and bonds or in the form of investment funds, PPR or ETF, are intended for the market risk portfolio. A portfolio that tends to meet long-term objectives and whose allocation must be defined taking into account the investor's profile, preferences, restrictions and investment objectives, return and risk.

Own business can be framed in what is called an aspirational portfolio. A portfolio that involves greater risk, but could also mean the achievement of non-essential objectives.

Returning to alternatives to cash in the bank, I would like to highlight the importance of the different financial instruments available in the market through investment companies, from banks, brokers, and asset management companies, among others. In fact, the role of banks in the investor's life is underlined here: they are important as intermediaries, that is, as business facilitators through the platforms they provide.

Therefore, when choosing a bank to park your money, also check the different investment possibilities it offers. If this is not the most suitable, make use of your power of choice and transfer the money to institutions that are more “friendly” to the investor. In this selection process, some questions are important:

- Do they have ETFs and mutual funds from different investment houses on offer?

- Is it possible to trade bonds and treasury bills and corporate bonds?

- What is the price associated with the different transactions, custody and transfers?

Of course, we must also analyze and compare the different platforms, the way of custody and liquidation of the assets, if it is an investment company duly recognized and regulated, but this due diligence, I would say that it is common to all investments whether they are financial assets or assets real.

Financial assets vs real assets

This distinction between financial assets and real assets has also been in the minds of some investors, namely, due to the preference they express for real assets. These assets are usually associated with raw materials, precious metals, land and other real estate, equipment, natural resources or art. They are considered physical goods with a visible value taking into account their unique characteristics.

Financial assets are assets that represent a right over a certain underlying asset, which can even be a real asset or an intangible asset (patents, copyrights, brands or intellectual property).

In reality, the shares of a company, for example, are a right over the results and tangible and intangible assets of that company.

Digital Financial Literacy in Portugal

After years with low or negative interest rates, we are even more asleep and in the hands of financial institutions that do nothing to better manage their customers' savings. Should we shrug our shoulders and demand more taxes for the industry or should we do our job and look for alternatives?

On this question, I leave a recent OECD study on financial literacy in Portugal and an article by FundsPeoplo: digital financial literacy in Portugal and Portugal lags behind the European average in financial literacy questions.

The study explained in the FundsPeople article, sheds light on topics such as:

- financial knowledge

- financial advice

- retirement

We compare badly with Europe on issues such as inflation and compound interest, we trust financial advice less than the European average and we don't know if we will have enough money for retirement.

In the case of financial advice, it is good to remember that banks rarely provide this service independently. There are institutions and professionals who do this and the added value of this service should well compensate for its cost.

There is no way around the issue: we are doing our homework badly and we are becoming more dependent and in the hands of financial institutions and the state itself. To be more confident investing, we need more knowledge and a personalized plan. In this way, we will make better decisions about investment and obtain better results, because, I agree with you: in the band, the money “stuck” in deposits does not yield anything.

WE WANT TO HELP YOU BECOME A BETTER INVESTOR:

We help you develop your Investment Policy Statement

We develop individual or group training on investments and savings, with the Future Proof Academy

We quantitatively analyze your current portfolio with Future Analyzer technology and computational finance

Request more information about the investment advisory service provided by Banco Invest.

Other articles that can help you on your path to the investor journey:

Savings certificates and time deposits,

Is real estate investment worth it?

What to know to invest in mutual funds

How to invest in ETFs?

All about retirement savings plans

Money lost and money lost

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.