How to invest in ETFs?

Increasingly common in the investment portfolio, ETFs are a success story in the financial industry and a symbol of innovation and diversity in recent decades.

ETF is an acronym for the English designation of “Exchange traded fund”. In a free translation, they are funds quoted on a stock exchange, that is, an ETF is a set of securities that are traded on the stock exchange just like the shares.

ETFs are a type of financial product with the objective of tracking the performance of a benchmark index, composed of assets as different as stocks, bonds, commodities, exchange rates or a combination of different types of investment. They can also be assembled to follow a specific strategy, trend, industry, sector or region, always based on a benchmark.

ETFs can trade at a discount or a premium against the NAV (net asset value). This situation is related to market liquidity and the authorized participant's ability to manage the creation and redemptions of ETF units at a value as close as possible to the market value of the ETF assets (NAV).

An authorized participant is an entity that has the right to create and redeem shares of an ETF. It is a very important entity in the liquidity of an ETF, that is, in its ability to be traded by investors in a fluid and secure manner in a market.

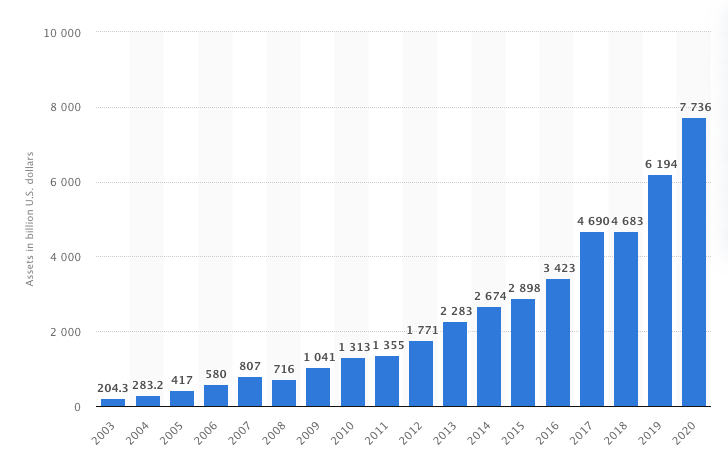

This importance is even more noticeable when we verify that in recent years the money invested in ETFs has grown significantly. According to Statista, in 2020, assets managed through ETFs reached 7.7 billion dollars, with 7602 registered ETFs and assets.

The diversity of ETFs available on the market allows investors to build the most suitable strategy for their situation, such as: income distribution, accumulation, speculation, portfolio diversification.

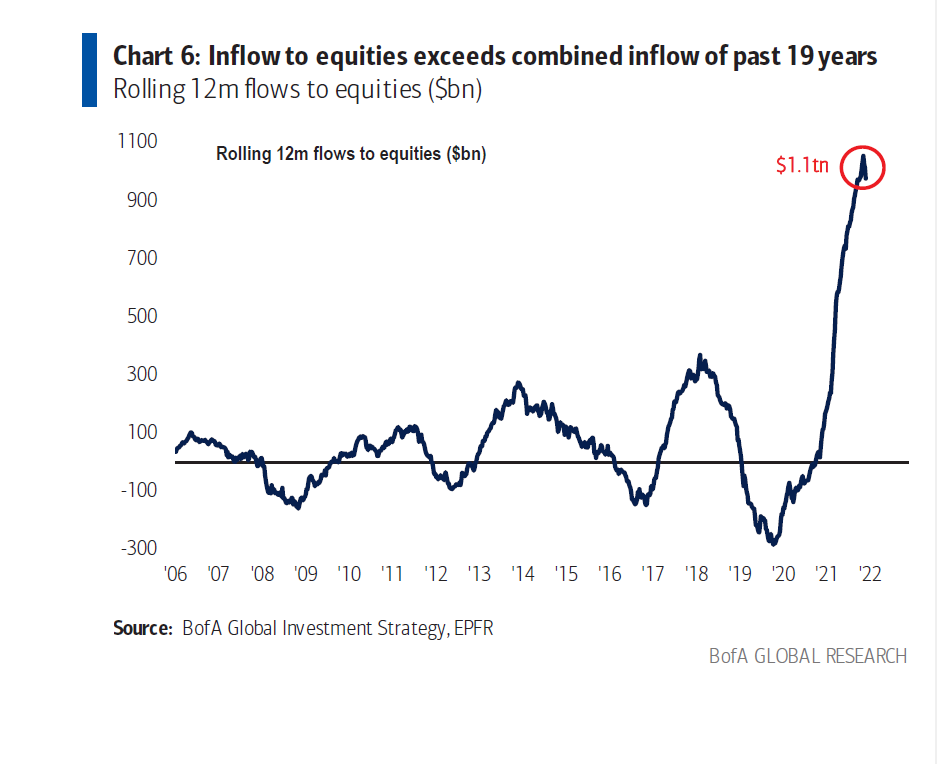

The trend is such that this year, in a report released by the Bank of America (BofA), of the 900 billion dollars invested in equity instruments, 785 billion were invested through ETFs and only the remainder through equity funds. investment.

In fact, the amount invested through ETF and stock investment funds exceeded the amount invested over the last 19 years, as shown in the graph below by BofA.

This colossal influx of cash to the ETF has raised some questions around the market distortion that a concentration of this nature can bring, for example, to the discovery of the price of an asset. In fact, given that ETF's nature is to follow an index, it means that you will have to purchase all the securities that make up that index, without properly analyzing their intrinsic value. This means disruptions both in the asset valuation process and in the companies' management process itself.

ETF Types

ETFs are understood as a non-complex instrument, as we have already mentioned in this article on financial products where to invest money. However, in the different types of existing ETFs, we may have ETFs considered as complex financial products. Therefore, it is useful to distinguish between the various types of ETF that we can find.

ETF typology by asset classes:

- Stock ETF – in this case the objective is to replicate an index of a region, sector, industry, trend, strategy. It comprises a basket of stocks from that index that you intend to replicate;

- Bond ETF – are ETFs used for investors to gain exposure to bonds in a diversified manner and also to obtain periodic income, as this is the objective. ETFs may include obligations of corporations, governments, states and regions;

- Commodity or raw material ETF – here the interest is the replication of a raw material or a basket of raw materials such as agricultural products, metals, gold or oil;

- Exchange rate ETF – these investment vehicles are used to track currency pairs, ie, domestic currency with foreign currencies. However, an ETF for bitcoins has also emerged.

There are some variations to ETFs, such as ETC, ETN or ETP. These variations may contain risks other than the normal ones associated with ETFs, such as recourse to debt and consequent credit risk, but also some advantages. For more information, see this article by Luís Silva on contango, but which explores these various concepts

It is also relevant to note the possibility of terms of physical replication ETF and synthetic replication ETF, through derivative instruments such as swaps or futures.

Physically replicating ETFs actually invest in the asset, whether stocks, bonds or commodities, while synthetics seek to track the performance of the underlying index through derivative instruments. They do not invest directly in bonds.

Synthetic ETFs have the advantage of being cheaper and even more perfect in tracking the index. This is because physical replication ETFs are not always able to invest in securities due, for example, to their poor liquidity.

One last note for physical ETFs that can also borrow securities. It's a way to generate additional income.

Taking into account European investment legislation, we can divide ETFs into:

- Harmonized ETF – funds regulated by European directives and designated as “ETF UCITS”;

- Non-harmonised ETF – non-regulated funds.

Regarding the investment strategy, there has been a great evolution. If in the beginning ETFs were seen as an important arm of passive management, nowadays, actively managed ETFs already represent practically half of the total investment in equity ETFs.

Passive ETFs are typically cheaper than active ETFs. In active ETFs, managers assume a more important role in fund management, leading to the creation of many indices in different sectors, industries and strategies, increasing the ETF offer.

Also related to investment strategy we can find index ETF and dividend ETF. ETF indices serve the strategy of investing in a market index, enabling the investor to take long or short positions from very low investments (from an ETF share).

Still regarding the strategy, we can have leveraged ETFs and inverse ETFs.

Leveraged ETFs allow an investor to gain exposure to an index on a leveraged basis. For example, getting double exposure to the S&P500 index means being exposed to double the changes in the index, maximizing gains as well as losses. Ultimately, in theoretical terms, if the index drops 50%, the investor would lose all the invested capital.

In relation to inverse ETFs (also known as inverse or short ETFs), the investor gains from the fall of the underlying assets or indices. This inverse exposure is possible through the use of financial derivatives and/or securities lending contracts.

In addition to taking a short position, it is also possible to leverage this position through leveraged inverse ETFs.

Riscos associados aos ETF

Like any investment, there are risks associated with investing in an ETF. Risks end up being transversal to all financial investments, but there are also some specific ones related to ETF. We highlight the following risks:

- Market risk – related to the price of securities underlying the ETF, subject to volatility and favorable or unfavorable market conditions;

- Liquidity risk – in situations of low liquidity in the market, the investor may have to sell the ETF at a price lower than the real value of the assets that make up the ETF;

- Capital risk – there is no capital guarantee on investment in ETFs. Investor is subject to asset price fluctuations, in addition to the costs associated with ETF transactions;

- Interest rate risk – risk related to monetary and fiscal policy. Interest rate movements can have an adverse impact on the price of the ETF. This risk is particularly felt in bond ETFs and ETNs;

- Credit risk – this is the risk of default of the underlying assets of the ETF or the parties related to the ETF. For example, the case of bond ETFs and ETNs;

- Exchange risk – exchange variations can be adverse for the investor. These variations can be felt in the underlying assets, but also in the fund's own currency. There are ETFs with exchange protection, but these bear an added cost for this protection;

- Counterparty risk – for example in the case of ETFs investing through derivative contracts such as swaps;

- Operational or trading risk – this risk is associated with human or technological errors or fraud in the transaction and settlement process for the purchase and sale of ETFs.

A risk especially associated with the ETF is the risk that the ETF does not better track the underlying index, the risk of indexing deviation or tracking error. Even in actively managed ETFs, the investor's expectation is that this error/deviation will be reduced.

The market impact of the increasing investment in ETFs remains to be clarified. The truth is that it is easier to invest and disinvest in the market using ETF. This means that large amounts of money can be invested and disinvested from the market quickly, which can lead to disruptions and significant variations.

On the other hand, we see that in the March 2020 pandemic crisis, ETFs played an important role in determining the price of bonds, at a time of weak liquidity and great anxiety and fear in the market.

Main advantages and disadvantages of ETFs

Some of the main advantages of ETFs are:

- Liquidity and flexibility in the transaction, with intraday trading;

- Possibility of implementing different strategies, according to objectives and preferences;

- Since the objective is to follow a market index, the ETF usually presents a very low level of deviation (tracking error) compared to the respective index, that is, the returns and risk are aligned with the index, showing a normally very high correlation;

- Instruments on average cheaper than mutual funds and even cheaper than buying a certain set of shares from different companies;

- Diversity of ETF offer, in different assets, sectors, regions and trends, which makes it possible to manage risk through diversification.

As for the disadvantages, we can mention:

- The impossibility of redeeming ETF shares. The investor has to resort to a financial intermediary and use the secondary market to buy or sell the bonds;

- Actively managed ETFs have higher management costs;

- Liquidity difficulties in some markets;

- Some of the benchmarks and indices are created to be replicated by ETFs, often focused on a single industry, sector or trend, limiting the effects of diversification.

To invest in ETFs, in addition to the importance of defining your investment policy and financial plan, it is necessary to open an account with a financial intermediary that offers trading in this type of instrument. Look for an intermediary with a wide offer, in an open architecture, check and compare transaction costs and trading conditions and order execution policy.

Future Proof, through the partnership of an agent linked to Banco Invest, offers a very significant set of ETFs from several investment houses, in a safe trading environment and with costs in line with the market.

ETFs are an attractive form of investment, both in the short and long term. It all depends on the investment strategy, profile and objectives.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.