Diversification: from Traditional Portfolio to Modified Portfolio

After analyzing the main mistakes and biases that we show as investors, let's try to answer two questions:

- What mechanisms are in place to overcome these errors or biases or at least mitigate their effects?

- How should we build the investment portfolio taking into account these identified errors and biases?

Mechanisms to tackle or mitigate the most common errors and biases

The answer to the first question seems simple, but it is not easy to do. We must be aware that these errors and biases exist and then recognize and identify the most common ones in our investment process.

This path involves reading and studying to continuously improve our financial literacy. Education plays an essential role in making investment decisions.

It also involves consulting different sources of information and doing your homework. And we can and must have help in the decision-making process. Namely in strategic asset allocation, cost-effective implementation, rebalancing and location of assets and behavioral coaching, as explained in this article about the role of the advisor.

However, the last decision must be ours. Let's look at the doctor-patient relationship. Medical activity has evolved a lot in this regard. If a century ago the physician had full discretion over what decisions to take to improve his patient's health, today it is not like that. The patient must have access to all available options and then make the best decision. Ultimately, it is up to the patient to make the decision.

Most errors and biases can be moderated or mitigated, some can be eliminated. In the case of cognitive errors, it is easier to moderate or eliminate through, for example, education. In the case of prejudices and emotional biases, the solution is often to adapt to the diagnosis.

The construction of the optimal portfolio

There are a number of situations that we must take into account when building our investment portfolio: risk tolerance, the goals we intend to achieve, our preferences and restrictions, our psychological and situational profile and expectations for the future.

The next step is to build a portfolio that meets all these characteristics and collected information.

Traditional Finance considers the investor to be rational and risk-averse. It analyzes the assets in an integrated manner and it is considered that the market incorporates all available and relevant information and, therefore, it is an efficient market. In a portfolio built on these assumptions, only the expected return and the variance of returns matter. The covariance between assets serves to determine the portfolio variance and build a diversified and optimized portfolio in terms of risk-return.

Rather, Behavioral Finance is based on psychology, trying to understand and explain the real investor and market behaviors rather than the ideal investor. The investor is seen as non-rational, averse to loss and as analyzing assets in a segregated manner. The portfolio is built layer by layer, where each layer or level is associated with a goal and is composed of securities or instruments that correspond to that goal or objective. In this case the covariance is not taken into account. Investors see each tier as having a separate level of risk and ignore asset correlations in the different tiers.

Behavioral factors

That said, I think it is unanimous to accept that behavioral factors affect the construction of the portfolio. The portfolios obtained by traditional theory are quite different from real portfolios.

What are these factors and how do they manifest?

- One of the factors is Inertia, and it is consistent with the Status Quo bias: investors tend not to change asset allocation over time, although risk tolerance and personal circumstances change. To combat this factor, there are portfolios that automatically change the allocation to riskier assets to more conservative assets as the investor approaches the retirement date.

- Naive diversification (1/n) is also common in portfolios: dividing our assets between several assets may not mean a good diversification. If assets are correlated, for example, more assets does not mean better diversification.

- The tendency to invest in the most familiar title or instrument is another factor to be taken into account in the construction of the portfolio. Familiarity is related to overconfidence and underestimation of risk. We tend to naively extrapolate only good returns (representation error).

These factors inevitably lead to excessive transactions, causing, among others, expenses in commissions and unnecessary taxes, in addition to emotional exhaustion.

- Related to this factor is also the habit of investing in the company where we work because, supposedly, we are able to control better or have more knowledge. There's a kind of underlying loyalty effect.

- Tax or financial incentives can also mean bad allocations: e may be tempted to invest in a stock because there is a discount to market price or a tax benefit after we hold the security for some time.

Diversification also means deciding between different dimensions. Portfolios can be diversified across different geographies/regions or asset classes. Prejudice related to the country or region of residence refers to these dimensions. Studies demonstrate (French and Poterba 1991; Kang and Stulz 1997) that portfolios are highly concentrated in the country or region of residence (home bias). The explanation for this behavior lies in biases such as confirmation, illusion of control, possession or endowment effect and status quo.

The portfolio modified by behavioral factors

Taking into account all of the above elements, from the individual profile, through the goals and preferences, expectations, behavioral factors, wealth level and lifestyle, we can formulate a structure to find our portfolio. A kind of guide for the modified portfolio, which starts from the traditional and behavioral portfolios, and results in an optimized and customized portfolio for an investor.

Answering the following questions impacts investment decisions and helps to develop a portfolio adjusted to behavioral factors:

- What are the biases and errors that we highlight the most?

- Which type predominates (emotional or cognitive)?

- Do these biases influence portfolio construction and decision making?

There are several approaches to incorporating behavioral factors. One is goal-based investing, which is consistent with our natural loss aversion (according to Kahneman & Tversky's Prospect Theory), and involves determining the investor's various goals and objectives, as well as the risk tolerance associated with each goal. The portfolio is built based on each goal, that is, in layers and not in an integrated way.

The way we set goals:

- We have multiple goals,

- We define multiple investment time horizons according to each goal,

- The most important measure of risk is the probability of failing the defined and bottom-up target.

- The fiscal component is important as it is always present.

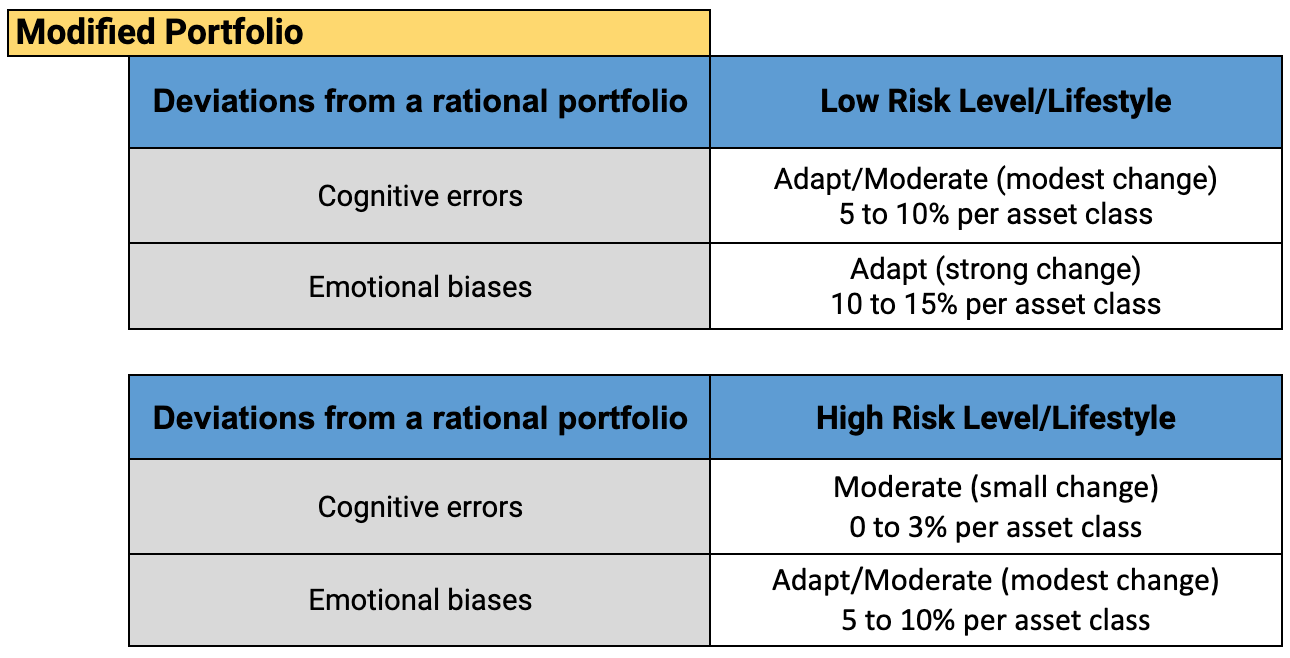

Another possible approach is the construction of a portfolio based on behavioral factors, namely distinguishing emotional from cognitive, and the investor's wealth level. The focus is on adapting the portfolio to the biases detected or moderating their impact on the portfolio.

The table above is just a suggestion. It will have to be adapted to each specific situation. But it mirrors the rationale and generic guidelines for building a portfolio modified by behavioral factors, errors and biases, and more personalized to our goals and preferences. It assumes that the investment decision will be related to the current and future standard of living, the level of wealth and the main errors and behavioral biases.

We will hardly have a rational portfolio. We are not machines and we have innate behaviors. But we can and should build a portfolio more adapted to the behavioral profile or moderate our mistakes and biases for an investment plan that is ours and not the result of generic tips or suggestions.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.