Banking crisis: smoke signals, is there a fire?

Central banks have been playing from several angles: they continue to raise interest rates and inject money into banks with liquidity problems. The situation is not at all easy. We are facing a new banking crisis, this time caused by the rapid rise in interest rates and not, in principle, by bad credit and property speculation as happened in 2008.

Contagion and loss of confidence are the consequence of this instability which, ultimately, can trigger a debt crisis, as you so well described by Ray Dalio in this reflection.

In a few days, 3 US regional banks collapsed and Credit Suisse was swallowed up by UBS in an agreement with heavy consequences for shareholders and bondholders and, possibly, for the entire financial system.

This contagion can appear, generically, in two ways and may even be related:

- contagion of a technical and operational nature, as in the case of the 2008 crisis and consequent bankruptcy of Lehman Brothers;

- Reputation and trust contagion, based on liquidity problems that feed on themselves and configure a “run on the banks” to raise money.

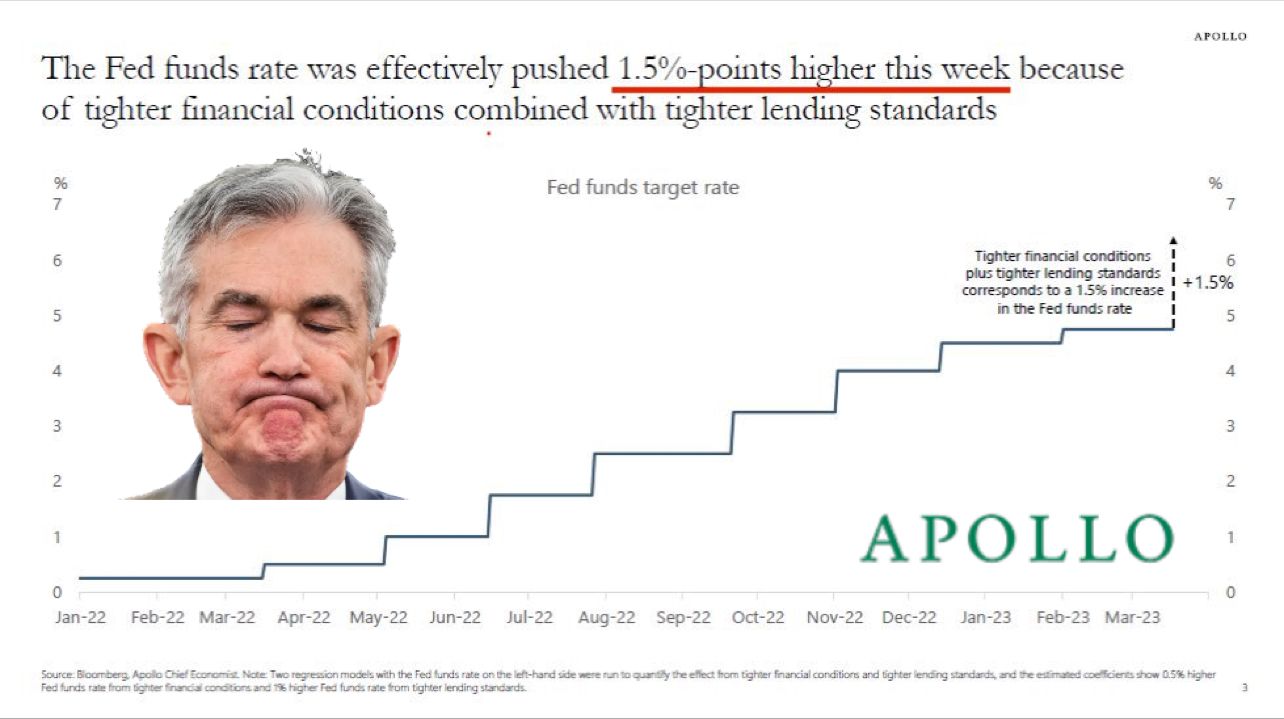

In my opinion, this situation will help central banks to control inflation because it reinforces the feeling of restriction and tightness in economic conditions: banks lending less, increasing difficulty in financing companies, increase in bankruptcies, unemployment growth, less consumption and a fully installed economic crisis.

This graph from Private Equity Apollo Gobal Management shared by Eddie Donmez and in the words of its chief economist Torsten Slok, indicates that “the recent turmoil in the banking sector is already tightening financial conditions and corresponds to an increase of 1.5 percentage points at the Fed's target interest rate.

Soon, central banks will be able to start lowering interest rates and, in principle, a new economic cycle will begin. It sounds simple, but it's not. And it's not linear.

The markets, as always, are reacting emotionally, erratically and trying to anticipate what might happen to the economy and companies in the near future. On the one hand, waiting for the central banks to reverse the cycle of rising interest rates and, on the other hand, waiting for companies to have less profits due to the deterioration of economic conditions. Deep down, the world seems to be waking up to the impact of:

- a disproportionate monetary policy aimed at creating liquidity for more than a decade, with a special focus on the COVID years;

- to the rapid rise in interest rates with consequences that are only now beginning to be felt.

Thus, we see an increasing refuge in the short-term debt of governments with high ratings in return for the exit of companies (debt and shares), mainly the most indebted ones with weaker results and more subject to the impact of this phase of the economic cycle ( recession).

This time we are not talking much about the geopolitical situation, but reality also comes through here. The Russia-China summit and the incident in the Black Sea could mean greater weight for this variable in the evolution of the economy and the financial markets themselves.

Alongside this, we see an overheated economy still from the post-pandemic effects and the various speeds of recovery that created imbalances at the logistical, production and raw material levels, the political and social difficulties of democracies as a result of ideological polarization and growing discredit in institutions, the climate crisis and woke capitalism.

Despite this environment, as long-term investors and with periodic savings as possible to reinforce the portfolio, I believe that we will be in a position to take advantage of this crisis over the next few months. The 3 ingredients we've been talking about seem even more important today: patience (time), savings capacity and optimism. All of them, it seems to us today, are even more difficult to achieve, but it is in these moments that the plan must actually be fulfilled.

Most of the factors that we talk about these days are factors that we cannot control. But from this crisis, at least one important lesson will come out (once again): bank deposits have to be seen as loans and, therefore, we will have to know that we run the risk of the debtor becoming insolvent. And here appear the variables that we can control, namely the way we save and invest. Instead of having 190 billion euros in bank deposits in Portugal being eroded by inflation and serving as (practically) interest-free loans, we can build a diversified portfolio, oriented towards our objectives and risk tolerance, where debt naturally fits from any country that we believe has the highest creditworthiness. It is very important that we define an investment policy to invest in different asset classes such as stocks, bonds, real estate, among others, and also consider debt reduction, should this situation arise.

There is a lot of talk about crisis and recession. There will be a lot of talk about bankruptcy. And there is a lot of talk about central banks as if they were the guardians of the system, a kind of Olympian gods. They are not. They make mistakes, provoke crises, change our lives and, at this moment, they have a well-defined agenda: to fight inflation, even if it means destroying the economy. It is not important to say whether or not we agree with this very restrictive monetary policy, it is important to mention that, more than ever, we will have to pay close attention to our financial plan and our individual capacity to guarantee a better future.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.