An analysis to the carousel of emotions

➤ Chart of the Week da FundsPeople

Although not a core indicator for a long-term allocation strategy, the Fear & Greed Index, instructed and published by CNN Business, can be very useful in certain situations such as reinforcements, portfolio rebalancing, changes in investment policy, or big changes in feeling.

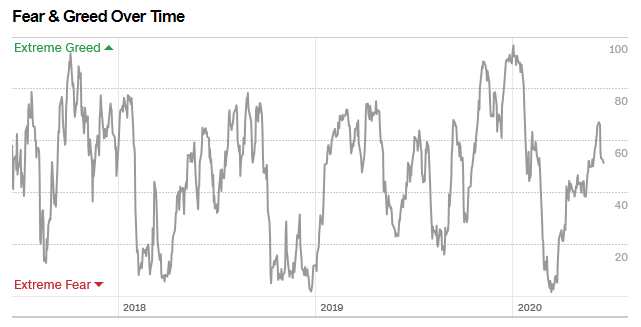

It is still very interesting in an educational logic. Investors are very emotional and usually this indicator serves to contextualize the market moment and to avoid exaggerated optimism or high pessimism.

In addition to forecasting machines, financial markets are machines of emotional intelligence. To dissociate the evolution of an asset from feelings such as fear or trust, from the capacity for motivation or influence, is to deny the essence of human behavior.

This index also very well reflects that old maxim by Warren Buffett:

Be fearful when others are greedy and be greedy when others are fearful.

It is a kind of contrarian view applied to the stock market.

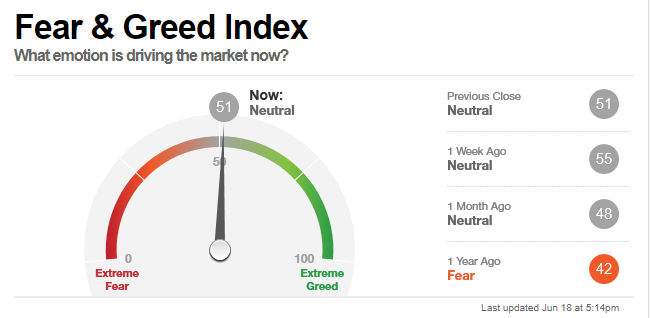

The index is made up of 7 indicators, from momentum to volatility, passing through market strength, the demand for high yield bonds, the put/call ratio, the difference in return between the stock market and the treasury bond market and the trading volume.

Each of these 7 indicators are measured on a scale from 0 to 100, the index being calculated by the weighted average of the indicators' results. A reading of 50 is considered neutral, while a lower value signals more fear than usual and a higher value means a feeling of greater confidence than usual.

At the moment, the index is neutral, reflecting a little the feeling of expectation for some solidification after such volatile months. It may be a good time to reposition the portfolios according to strategic allocation, closing the tactical positions taken after the asymmetric movements of the market in recent months.

By the way, after the incredible recovery of the markets, there have been several warnings that multiples like the P/E are too expanded, with values above the average.

As a mechanism for forecasting and updating expectations, markets seem to be pointing to other factors, perhaps less classical and fundamental, but more erratic and emotional. The current market conditions with very low interest rates and the strong intervention of central banks, together with the return of confidence and hope for a new economy in the future, and possibly find part of the justification for these values.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.