The Economy and Financial Markets

Peter L. Bernstein once wrote that the fundamental law of investment is uncertainty about the future. A kind of “I just know that I don't know”.

However, developing predictions about the future is essential as almost all investment decisions are made based on expectations. In particular, expectations regarding the economy, which derive from and influence expectations regarding the return and risk of the various asset classes, and the factors and events that may affect valuations.

Economics is a social science that theorizes about the behavior of individuals and organizations. We can say that financial markets are an economic discipline that enables individuals, groups and organizations to trade and speculate on the scarce resources that exist and produce in this economy in the future.

Developing the framework of indicators that will constitute our expectations is a fundamental process to define the appropriate and appropriate asset allocation for each investor.

Correlation and Causality

Our nature leads us to gather information and see patterns, justifying our opinion with the information that supports it. A personality trait known as confirmation bias.

For example, flipping the coin. We rationally accept that the events, heads or tails, are independent and that they have the same probability, no matter how many times we throw it. However, we also see these events as sequences, making false mental correlations between random events. We see the past as a harbinger of the future, thinking that next time it's going to be expensive.

We usually make mistakes when we take a certain correlation to be true, but in reality it doesn't exist or is low. A kind of illusion. We are so used to talking about the relationship between certain variables that we do not even question its foundation or its real causality.

In a context of investment decision making, these mistakes can mean not fulfilling the established objective.

The relationship between the Economy and the Financial Market

The relationship between financial markets and economics is one of those intuitions that seems more than what it really is. There is certainly a relationship between economics and financial markets. They are interconnected. But there is one main difference: time.

In this paper from the Credit Suisse Research Institute, the authors, Elroy Dimson, Paul Marsh, and Mike Staunton, write that “investor decision-making tends to anticipate the future circumstances of the economy, and empirical evidence supports this claim. Stock market fluctuations predict changes in GDP, but movements in GDP do not predict stock market returns.”

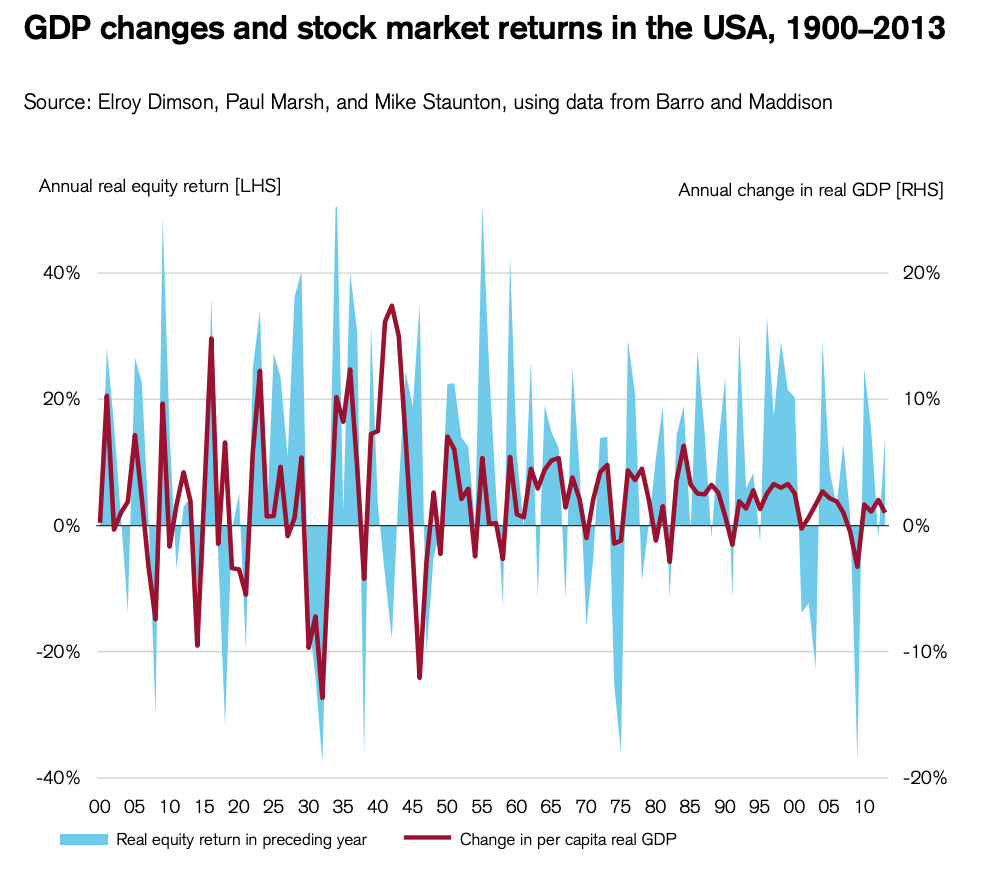

The following chart plots the behavior of annual changes in real GDP per capital alongside real annual returns for the US market in the previous year.

The work already cited, and on the graph above, indicates that “there is a correspondence between the measures analyzed. The correlation between them is 0.46. It appears that favorable economic news tends to accompany the favorable performance of the stocks. However, the time factor in this graph demonstrates that stock market returns in a given year are correlated with improvements in GDP in the following year - not the same year. In fact, the correlation between the real return on US stocks and changes in real GDP per capita in the same year is essentially zero (0.06). That is, there is no correlation.

So it is possible that capital markets are underperforming in the midst of robust economic growth or vice versa. It suffices for the economic prospects to be one of deceleration or weaker growth.

As Damodaran said, financial markets are authentic forecasting machines, which provide us with the current value of a service or product, of a sector or of a region at a given moment. He would add that in addition to forecasting machines, financial markets are emotional intelligence machines. To dissociate the evolution of an index, or a title, from feelings such as fear or trust, from the capacity for motivation or influence, is to miss the essence of human behavior.

Financial markets and, more specifically, capital markets, are one of the leading economic indicators (leading indicators). They are a mechanism for anticipating what might happen in the economy in the future.

The stock market moves faster and in anticipation of the economy's own reaction, which, in the meantime, will pick up and create jobs, but whose growth will only be felt ahead of time.

Of course, there are many other factors that influence the evolution of financial markets, such as fiscal and monetary policy, investor confidence or expected results from companies, but this time difference is important: the market tends to anticipate what economic developments will be. in the future.

Market capitalization and GDP

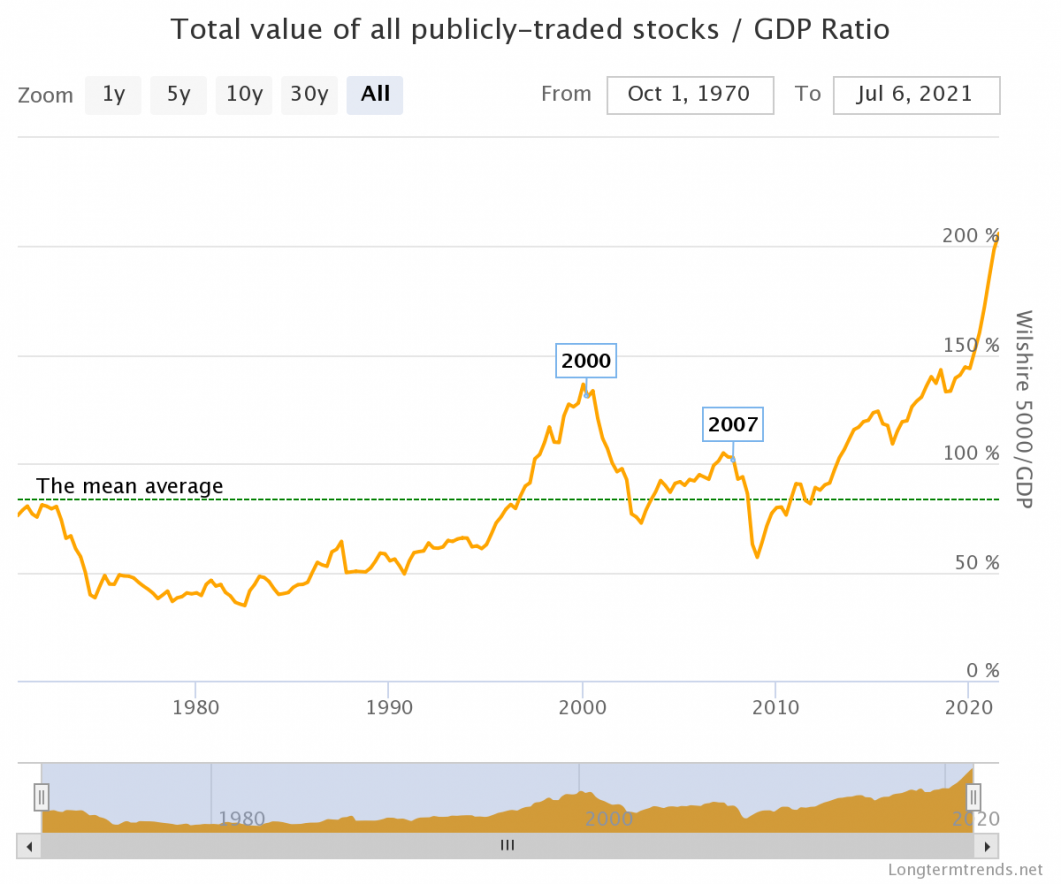

When talking about the differences between financial markets and the economy, a ratio that has been so appreciated over the decades is immediately apparent: Market Cap to GDP - market capitalization as a percentage of GDP.

This ratio, known and popularized as the Buffett Indicator, is a long-term indicator for the stock market and is seen as a way of understanding how the market valuations are at a given moment against economic fundamentals. Thus, we should expect similar growth in the equity market (from a total return, price and dividend perspective) and in real GDP (adjusted for inflation).

There is a clear misalignment in the relationship between the variables. We can say that the market is overvalued. But they also suggest that economic variables such as interest rates, innovation or the inflation rate can justify this discrepancy. In addition to the time factor, as explained above.

There is increasing criticism of the use of certain statistical and economic measures such as GDP, as they are no longer able to capture the true state of the economy as well.

GDP ignores, for example, leisure, happiness, housework, flexibility in the labor market. It ignores the distribution of wealth at a time when inequality is growing. It ignores the environment, sustainability, innovation, education. Skips the production of personal data. It ignores digital disintermediation, it ignores the shared economy or even the economy of producing digital goods from home, such as the production of content for blogs, videos, medical services or open source software. Many of these activities are even zero price activities. Therefore, we will have to conclude that the macroeconomics will still not have been able to systematize the economy of the future.

Basically, we measure the economy with concepts and methods from the 1940s of the last century. With so much debt, low productivity and high inequality, the economy and society have evolved and become too complex to be summed up in a measure like GDP.

GDP, and other economic indicators such as inflation, unemployment rate, or debt as a percentage of GDP, are absolutely essential in an analysis process and are part of the information matrix to be produced. But other metrics and indicators must be considered to complement the analysis and decision-making process.

The number of users, scalability, happiness, sustainability and social responsibility are preponderant factors in new businesses and good investment stories. Is it the future? Not all. It is up to each investor to do their homework and decide the best path to take to achieve their goals. The economy, with or without GDP, will continue to follow its parallel path in the search for individual well-being and as a society.

Today's large companies depend less on tangible assets and human resources and more on concepts such as brand, users, formulas, algorithms, software, intellectual property.

This model makes companies lighter and more flexible, more open to the world (scalable), but also more unstable from an accounting point of view. For example, when we look at the balance sheet and book value of the company and its market value, we see huge differences. These are companies with invisible assets, which are not on their balance sheets, but which are expected to generate high future returns. There is a clear correlation between invisible or intangible assets and the market capitalization of these companies.

The influence of this relationship on decision making

If the stock market is going up, it means that companies are improving their expectations of results, which means more sales, more salaries, more taxes, more investment and, finally, more economic growth. Capital markets trade based on the expected cash flows of companies that make up the economic fabric and also reflect the macroeconomic environment, albeit at different points in time.

Focus on the future is important. Our portfolio is being built and managed for the future, not the past. We want to form expectations about assets, asset classes, sectors, industries, regions and companies that will thrive in the future and that will create value for investors.

Market movements reflect our behavior. And this is what we can take from history. A certain predictability in our behavior. Those mistakes, feelings and those emotions will be there, always.

Therefore, the result of our portfolio in the future is totally dependent on our decision-making in the context of expected risk and not on past returns.

Thus, if an investor has defined certain asset classes in its investment policy, it must gather the necessary information to formulate long-term expectations regarding the return and risk of those asset classes.

The final sentence is well known: Historical profitability is no guarantee of positive results in the future.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.