The capital market in Portugal

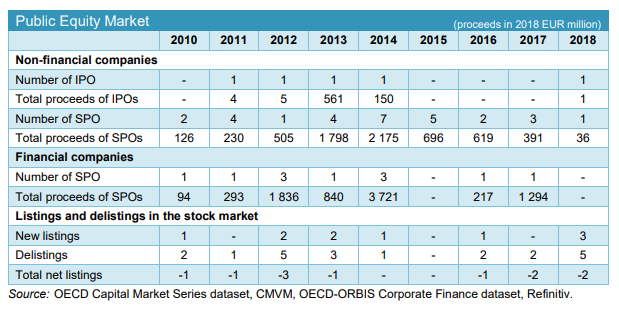

The capital market in Portugal is going through a crisis. Since the drop in the number of listed companies, through the rare IPOs (initial public offerings) and the lack of market liquidity, few companies and investors have shown interest in resorting to the market to finance their activities or invest their savings.

The capital market is a broad term and generally associated with the place where financial instruments are traded. The stock market and the bond market are the most common capital markets. These markets include investments and savings, equity holders and entities looking for capital, individual and institutional investors on the one hand, companies, governments and other entities on the other.

Currently, the Portuguese stock exchange is included in a pan-European platform, Euronext, and a visit to the website of Euronext Lisbon can be seen that the beginning of the history of the capital market in Portugal dates back to the 18th century.

However, the loss of prominence of the capital market in Portugal is notorious, especially in the last 20 years. And by coincidence or not, these last two decades have brought economic stagnation, financial and social difficulties and a two-thirds reduction in companies listed in the Portuguese market.

An OECD study, which can be consulted here, draws a picture of the market in Portugal and lists the main recommendations for investment and the growth of the Portuguese economy based on the development of the capital market.

What are the reasons for this downward path?

The study points out several factors for the lack of interest and the weak appetite for companies to seek the capital market to finance themselves and develop their projects:

- High costs of supervision, compliance and governance and also in the IPO registration process;

- Complexity of regulation and requirements to access the market;

- Market liquidity and the lack of an enabling and favorable equity market environment;

- Poor visibility of the Portuguese capital market;

- The willingness of entrepreneurs and shareholders not to share control with other shareholders;

- Preference for solutions presented by banks.

But the reasons are not just related to the market itself.

The 2008 crisis also left very deep marks on the country's business and social structure. The successive advances and setbacks of fiscal and budget policy, administrative bureaucracy and inefficiency of justice and an unfavorable social environment for the market, did not provide the desired ecosystem for the development of the capital market.

Even though successful cases and business initiatives of enormous value on a world scale appear, the Portuguese capital market was never the choice.

What is a strong and dynamic capital market for?

There are several reasons for seeking a more active capital market that is present in the national economy:

- Diversify the sources of financing for companies, either by issuing capital via shares or through long-term debt, such as bonds. Avoid over-reliance on short-term debt, mainly through recourse to the banking system;

- Involve society and household savings more in the economy's production process. This involvement can be achieved directly on the stock exchange, but also through collective investment such as investment funds, investment companies, crowdfunding structures or insurance;

- Allow deleveraging of the banking system;

- Increase investment in research and development, innovation and entrepreneurship;

- Attract and maintain qualified human capital;

- Ensuring a strong and dynamic capital structure to enable scale and global vision for companies;

- Bring more transparency, trust and sustainability to the business fabric.

A more open future to the market

It is clear that in a context of European integration it is natural for stronger and more global institutions to appear. But it is also natural that integration results in clusters often associated with the specific characteristics of a country or a regional economy.

Portugal is a country where specificities fit and where markets can have a strong intervention and impact in the future. Even though it is a country of micro and small companies.

The institutions that regulate and operate in the market are fundamental. They can and must do more. Mainly at the level of the bureaucratic and regulatory process, in mechanisms that are more accessible to SMEs, in a more transparent, simple and stable fiscal policy and in a more effective and efficient legal framework.

But also at the level of society, it is necessary to develop more active work. An example at this level is financial literacy. The positive impact of capital markets will be greater the better the financial knowledge of the various market participants. And here it is fair to highlight the CFA Society Portugal and projects such as MoneyLab and Doutor Finanças and respective forum. But also the recently formed Portuguese Financial Literacy subreddit and publications and magazines such as FundsPeople.

Starting today, I would like to highlight the World Investor Week initiative, which takes place this week.

The measures and remedies indicated by this OECD study can work if they are applied together and in harmony, bringing together regulatory institutions, companies, investors, private bodies and associations, and government entities.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.