Spending money on stuff makes you poorer

Spending money is an everyday necessity, but also a sign of status. It matters for what people think about us or what we want them to think of us. Between spending money on a book or going out to dinner, the expense may be the same, but the level of satisfaction or perception may be quite different.

What is the impact on our lives if we show everyone that we have a top of the range car? The truth is that the decisions we make regarding spending and the products and services we consume influence our status in a society.

If we go out to dinner often or if we drive that top of the range car, we may have a miserable savings, but what our friends, family, colleagues and acquaintances will think of us will be very different from what is the actual reality of our account. bank.

What's more important, status or financial freedom? Will this status bring us happiness? And does money bring happiness? We can be happy and achieve all our goals with different levels of wealth. What for some is a lot of money, for others is little.

This idea is conveyed by Morgan Housel in his book Psychology of Money. The author is very clear: savings is the difference between income and our ego. And our ego is constantly put to the test. Every day new needs arise that we didn't even imagine existed.

There is a natural balance to be made. In this equation, both variables are important: savings, consumption and income. Throughout the stages of our life we have to know how to deal with these variables and the differences between them.

Do we need the amount of shoes we have at home? Is it really necessary to buy something whenever it is marked as a promotion? Do we really need a bigger house? Is it time to change cars?

Many of these purchases are impulsive, a momentary satisfaction, far beyond the satisfaction of a basic need. To mitigate these impulses there are several techniques: making a list of what we really need, constantly questioning whether we really need what we are buying and even limiting our monthly expenses.

Making savings a priority is another way to limit our spending. It's a paradigm shift, maybe even a mental shift. Instead of assuming savings as the difference between income and consumption, a kind of residual value after consumption, we can define it from the start. After obtaining the income, we immediately define the value of savings and only then the residual value available for consumption. In this way, consumption is left for later and not savings.

Can we all make savings a priority?

The salary level in Portugal is incredibly low and disparate and when the income level rises, a high tax burden immediately appears that limits our bargaining power and ability to make decisions. Then there is a whole set of expenses that today are assumed to be fixed and that are part of a certain standard of living that we consider essential.

But it is possible. Not even if we start with small amounts. The satisfaction of being able to save and the security that we feel knowing we have an emergency fund or a plan to achieve a certain goal (like retirement) can be as tasty as going out to dinner at the best restaurant in town.

From expected utility to benchmarks

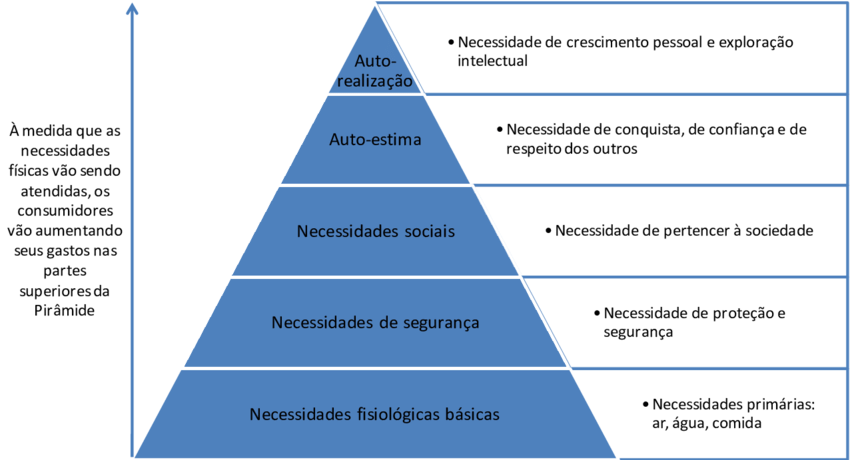

In terms of needs, we know Maslow's pyramid, where the five categories of needs are hierarchized, from the basic to the most complex: physiological needs, security, social needs, esteem and personal fulfillment. The world has evolved, but it is clear that the most basic needs are directly related to survival instincts. With the satisfaction of the main needs, we are looking for the fulfillment of other needs. Basically, we are creating more goals and motivations for which money plays an important role.

Source: Researchgate

The famous theory of expected utility also tells us that as rational beings we always seek to maximize this utility, that is, we make decisions based on the utility we expect to derive from that decision. But we also know, as a result of research and work carried out by authors such as Daniel Kahneman and Amos Tversky, that we do not make decisions in a rational way, but through satisfaction and different points of reference. Indeed, perspective theory (Kahneman, D., & Tversky, A. (1979). Prospect Theory: An Analysis of Decision under Risk. Econometrica. 47 (2), 263.) is even a testament to our ability to take of decisions. Emotion takes precedence over reason. The weighting and value of each decision taking into account the reference is the key to the decision.

And so we come to the importance of financial literacy. The difficulties we have in controlling emotions in the investment process, the lack of knowledge of mechanisms such as the capitalization effect, the poor management of risk, which is almost always confused with volatility, or the difficulties in analyzing the implications of monetary and fiscal policies in our daily and future life, are concrete examples of the urgency of the topic.

And here, the work of Kahneman and Tversky is even more revealing.

People tend to make decisions based on the potential value of losses and gains rather than the end result. This theory reflects the way we make decisions, the value and weight we place on each decision. In reality, we base decisions on the usefulness of the options, but also on benchmarks. For example, what our friends will think, what a certain analyst said about a company with great potential, the judgments and opinions of society in general about a fashionable car.

In investment decisions this theory is especially felt. Traditionally we are presented as risk averse, except when we are facing bad results. In this case we look for the risk to try to get a better result. Did it ever happen to you? They have certainly played more in any game of chance in the expectation that their luck would change. It is also interesting to note that a loss after a gain is less painful than a loss after a loss, even if the final value is the same. Never felt it?

Imagine a bet in which you win €100. On the next bet they lose €200. How do you feel? The total loss is €100. Now imagine the scenario of a bet where you lose €50. They bet again and lose €50 again. The total loss is €100. Same as above, but much more painful. There were two losses in a row.

Let's consider the following example. Make your choice intuitively:

Case 1 - Imagine that you are faced with two scenarios:

- Scenario 1 - a certain gain of €500;

- Scenario 2 - a 50% chance of winning €1,000 or nothing, ie a 50% chance of winning €1,000 and a 50% chance of winning nothing.

What's your choice?

Case 2 - Imagine that you are faced with two scenarios:

- Scenario 1 - a certain loss of €500;

- Scenario 2 - a 50% chance of losing €1,000 or nothing.

What's your choice?

The most normal is to choose scenario 1 in case 1 and scenario 2 in case 2. It seems to be human nature to prefer an uncertain loss to a certain loss. But we prefer a certain gain to an uncertain gain!

Note that the results of each case only differ in the sign: gain of 500 vs loss of 500 – an example of the reflection effect.

The cost of savings transactions and investment activity

In addition to consumption, spending that impoverishes us can also be seen in investment activity.

And here it is also important to define rules. For example, saving €100 per month and investing that amount in a certain financial product with a high transaction cost or prohibitive management costs given the current interest rate level or the potential for profitability can mean destruction of savings and mental effort. and social that we do to save.

There is a very interesting phrase attributed to Warren Buffett that helps us to understand the importance of patience and the decision-making process, especially in the case of people who are just starting their savings plan or who, for various reasons, do not can save:

“The market is designed to transfer money from the most active investors to Patients.”

The savings process cannot be in vain. It cannot be destroyed. It cannot be an impoverishment machine. This case can be especially serious for people with fewer resources as wrong decisions take on a much greater weight.

Patience is therefore essential. Don't spend money on impulse either.

Not everyone needs to increase savings levels. There are those who can or must move on to the consumption phase. There are others that don't. This balance is easier to find if financial education is the basis of the process of seeking financial freedom and if we have strong and reliable institutions.

Look for information, question your decisions and don't let yourself be swayed.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.