How to invest sustainably - ESG Investing

The financial industry is looking at the ESG and the whole theme of responsible investment and positive impact with great dynamism and interest. A kind of green wave that is sweeping the industry!

In this more practical article on how to invest sustainably, we will try to answer some frequently asked questions:

- Should we invest according to sustainability factors?

- How can we select investment funds, ETFs or companies according to ESG criteria?

- Is sustainable investment more expensive?

- The risks of ESG investment

- What is the role of the advisor in this process?

The idea is to respond to a need for a new generation of investors who are more aware in ethical, environmental and social terms and more interested in sustainability and values beyond financial profit. But also an opportunity to diversify revenues and combat the gradual reduction of commissions in a highly competitive industry.

SHOULD I INVEST ACCORDING TO ESG CRITERIA?

First, we must consider our investment plan, which must include our values and principles, motivations and reasons for investing. In addition to financial profit, there is a set of values that make financial investment more personal, more consensual. A sense of belonging and well-being that only profit does not convey.

We know that an investment strategy based on ESG makes the strategy more personalized and for this reason the financial reasons are not the only ones when it comes to justifying the selection of a fund or ESG ESG.

Respect for the environment, social cohesion and ethics are more than enough factors for us to opt for a portfolio geared towards these factors. However, it is possible to invest sustainably and incorporate our personal values and have a positive impact on society even without investing in financial products with the ESG seal. Investing in clean energy or diversity is not just in products with the ESG label.

If the plan or portfolio is managed with the support of a financial advisor or through a discretionary management mandate, the investor should question what type of instruments the portfolio has and in which industries or companies they are invested.

It should also question the main metrics and comparisons between the different alternatives, as well as the impact of each instrument on traditionally more problematic businesses such as armaments, tobacco, oil or coal, for example.

HOW CAN WE SELECT AN INVESTMENT BASED ON ESG CRITERIA?

As explained in this article, consulting the ETF IWDA on the website of iShares (a management company of Exchange-traded funds), it is possible to select the equivalent according to ESG or SRI criteria.

In a transversal way, the industry is using this approach, increasing the available solutions or adapting some of the already existing products. In fact, some are changing the designations and including ESG or SRI metrics in order to position the instrument before peers.

On the official pages of each management company, on Morningstar itself (company that provides data to analyze different investment options, namely investment funds and ETF), or on investment platforms (banks, brokers, robot-advisors), it is possible to know:

- The positioning of the instrument in terms of rating;

- What percentage of the portfolio is invested in industries not normally associated with the ESG;

- Carbon intensity in terms of emissions by sales volume;

- The quality score;

- Business involved.

Also on the bond side, we see a market growing in the direction of green bonds.

There are several important issuers, companies and institutions, which are issuing green bonds to finance environmental and/or climate projects, namely related to:

- energy efficiency,

- prevention of pollution,

- sustainable agriculture, fisheries and forestry,

- protection of aquatic and terrestrial ecosystems,

- transport,

- sustainable water management.

In Portugal, EDP has already adopted this type of issuance to diversify its sources of financing.

In addition to issuers, we can also find investment funds with a management mandate to purchase green bonds.

IS SUSTAINABLE INVESTMENT MORE EXPENSIVE?

This Wall Sreet Journal article reports that sustainability has been good for Wall Street, as management fees are 43% higher than in standard strategies.

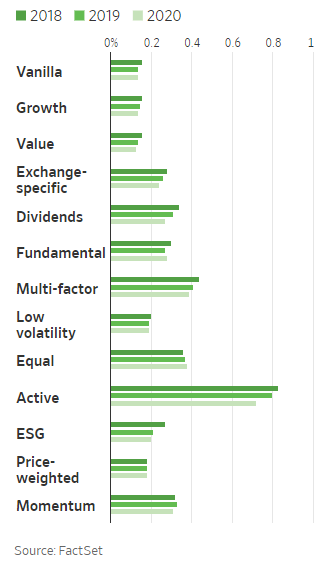

Although we are in a trend to reduce the costs associated with asset management, funds and ETF ESG are, as a rule, more expensive than other categories such as growth and value or low volatility strategies.

US equity ETFs weighted average asset-weighted cost by strategy, 2018 to 2020.

THE RISKS OF ESG INVESTMENT

All investment strategies are risky. And with sustainable strategies it is no different.

Perhaps the most important risk at this point is the emetric classifications used for ESG indices, which, as mentioned here, are comical and varied.

On the one hand, investors seek to satisfy their personal motivations and values to invest with the perspective of interesting approaches and, at the same time, generate a solid investment performance. On the other hand, it also increases the possibility that some investment companies use the ESG designation to acquire new clients without implementing rigorous ESG investment strategies.

Data analysis is also one of the risks. With the evolution of ESG investment, we will realize whether or not the criteria are working and being implemented.

In recent months, there have been analyzes supporting that these strategies (e ETF ESG funds) can obtain better returns when compared to non-ESG alternatives. The idea is that companies that better manage environmental risks and that best defend and respect ethical and social issues can have better results in the future. It will be the products and services of these companies that new consumers will look for.

But there is a risk that the results will not be as expected and even the possibility of companies abandoning their sustainable vision making ESG investment a non-priority.

THE ROLE OF THE ADVISOR

Several investment funds and ETF are changing their investment policies and their designation to also assume a sustainable strategy.

Within the scope of the ESG, the advisor is important to select and allocate the most adequate instruments to the investment policy defined with the investor and to implement a cost-benefit strategy that safeguards the interests and motivations of each investor.

In addition to the appearance of a younger investor who is aware of environmental, ethical and social values, we also have the increasingly important role of women in investment decisions. Reflections in The Economist and McKinsey present some important ideas: women want a different experience, a personalized service, an advisor who understands their personality. It's more important to fulfill goals, pay for school for your children or grandchildren and buy a second home, for example, than hitting the market.

The growth in the supply of solutions can be seen as an increase in difficulty and complexity, but, on the other hand, as a broader set of solutions to build more personalized investment portfolios in line with the values and interests of each investor.

And this is the great advantage that the wave of sustainability can bring immediately to investors' options. The other is certainly larger and more comprehensive, and could mean a better quality of life and respect for the environment, ethics and equity.

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.