Because the stock market is not my biggest concern (for now)

Note: You can and should click on the graphics if you want to see them in large size

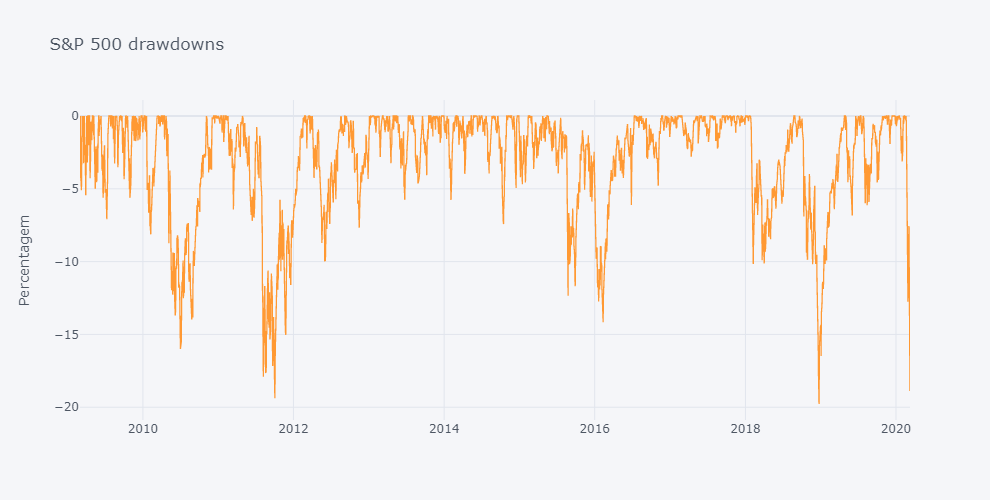

The sharp drop in the stock market over the past 3 weeks is, of course, something that has many people apprehensive about. But as you can see from the graph below, it's not an abnormal drop in terms of depth. We have a drop of these semi-regularly, and the most recent was only about a year and a half ago, at the end of 2018.

There have been, since the beginning of this Bull Market, in March 2009, at least 4 relatively intense falls:

- Summer 2010 (it was thought there would be a 'Double dip'/double recession);

- Summer/Autumn 2011 (European crisis);

- Summer 2015/Early 2016 (crisis in China);

- Winter 2018 (China/USA trade war).

I'm sure if you search google you'll find news "predicting" the next calamity at any of these times. From the "let's have another 2008" to the "end of the euro".

This type of decline is natural in the stock market and is something to be expected. It is not a question of IF but WHEN. For now, the S&P 500 has not entered values considered Bear Market (down more than 20%)

Abstracting a little of what has been going on and taking a calm look at the drawdown chart do you find this recent drop significantly more intense than other equivalents in the last 10 years?

The truth is that during this period the S&P 500 went from about 700 points to 3300, having more than quadrupled. This is not to say that this fall will have a quick recovery like the others. That nobody knows. But for now, this drop is pretty much in line with the S&P's declines with some regularity.

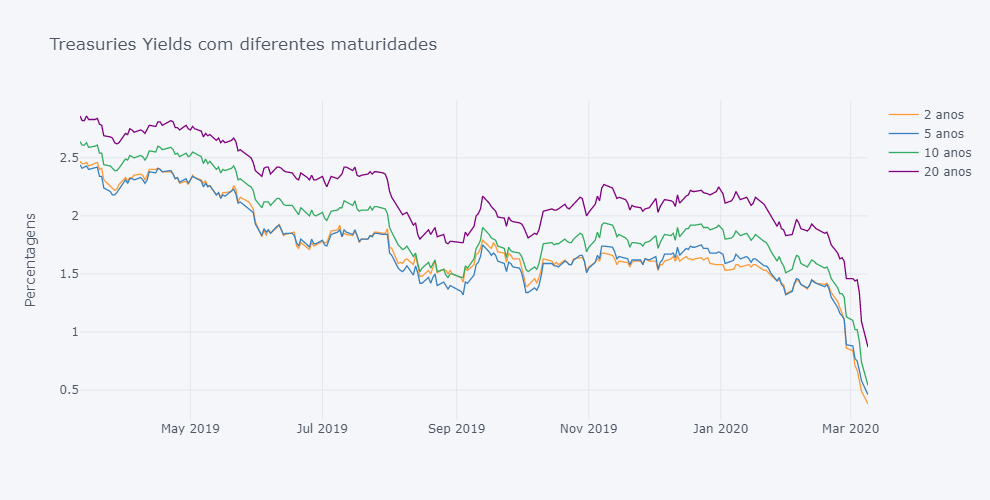

But what really worries me is the rise in bond prices, namely long-term treasuries. This rise in US government bonds is the result of a precipitous drop in yields.

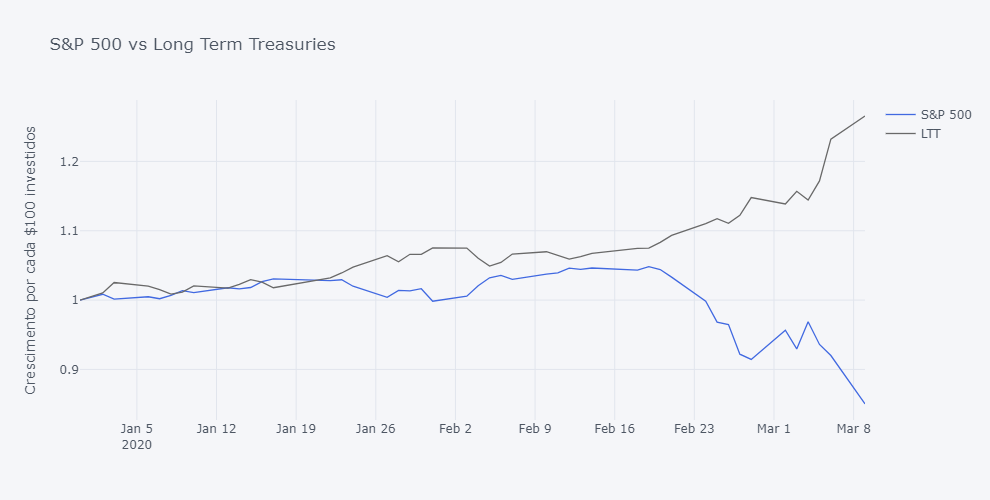

This led to a strong rise in treasuries, especially long-term ones (the longer the maturity, the greater the volatility of the bonds). These bonds already present YTD returns (since the beginning of the year) above 20%, virtually contradicting the behavior of the S&P, with which they have a negative correlation.

These bonds already present YTD returns (since the beginning of the year) above 20%, virtually contradicting the behavior of the S&P, with which they have a negative correlation.

While the stock market slump may continue, I personally think the impact will be limited on long-term equity returns. However, the same cannot be said of low bond interest rates, which will have a negative impact on long-term returns. Expectations of future medium/long-term bond returns decreased significantly compared to the beginning of the year.

Of course, I feel apprehensive when the stock market drops 7% in a day, but I get even more concerned when I see 20-year bond yields hovering around 1%. European government bonds have been negative for some time, but treasuries have resisted this "temptation". Until when? The bond market is already discounting an interest rate cut of 50 basis points on March 18th as being the most likely and thereafter a continuation of the accommodative monetary policy.

My focus being on the long term at this point I feel more concerned about the return (or lack of it) in the bond market than about the recent volatility of the stock market.

Finally, I leave the disparity, visible mainly after February 19 this year, in the performance of the S&P 500 (representing the stock market) and the S&P US Treasury Bond 20+ Year Index (representing the long-term treasuries market) in this year 2020 Ironically I'm more concerned about that 25%+ YTD rise (from long-term treasuries) than the 15% YTD fall (from the S&P 500).

With a degree in economics (2006) and a postgraduate degree in Finance from Universidade Católica do Porto (2010), he later realized that he shared the same enthusiasm for programming.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.