Long becomes the wait

The economic recession is already one of the most anticipated events of recent years. A kind of hangover after the pandemic incentives and the consequent inflationary crisis, with implications for decision-making that has helped to prolong the boom environment (still) without the bust. Are we contradicting economic theories or simply acting to contradict or reformulate expectations?

About 2 years ago, in episode #6 of the Future Proof Talks' podcast – Inflation, the monetary illusion - we talked about inflation and also wrote an article on the subject, the great debate on inflation. Deep down, anticipating that it would become the main indicator from then on. And indeed it was. And fighting it would trigger a recession. Do you still have that expectation?

Wimbledon already ended with the victory of one of the favourites and the intense rope stretching in the Tour de France caused the “fall” of one of them. These are far more exciting events than playing on the chessboard of macro indicators, in which pawns are involved in a nightmare of data and forecasts where interest rates, inflation, GDP, debt and unemployment stand out.

In this macro chess, I see interest rates as the rooks, GDP as the knights, unemployment as bishops, and debt and inflation as the central elements: the queen and the king. There are two players: governments and their fiscal policy on the one hand and central banks and their monetary policy on the other. The public is watching, but it doesn't seem to give much importance to the game, which, by the way, seems to be what the players expect.

But as with everything in life, there is a limit and the wait becomes long. Of course, we can say that, occasionally, one player seems to be in a better position than the other, but in this scenario, both win. Governments guarantee record revenues and some illusion in the management of public finances (aka financial repression) and central banks become even more central and preponderant in the lives of families and companies, already looking at the dangerous concept of digital currencies. We are not sure if they both play on the same team, but match-fixing could be a strategy designed to ensure control and a more planned economy.

False consciousness

And this whole path leads us to consciousness. Do we know what we want? Or do we prefer someone else to tell us what we want?

John Authers writes, with some incredulity, that a kind of Marxist false consciousness is at work. Authers states that “politicians can feel entitled to do things that are clearly not supported by the majority of the population, based on the fact that these people do not know what they really want”. And in this context, the game of chess becomes even more decisive and complex.

Let's look at the behavioural side of economics. It's common to have needs that we didn't have before. Just look at the products and services that companies are constantly creating and launching on the market. The vast majority are new needs that only the most astute people realized we would have. Before we had an iPad, who needed an iPad?

That's how the market is: creative and dynamic. The meeting between solutions and problems. A means to and not an end in itself. But politics is not, and it must remain so, that is, away from the will to deliberate on individual or society's freedom.

Perhaps for this reason many are the narratives created and fed in recent months. The problem of the narrative was developed in an episode of the podcast, with the participation of Paulo Ferreira from Rádio Observador, where we talk about the Narrative Economy (Shiller). Well, in this first half of 2023, take a good look at the number of narratives put into circulation:

• Hard landing and recession

• Soft “landing”, mild recession

• Economic acceleration

• Reopening of China and consumption growth

• What's up with China, recession?

• The war caused inflation

• War avoided/postponed recession

• Inflation boom in Germany and Europe

• Recession in Germany and spike in inflation

• Regional banking crisis in the US signalling the end of US hegemony

• Central banks will cut at the next meeting

• Central banks will continue to raise interest rates

• Energy transition and ESG no longer matter

• Debt crisis and unmanageable deficits, inflation must remain above average

• AI is there to save the economy or destroy jobs.

Crisis? What crisis?

Our extreme difficulty in accepting, concluding or admitting when we are wrong is known. If the forecast is for a recession, sooner or later it will happen and we can find all kinds of indicators that lead us to confirm our vision (confirmation bias).

Let's look for contradictory information.

Inflation seems to be giving way and the public debt, the result of the marriage with inflation, could also declare itself victorious.

In the coming months, even with a recession, finally, the topic will no longer be which companies and sectors will be able to pass on inflation, but which companies will be able to maintain margins. Have we turned the page on recession?

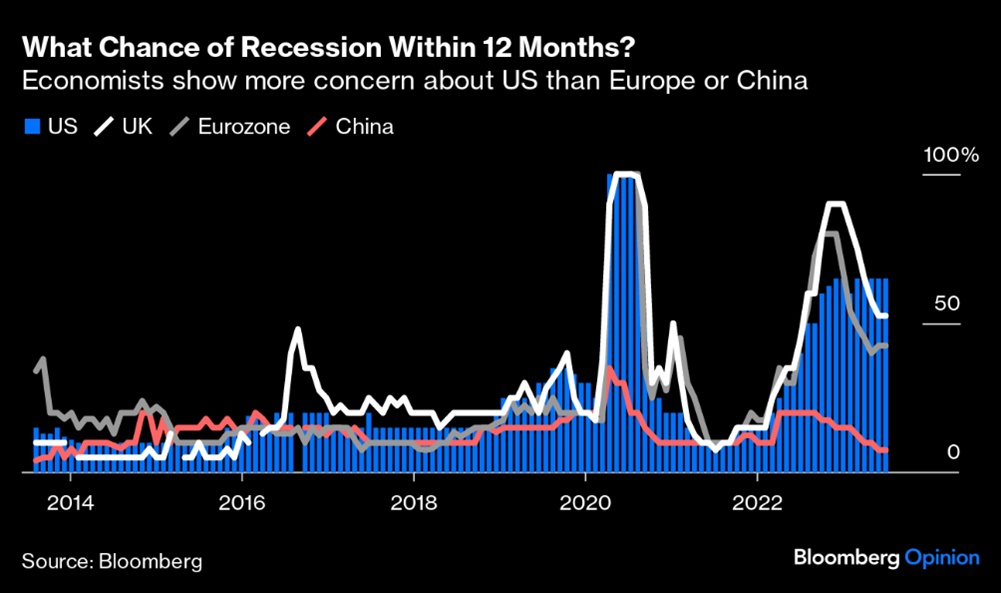

These are the recession probabilities for the next 12 months:

We are left with humility. Deep down, recognizing that we simply don't know what we don't know. There it is, continuing to play chess in search of a continuous draw or equilibrium, which could even be Nash's.

We have been waiting for the recession for well over a year. Is it a meaningless expectation? An unnecessary suffering that only increases as time goes by? Do you feel the anxiety?

Throughout this text I asked many questions, almost all rhetorical, but with a possible common answer: yes, anxiety is felt. It's the age of anxiety. Visible in the crises of housing, food or energy, sprinkled with a dark atmosphere of war and intense social and ideological conflicts.

There it is, we have to look to the future knowing that those who don't know the past are condemned to repeat it.

The hexx

In the terrified twilight of the pavement where we stagger lost, we cannot turn back, unlike bishops, rooks, knights, king and queen and their multiple lives. We can only look forward and live life using emotional intelligence.

This market will always be on the side of investors, especially those who are willing to control what is controllable, such as time (or patience), saving capacity and optimism that we will be better in the future. The world will continue to evolve, from shock to shock, in a kind of natural selection, where losers opt for Russian roulette in search of bad luck and winners define their path in search of the future.

Note: this article was written with the precious help of songs!

Vítor is a CFA® charterholder, entrepreneur, music lover and with a dream of building a true investment and financial planning ecosystem at the service of families and organizations.

+351 939873441 (Vítor Mário Ribeiro, CFA)

+351 938438594 (Luís Silva)

Future Proof is an Appointed Representative of Banco Invest, S.A.. It is registered at CMVM.